Company secures reprocessed seismic, Jones Act waiver for drilling program

I can’t wait to drill Kitchen. I’m fired up!” Danny Davis, president of Houston-based independent Escopeta Oil, has a hard time holding back his enthusiasm while waiting to mobilize a jackup rig for a drilling program in Alaska’s Cook Inlet.

The company is confident that the research it conducted over the last 12 years is sufficient to lead it to the discovery of up to 1.7 Bbbl of oil and 7.5 tcf of gas, which would be the largest find in Alaska in almost 40 years.

The Escopeta hunt is spearheaded by Davis and three veteran geologists: Bob Worthem (30 years at Unocal), David Doherty (20 years at Arco), and Frank Banar (37 years at Mobil). All have many years of experience in the Cook Inlet.

The beginning

Exploration in the Cook Inlet dates almost from Captain Cook’s voyage into the basin in the late 1700s. In 1853, Russian explorers discovered oil seeps on the west side of the inlet in the vicinity of the Iniskin Peninsula. Thirty years later, a Russian named Paveloff scooped the region’s first oil samples. Over the next 100 years or so, only a handful of wells were drilled and those were without commercial success.

It was not until 1957 that a major Alaskan commercial discovery was reported. Richfield Oil Corp. (absorbed by Atlantic Richfield Co. [Arco Alaska], then by ConocoPhillips) kicked off modern exploration in the area in 1955 with a drilling program on the Kenai Peninsula in the Swanson River area. The company finally struck oil on July 23, 1957. The Swanson River Unit 1 well, drilled to a TD of 11,000 ft, tested at 900 b/d of oil in the Tertiary Hemlock Conglomerate.

This 250-MMbbl discovery marked the onset of an oil rush into south-central Alaska, and further lead to the state being admitted into the US, as some suggest. Alaska was first recognized as the 49th state in the Union on Jan. 3, 1959.

By that year, 187,000 b/d of oil were produced annually and the state held its first competitive lease sale offshore the Kenai Peninsula. In October, the Cook Inlet reported its first major gas discovery. Unocal (now Chevron) and Ohio Oil (now Marathon Oil) discovered the Kenai field on the Kenai Peninsula. It is the largest natural gas discovery ever reported in the basin, estimated at 2.4 tcf. Gas production started the following year and continues today.

By 1960, further development of the Swanson River and Soldotna Creek units raised annual oil production to 600,000 b/d. In 1962, Pan American Petroleum Corp. (today’s BP-Amoco) discovered the Middle Ground Shoal oil field, the first offshore discovery in the Cook Inlet basin. The first offshore production platform was installed on this field, as well, by Shell in 1964.

The following year, Unocal discovered the basin’s largest oil field, McArthur River, estimated at 1.5 Bbbl, and its neighbor, Trading Bay, while Mobile Oil discovered the Granite Point field to the north.

Over the next several years, extensive exploration was performed, ramping up oil production to a peak level of 225,701 b/d (~82 MMbbl/year) in 1970. Gas production from the Cook Inlet did not peak until 1996, averaging 611 MMcf/d (~223 bcf/year).

Precipitous drop

In 2005, oil production in the Cook Inlet had declined steadily from its peak to around 18,621 b/d (~7Mbbl/year). In August, average daily production continued to drop to 16,732 b/d. Gas production from the basin leveled out in 2005 at 556 MMcf/d (203 bcf/year), a modest drop from its peak.

A majority of E&P in the Cook Inlet was conducted in the ’60s and ’70s. A total of 1,155 (526 onshore, 629 offshore) wells have been drilled in the basin to date (September 2006), with the number of wells spudded peaking at 110 in 1968. Of the 267 exploration wells drilled through 2000, around 160 were spudded from 1958-1970, including a record 36 in 1966. From these wells, 14 offshore discoveries were reported in addition to Swanson River and the Kenai gas field. All of the major oil fields discovered in the basin that exist today were drilled between 1962 and 1965. And 14 of the 16 existing offshore production platforms were installed between 1966 and 1969.

“Then a precipitous drop occurred,” explains Doherty. “Two things happened outside that basin that contributed to this drop at the same time that these platforms were being installed,” he says. Atlantic Richfield and Humble announced discovery of the Prudhoe Bay oil field on Alaska’s North Slope in 1968, estimated at 9.6 Bbbl. Then, in 1971, Arco drilled the US’s second largest oil field, Kuparuk (also on the North Slope), estimated at more than 5 Bbbl.

“These two giant oil discoveries combined with the monumental oil pipeline project to get the product to market, diverted money and manpower away from the Cook Inlet basin where the reserve size per field is in the hundreds of millions compared to the North Slope’s billions of barrels of oil,” he says.

The discovery of the US’s two largest fields lead to an influx of people and resources to the North Slope in search of the next big find. A number of companies left the Cook Inlet, relegating it to the backburner.

As a result, drilling activity in the basin dropped significantly from its peak in 1968. Then; 69 wells were drilled in 1969, followed by 29 in 1970, and only 7 in 1971. From this point, drilling has pretty much remained flat through today. However, there has been a slight resurgence of drilling in the basin since 2000, driven by onshore gas exploration and development. From this point through today, 158 (120 onshore and 38 offshore) wells have been drilled.

Undeveloped discoveries

In comes Southeast Texas-based Escopeta Oil Co. “We got up here (Cook Inlet) in 1994 and were looking for things to do,” says Davis.

“I looked at a prospect called Capes Starichkof. They (previous owner) thought there was 100 MMbbl of oil in this lease based on an inhouse report,” says Davis. So the company put together its resources and bought the lease that spring.

“The importance of this play is that we were buying leases on a field that was discovered in 1967 that had development potential,” says Davis. “It held 116 ft of pay in it and tested at 57 bbl of oil, and they walked off and left it.”

The company laid out a plan to drill an offset to the discovery well to get 200 ft updip targeting 100-200 MMbbl of oil.

Then, in 1997, Arco approached the company and subsequently acquired its interest in the prospect.

In 2001, Arco, after its Alaska operations were bought by ConocoPhillips, setup a rig (where Escopeta had planned to dill) and drilled out to 18,000 ft, and tested it at 1,000 b/d of oil. Pioneer (operator) has since bought a 40% interest in the discovery and now is considering development options.

Inline with the company’s strategy, it started to search the Cook Inlet for additional undeveloped discoveries, and found Shell’s SRS wells, which were drilled in 1962 and 1965 in the northern part of Escopeta’s East Kitchen prospect. One well tested at 400 b/d of oil in the Lower Tyonek, and the other one logged 600 ft of bypass pay; 330 ft of oil and 250 ft of gas. This well was cased but never tested.

“At the same time we were chasing the Kitchen prospect,” says Davis. Kitchen is a big thrust fault trap on the eastern flank of the basin’s Middle Ground Shoal field. “The US Geological Survey (USGS) and US Department of Energy (DOE) reported in the ’80s that this was the biggest exploration play in the basin that nobody had ever tested,” he adds. “And it still has not been tested.”

The company bought some property over the prospect, and acquired seismic, which shows the thrust fault track called Kitchen. “This is probably going to be the biggest field found in Alaska in almost 40 years,” says Davis.

Meanwhile, Escopeta was researching the Sunfish (Tyonek Deep) discovery drilled by Arco in 1991. Similar shows were found in these sands, according to Banar. “But because of the political situation and the imminent threat of ice, their (Arco) testing procedures were terrible,” he says. “The company tested a 1,100 ft interval including several sands in the Hemlock and Lower Tyonek, and got back a trace of oil and a bunch of water, so Sunfish was declared a bust.” This is the last oil discovery in the basin reported to date.

null

Seismic reprocessing/remapping

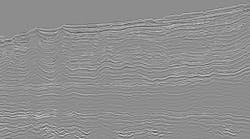

Escopeta purchased existing, 1980s vintage 2D seismic over the area that includes Shell’s SRS wells and Acro’s SCI wells. The company had the seismic lines reprocessed and the area, which it calls East Kitchen, remapped. “We are the first company to map this segment of the basin,” says Davis.

The company had the data on these lines reprocessed using a technique called wavelet energy absorption (WEA), performed by Apex Metalink. “These anomalies on the seismic are related to hydrocarbon accumulations in different reservoirs,” explains Banar. “The oil shown in these wells has been generated from the Jurassic, and is buried up to 30,000 ft to the south, but the Jurassic source rocks are much shallower and in contact with the Tertiary reservoirs in both the Kitchen and East Kitchen prospects,” he says.

“All of these structures were formed sort of like offshore California’s Pliocene strata, which is really young stuff,” he says. “The reservoir sands were deposited before the structures were formed, so we know the sands are there, it’s just that the structures came late.”

The Cook Inlet is the most underexplored basin in the US, argues Davis.

“When you go into these basins, the first thing you drill is the rollovers - the big anticlines. Then, on the second stage of exploration on a basin like this, you have to drill fault traps, stratigraphic traps - different types of plays to find the second stage of exploration - and that’s what we plan on doing,” he says.

“East Kitchen is still in its first stage because it’s an anticline,” says Davis. “Kitchen is in its second stage because we’re drilling a thrust fault trap that’s characterized by a big stratigraphic equivalent where all these oil sands loaded up against this thrust fault from the oil generating area below. We think we can drain around 20,000 acres.”

According to the company’s WEA studies, the Kitchen trap contains 2,000-3,000 ft of pay. This trap is fed by coals, which are prevalent in the area. The coals leak gas which moves up into the sands and the sands trap up against the fault. This type of fault trap produces in and around these fields.

“No one has ever discovered a Cook Inlet field from a big thrust trap that’s got a significant stratigraphic component to it,” says Davis.

Resource potential

The Cook Inlet basin is the source for all natural gas used in south-central Alaska. Given the importance of the basin in fueling the surrounding economy, resurgence in exploration drilling would help offset further declining production. A US DOE report estimates that gas production from the basin will continue declining to 113 MMcf/d by 2015 and 15 MMcf/d by 2023, while demand from this area is projected to increase to 290 MMcf/d by 2035.

Meanwhile, crude production in the basin is projected to decline to around 4,000 b/d by 2023.

However, a study conducted by the DOE in 2004 suggests that the basin holds an undiscovered natural gas resource of 25-30 tcf, more than double the amount already discovered. The study further indicates that 1.6 tcf of proven gas reserves remain; 7.1 tcf has been produced to date.

The department’s latest research concludes that the greatest potential for finding new reserves is in the basin’s stratigraphic traps. The report indicates that historical discoveries in the Cook Inlet have been structural plays. In a basin like the Cook Inlet, only about half the petroleum endowment is discovered in structural settings; the remaining discoveries probably are in stratigraphic plays. The Cook Inlet has not been explored for stratigraphic plays to date, indicating a large upside potential, the report says.

Meanwhile, US Geological Survey scientists have concluded that only 4% of the oil which could have been generated by the Cook Inlet basin source rocks has been identified. Reports indicate that 94 MMbbl of proven oil reserves remain; 1.4 Bbbl has been produced to date.

The MMS estimates that the federal OCS region of the basin (Lower Cook Inlet) holds recoverable resources in the range of 760 MMbbl of oil and 1.4 tcf of gas.

Drilling plan

Escopeta Oil and partner, South Africa-based Centurion Gold Holdings Inc., plan to drill four wells on its identified prospects in the basin in 2007.

The partners secured Songa Co.’s jackupTellus for the drilling program. The rig currently is being upgraded and refurbished in Port Arthur, Texas. The Tai An Kou heavy-lift vessel, contracted through Coscol (HK) Investment & Development Co. of Hong Kong, will transport the rig to the Cook Inlet. The jackup will begin its 60-day journey in December 2006. Its scheduled transit will follow a route from the Gulf of Mexico, around the tip of South America - since the Panama Canal is too narrow - to Alaska.

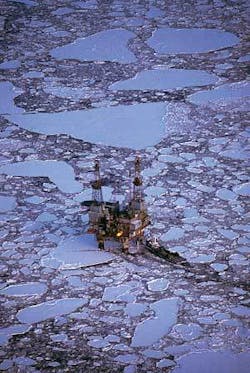

The first well to be drilled under the program is the $35-million East Kitchen No. 1 on an anticlinal feature which Shell tested in 1965. “Based on our inhouse numbers, we estimate potential unrisked reserves over 9,500 acres exist in the range of 400 MMbbl of oil and 2.5 tcf of natural gas,” says Davis. The East Kitchen prospect is in 70 ft of water, approximately 6 mi offshore, north of the Kenai Peninsula. The company plans to drill the well to 17,000 ft TD in spring of 2007. “You can’t drill in the area from late December to the middle of March because of ice,” says Davis.

Then, in mid-summer 2007, the company will move the rig 4 mi west to drill and test the 106,000-acre Kitchen prospect, which is situated on trend with all of the basin’s major fields. “Kitchen is estimated to hold 1.3 Bbbl of oil and about 5 tcf of gas,” says Davis. A total of three wells (one exploration and two delineation) are scheduled to be drilled on this prospect.

The company projects it could produce East Kitchen with one platform equipped with capacity for 50,000 b/d of oil and 100 MMcf/d of gas, and two platforms on Kitchen each also fitted with capacity for 50,000 b/d of and 100 MMcf/d of gas.

“We could have first production two years after we hit pay,” says Davis.

Several majors including ConocoPhillips, Chevron, Forest, and Pioneer Natural Resources own lease positions in the basin and likely will use Escopeta’s contracted rig after it completes its drilling program in 2008.

Jones Act waiver

Escopeta faced one of its many obstacles when it determined that the only vessel available to move its rig from the GoM to Alaska was foreign flagged. According to the US Jones Act, only US flagged vessels can be used to move cargo from one American port to another.

Davis appealed to the US Department of Defense, Department of Energy, Department of Homeland Security, Maritime Administration, and to President Bush for a waiver of the Jones Act.

On June 27, 2006, Davis received a letter from Michael Chertoff, secretary of Homeland Security, granting his request. “This is the first time in over 30 years that the government has done anything to get behind the oil industry,” says Davis.

Chertoff’s letter indicated that approval was given based on declining oil and gas reserves in the US and Cook Inlet basin, and cited that “such a waiver is in the interest of national defense.”

“It’s a mater of national defense to keep the Air Force and Army bases nearby supplied with natural gas while providing the adjacent refinery with American crude oil for a change, and not have to rely on the Middle East,” says Davis.

He confirms that Escopeta is the first independent in the history of the American oil and gas industry to receive a waiver from the US Department of Homeland Security to use a foreign flagged vessel to move a jackup from Texas to Alaska.

Editor’s Note: Historical data and future projections were compiled from a number of industry sources including the Alaska Department of Natural Resources Division of Oil & Gas, US Department of Energy, Alaska Department of Revenue Tax Division, Alaska Oil & Gas Conservation Commission, Kenai Peninsula Borough, and Petroleum News.

David Paganie, Managing Editor

| Platform | Installed | Water Depth (ft) | Operational |

|---|---|---|---|

| Middle Ground Shoal A | 1964 | 83 | Yes |

| Middle Ground Shoal Baker | 1965 | 102 | No |

| Granite Point Platform | 1966 | 75 | Yes |

| Trading Bay Monopod | 1966 | 66 | Yes |

| Granite Point Anna | 1966 | 77 | Yes |

| Granite Point Bruce | 1966 | 62 | Yes |

| Middle Ground Shoal Dillon | 1966 | 92 | No |

| Middle Ground Shoal C | 1967 | 73 | Yes |

| McArthur River King Salmon | 1967 | 73 | Yes |

| McArthur River Grayling | 1967 | 125 | Yes |

| McArthur River Dolly Varden | 1967 | 112 | Yes |

| North Cook Inlet Tyonek | 1968 | 100 | Yes |

| Trading Bay Spurr | 1968 | 67 | No |

| Trading Bay Spark | 1968 | 62 | No |

| McArthur River Steelhead | 1986 | 183 | Yes |

| Redoubt Shoal Osprey | 2000 | 45 | Yes |

| Source: Alaska Oil & Gas Conservation Commission. | |||