Offshore staff

HOUSTON – Rising US onshore drilling costs are making deepwater E&P more competitive, according to a recent report from Westwood Energy.

Data from the Westwood’s Energent team in Houston indicates that consumption of sand for hydraulic fracturing in the onshore US market hit new highs of over 30 billion lbs (13.6 billion kg) in 2Q 2017, topping the previous peak in 2014, despite only half the number of land rigs working. The US completions market is running in overdrive, the report said.

Onshore US contractors are scrambling to reactivate pressure pumping equipment, assemble crews, and open new sand mines in order to keep up with demand. Insights from Westwood’s Energent team suggest that the market is expecting “double-digit” price increases in 2018. This is expected to average circa 15%. But in some segments, such as proppant, reported price inflation is currently significantly higher than this.

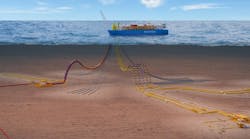

Offshore, the market is also recovering. However, pricing pressure is absent. The industry simply built up too much capacity for the expected level of activity, leading to an oversupply of rigs, construction vessels, and support vessels. This is good news for E&P companies that can now take advantage of lower pricing when sanctioning new developments.

Activity levels are certainly showing encouraging trends, Westwood said. A total of 17 FPS units were ordered in 2017 (compared with zero orders in 2016), and a further 19 units are expected to be ordered this year.

E&P companies are starting to report that some deepwater projects have more favorable project economics than shale. One example was cited by Hess Corp. in recent weeks, which indicated that the Liza Phase 1 project in Guyana required circa $35/bbl in order to break even, while a comparable onshore project in the Delaware basin required $45/bbl to break even. Guyana has proven to be a huge success for ExxonMobil and its partners, with total recoverable resources now estimated at over 3.2 Bboe. A second FPSO for Liza, with a production capacity of up to 200 kbbl/d, is expected to be ordered in 2019.

Looking forward, Westwood is tracking 39 FPS units currently under construction, and has identifiednearly 100 further FPS deployment prospects in the coming years. The firm said that this data was a source of “cautious optimism” for the offshore sector in 2018, and an opportune moment for E&P companies to be sanctioning projects.

01/26/2018