Patchy pickup in offshore rig demand, report finds

Offshore staff

ABERDEEN, UK – Westwood Global Energy Group’s RigLogix team has issued its latest RigOutlook, covering the period April 2018 to February 2019.

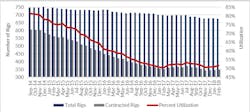

Worldwide competitive rig use (jackups, semisubmersibles, and drillships) dipped to a low of 50.3% in January 2017, the report found, but recovered to 51.7% this February.

There have been day rate improvements in two regions – modest pickups for jackups operating in the US Gulf of Mexico, and rates more than doubled for the harsh environment semisubmersible fleet offshore Norway.

Jackup attrition looks set to continue but will be offset to an extent by newbuild additions, some underBorr Drilling’s agreement with Jurong Shipyard.

There is rig demand in some regions but the number of incremental rigs this will add to the rig count is likely to be minimal as other working units are released.

As of May 2018, 15 of the 19 marketed harsh environment semis based in Norway were contracted, including four awaiting the start of their contracts. However, only three of the 15 will potentially complete contracts in 2018 while nine of the 15 are committed into 2020 or beyond.

With demand for these units set to keep rising, operators are now securing contract time for projects that in many cases do not begin for another year or even longer, according to the report, and as a result, day rates have more than doubled from 2016/2017 levels.

Over the next year, RigLogix does not expect a big increase in rig demand globally, but over the longer term, more rigs will likely be put to work. However, a return to the days of 90-100% rig use still seems a long way off.

05/03/2018