Brownfields offer opportunities for seismic service sector

OBN technology may be well suited for these applications

Charles Davison

FairfieldNodal

At a recent conference primarily for the offshore oil and gas sector, industry CEOs and other key leaders were present and provided their expert insight into where the industry was headed.

One very clear message delivered by all the majors was that the “E” in E&P is dead - at least for the short- to medium-term, however long that may be. That admission is a clear signal that the industry recognizes that a “new normal” is really here.

That means long-term change, perhaps even radical, structural change, to the industry is underway. For an industry that eschews quick change, market forces are already carving away at staid conventional approaches and attitudes about business. Such changes are potentially huge for the seismic industry; and, where there is change, there is opportunity.

Seismic is a very small share of the enormous economic engine that comprises the global oil and gas industry. Interestingly enough, nearly every decision made in the oil patch, whether on land or offshore, passes through the seismic stage gate. It has a key role in the industry. The right seismic image can be the difference between a $140-million dry hole, or a well that produces a billion dollars in oil profits. The quality of that image is critical in making billion dollar decisions.

And yet, oilfield service companies and vendors will continue to face a challenging market in the near term and perhaps beyond. Expectations are that another flat-to-down-year is possible in 2017 as the industry downturn finally bottoms out. It will be a challenge for service companies of all varieties to weather the storm.Seismic companies are similarly challenged, and for certain types of seismic acquisition methods, and those companies concentrating their services offerings exclusively at the front- end life-of-field, the challenges may be significant.

Image still key

It is recognized that overall production will grow in 2016 and beyond. The brownfield is very much alive, perhaps more than ever, due to the industry’s new normal.

Despite the cuts made to every life-of-field stage, it is clear that companies will focus much more on maximizing the productive capacity of existing brownfields. This will be truer for offshore field developments than onshore due to the significant complexities and associated expense.

The lifting costs and conventional breakeven price per barrel associated with an existing producing field offshore, even those in decline and requiring some form of intervention, are still vastly less expensive than greenfield developments.

The math is simple: brownfield breakeven prices/bbl range in the $30/bbl-$50/bbl spread. For unsanctioned offshore projects, the average breakeven costs are in the $65/bbl-$85/bbl range even after the massive supply chain cost compression experienced over the past two years of this downturn. Expected average market oil price/bbl in the $40-$60 range through 2020 makes it clear: Operators will have to focus on how to best characterize their existing reservoirs, intervene, and exploit oil production from existing fields as its first priority. Furthermore, those decisions still have to flow through the seismic stage gate.

Brownfield seismic methods

Seismic is now ever more critical to maximizing production in thebrownfield.

Offshore brownfield exploitation generally involves operations in remote/difficult-to-access areas; environmentally sensitive areas; geologic basins with complex overburden, structure, and stratigraphy; and most importantly, with field developments characterized by dense infrastructure. Given these realities, conventional towed streamer “surface” acquisition is challenged in its ability to provide similar high-quality, reliable, ocean bottom seismic data acquisition.

OBS, and specifically ocean bottom node (OBN) seismic acquisition is the technology of choice for the brownfield, and there are a number of valid reasons why. The most important reason is found in the type of seismic acquisition required in the brownfield, generally known as 4D.

Critical in the brownfield,4D seismic establishes the required time-lapse characterization of the reservoir. However, most mature brownfield reservoirs, developed using 4D seismic, are surveyed only every two, three, or five years apart. This is obviously a function of cost and priority. In the past, it has been mostly about E-seismic. P-seismic has taken a back seat. But this approach creates an unnecessarily high risk scenario; operators can easily miss the opportunity to effectively manage the reservoir and intervene if needed.

Ultimately, the 4D, P-seismic game is about creating the highest quality imaging required to accurately characterize the reservoir, and then make the critical, best decision about how to intervene (if at all). Intervention to improve and further exploit the productive capacity of the well goes beyond additional profit growth. Successful intervention effectively delays decommissioning costs, which could run as high as $60-$70 million in some cases. P-seismic is an effective cost mitigation strategy as well.

The days of $120/bbl oil and resulting profitability adequate to cover over the significant opportunity costs created by reservoir management mistakes are gone. Effective and affordable reservoir management requires a 4D solution that enables multiple, closely time-separated surveys that measure how the reservoir is responding to production plans and well interventions.

While towed streamer acquisition is currently the lowest-cost alternative in shooting virgin seabed and providing reasonable images for greenfield applications, that is not the case in the brownfield. Towed streamers often conduct 4D seismic in the brownfield through wide azimuth (WAZ) surveys. WAZ requires a huge commitment of time and expense to conduct, and these surveys have significant limitations imaging brownfields.

Reservoir image quality is affected by the towed streamer’s inability to fill the image gaps created by dense brownfield infrastructure and other constraints. Nothing can change that reality. Additionally, towed streamer image quality suffers due to natural water column variability (added 4D noise), random surface obstructions, shipping lane restrictions, etc., that make shooting subsequent surveys exactly as the previous survey - known as repeatability - virtually impossible. They cannot recreate exactly all the environmental conditions present during the prior survey in order to exactly compare the image generated from the current survey to the image generated from the prior survey. The 4D image quality and comparability is inferior.

OBN and brownfield

OBN seismic technology is superior in the brownfield. For seismic image quality, OBN data for seismic image quality is unsurpassed.

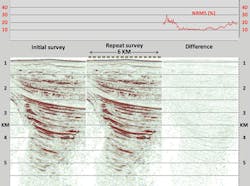

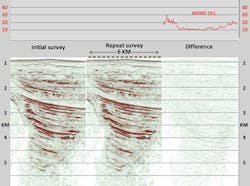

The image shown here is a vertical section derived from data captured via a deepwater node survey in the Gulf of Mexico. The left hand panel shows an image from the initial baseline survey. The center panel shows an image after redeployment and reacquisition of 16 of the nodes in the same location as the initial survey.

The “4D difference plot” image comparison, the right hand graphic, visibly captures the initial deployment image characteristics minus the time-lapsed redeployment. In this case the 4D data analysis conclusively shows that nodes provide highly repeatable seismic acquisition suitable for 4D reservoir monitoring in deepwater.

Nodes offer a distinct advantage over streamer surveys in 4D analysis, as the latter can be difficult to repeat in the unpredictable currents of the Gulf of Mexico. The geologic and imaging objectives of the survey are met by all azimuth, all offset, high fold and dense subsurface sampling that are now the standard requirements of new imaging and noise reduction technologies. These types of acquisition geometries are easily and efficiently achieved using OBN systems.

Additionally, the careful deployment of autonomous nodes among crowded field developments balances the competing objectives of subsurface imaging, affordability, acquisition efficiencies, and environmental impact.

Secondly, the use of node surveys is very comparable in cost to surface-based, WAZ streamer seismic acquisition, and the technology significantly lower costs when compared to other OBS systems, specifically ocean bottom cable systems. OBC systems use terminations, connectors, power distribution, and data telemetry equipment; and all of these are subject to technical downtime, which drives up seismic data acquisition costs and risks, and HSE and financial risks.

Lastly, an ongoing reservoir characterization solution must have the highest system reliability. Reliability allows for repeatability, and repeatability delivers 4D seismic data that provides the highest image quality. Reliability is therefore critical to quality. The reliability of the nodal systems and the lack of technical downtime allows for more emphasis to be placed on improving the operational performance and lowering expenditures associated with production exploitation.

Moreover, new nodal technologies should allow for OBN to become the effective, reliable, affordable permanent reservoir monitoring solution for the brownfield. These systems can economically deploy a frequent seismic monitoring solution, and deliver repeatable surveys for reservoir characterization for production optimization.

Nodes and PRM

The value of 4D seismic in reservoir management, increased recovery, and optimizing and extending the life of the field, is just now becoming well established. OBN is today routinely used to acquire full azimuth 3D seismic data for some greenfield development as well as providing effective brownfield initial 4D, or “baseline,” surveys.

Nodes can be economically deployed and retrieved amongst infrastructure and during simultaneous operations. OBN surveys have proven to be highly repeatable, producing time-lapse 4D data for reservoir monitoring that is the same image quality as data acquired via cable-based PRM systems, but with significantly favorable economics.

New nodal PRM has a deployment life of five years with 300 days of active recording, enough for twelve 25-day surveys. Installation involves little technical risk since it is deployed in the same manner as conventional node deployment, which has had over 30,000 successful deployments in the last 10 years.

Image is everything

With the economic and operational stakes higher than they have ever been for offshore operators to deliver improved profitability and lower risk thresholds for their maturing offshore brownfields, seismic has emerged as a critical part of the production exploitation game. The advantages of production-focused OBN extend beyond the seismological benefits, too. The avoidance of the significant potential negative environmental and HSE impacts should be considered: less “traffic” around the wellhead, fewer vessel-related man days for injury to occur, minimal, if any, seabed disturbance are just a few areas to mention. P-seismic is fast becoming a necessity for the brownfield, and the data (economic, environmental, and safety) indicates that OBN technology may be the answer.

OBN provides both the image quality needed and the permanent monitoring solution required to give operators the best results to manage the most important asset the operator has - the reservoir. It truly is “all about the image.”

Author’s note: FairfieldNodal is a member of the International Association of Geophysical Contractors (IAGC).