Deepwater capex still impacted by lower rig rates

Offshore staff

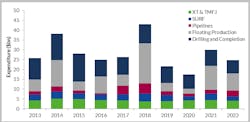

LONDON – Westwood Global Energy expects global deepwater expenditure during 2018-2022 to total $136.8 billion, 4% lower than in 2013-2017.

According to the analyst’s World Deepwater Market Forecast 1Q report, last year’s upturn in orders should continue into 2018, improving the outlook for installation investment.

The upturn has been driven by lower supply chain costs and a higher oil price, while many projects have been re-engineered or even re-tendered.

However, expectations for supply chain pricing over the forecast period look relatively flat, due to persisting over-supply in the rig and vessel markets.

Among the main findings of the report are:

Africa and the Americas will continue to lead the deepwater market, accounting for 79% of forecast expenditure.

FPSOs will continue to dominate thefloating production systems market, accounting for 33 of the total of 41 deepwater units expected to be installed during 2018-2022 period.

Totaldrilling and completion expenditure over the next five years will decline by 26% compared to 2013-2017 due to suppressed rig day rates.

Line pipe will account for 10% of global deepwater expenditure over 2018-2022, driven by large export gas pipelines, although this market remains susceptible to geopolitical tensions.

The increased spend in 2017-2018 period is due to a combination of various fasttrack projects, installation of some large pipelines, and delivery of delayed floating units such asTotal’s Kaombo and Petrobras’ P-74, P-75, and P-76 FPSOs.

Westwood foresees more stable expenditure post-2020, with an increase in FEED and tendering activities.

02/09/2018