Total investment could exceed $20 billion: Russia's largest

More than $20 billion could be invested this decade in phased development of the Sakhalin I and II fields off eastern Russia. The consortia for both production sharing agreements (PSAs) are aiming for a construction start this year, although the development plans for the projects have yet to be formally ratified by the Russian government. When work does get under way, the demands for office space and accommo-dation on Sakhalin Island will be immense, with thousands likely employed on the two concurrent projects.

Speakers from the government and the two PSAs outlined progress at IBC's recent Sakhalin Oil & Gas Conference in London. Although both developments are physically close, their respective schedules and scope limit opportunities for infrastructure sharing. One is an oilfield development followed by a gas phase with pipelines. The other is an liquified natural gas (LNG) venture.

The five partners in Sakhalin I declared their project commercial on October 29 last year. They comprise operator Exxon Neftegas Limited (30%), Japan's Sakhalin Oil and Gas Development Co. (30%), India's ONGC Videsh (20%), and Russian companies Sakhalinmorneftegas-Shelf and RN-Astra (respectively 11.5 and 8.5%). They plan to develop, in four phases, the Odoptu, Chayvo and Arkutun-Dagi offshore fields, which have combined reserves estimated at 2.3 billion bbl of oil and 17 tcf of gas. These figures were established following conclusion of a five-year appraisal drilling program in September 2001. The first phase of development will concentrate on oil production from Chayvo and Odoptu, with start-up scheduled for end-2005, building to a plateau rate of 250,000 b/d. This will be followed by full-scale gas extraction, most likely culminating in a subsea trunkline exporting supplies to Japan beginning as early as 2008, if commitments for sufficient volumes are obtained. Over time, demand may also emerge for an overland line tracking south-west through Russia to China.

Originally, Exxon Neftegas had considered building a new-concept, ice-resistant platform. Under its revised scheme, Chayvo's oil will be developed through 15 wells, drilled by the existing Orlan platform, with 10 more extended-reach producers drilled from an onshore location at Chayvo Bay, 8 miles west of the offshore formation. The Orlan was acquired from Global Marine Drilling last summer. It was subsequently towed 4,800 km from Alaska via the Bering Sea, arriving in the Russian Pacific coast port of SovGavan in October. The 44-day tow-out operation was managed by Crowley Alaska using two 7,200 hp tugs for the Arctic section, with a 23,500 hp tug added for the stretch across the Pacific.

The Orlan has worked for many years in ice conditions offshore, but will be modified for the Chayvo drilling program. A higher spec rig is being installed, and the accommodation is being upgraded, although crew numbers will likely be small. Currently, the platform has four main components - a steel mud base, a concrete brick caisson, and two steel deck barges which support the drilling equipment and living quarters. Overall length is just over 310 ft, with a maximum width of 295 ft and an overall depth (including mud skirt) of 100 ft. The draft for the tow was 34 ft.

Assuming final approval from the government, pre-drilling of extended reach wells from onshore should begin towards the end of 2002. When the Orlan is setdown in 2004, it will operate year-round in approximately 45 ft water depth. Full wellstream production will be sent to the shore via a flowline.

Odoptu will be developed using extended reach wells up to 6 miles long, drilled from two onshore locations between Piltun Bay and the Sea of Okhotsk. There will be primary separation of oil, gas and water next to the well sites. Produced hydrocarbons from both fields will undergo final processing at an onshore process facility situated 50 miles south of the Odoptu well pads and 5 miles west of the Chayvo onshore well site.

Excess gas from the Chayvo onshore production center will be piped to the Orlan for reinjection.

From the Chayvo onshore facility, stabilized crude will be piped 132 miles to a marine terminal to be built at DeKastri on the Russian mainland, north of Chikhachev Bay. That terminal will be equipped with storage and tanker-loading facilities for vessels up to 110,000 dwt. Year-round tanker movement will be effected using ice-breaker vessels.

Phase 2 of Sakhalin I will step up commercial exploitation of the gas from these two fields. The partners concluded that long-distance pipelines represented the most cost-effective method of delivering supplies to Far East export markets. Exxon Japan Pipeline is currently working with a Japanese company on the optimum route, design standards, and environmental and regulatory aspects for the line to Japan. This would landfall at Hokkaido, extending ultimately overland south to Tokyo. A feasibility study on the potential routes should be complete in the coming months.

Under Sakhalin I Phase 3, another drilling quarters platform would be installed to develop Arkutun Dagi. Later, in a fourth phase, subsea templates would be added to extract more gas from this field, and Odoptu's gas reserves would be further developed through wellhead platforms.

According to Neil Duffin, President of Exxon Neftegas, Sakhalin's harsh weather has been taken into consideration. "We can only do some of the work in winter, and other tasks in summer." Timing could also be affected by the strain on the island's resources. "We are planning diligently to involve Russian contractors and personnel capable of working to the high specifications and standards that this project demands. It is a key goal of the company to maximize Russian content over the life of the project," said Duffin.

LNG commitment

Since 1999, over 3.5 million tons of oil has been produced seasonally through the PiltunAstokh-A (Molikpaq) platform in the Sakhalin II offshore concession. The current shareholders are Shell Sakhalin Holdings, based in The Hague (55%), Mitsui Sakhalin Holdings (25%), and Mitsubishi offshoot Diamond Gas Sakhalin (20%). The project's operator is Sakhalin Energy Investment Company. CEO Steve McVeigh told the London conference that the second phase of development, like the first, would represent Russia's largest single foreign investment. It would also be Shell's largest "greenfield" project anywhere for 30 years.

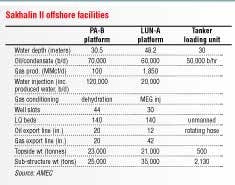

Phase 2 is an integrated oil, gas, and LNG project based on further development of the Piltun-Astokh and Lunskoye fields, situated 15 km offshore the northwest part of the island, in 30 and 48 meters water depth. Piltun-Astokh is mainly an oil field, with associated gas. Lunskoye is a giant gas field with an estimated 700 bcm recoverable, plus an associated 600 million tons of condensate. The gas reserves were upgraded by nearly 40% last year, following the conclusion of appraisal drilling and 3D seismic interpretation.

Shell and its partners plan to build and install two new platforms (one on each field), an onshore processing facility, 800 km of oil and gas export pipelines (mostly overland), and a two train, 9.6 million tons/year capacity LNG plant and export terminal at Prigorodnoye on the island's southern tip. This location was selected for its favorable water depth and virtually ice-free status during the winter. The two LNG trains would be the world's largest, McVeigh claimed, and would augment world LNG supply volume by 10%.

Production sharing terms for this project were approved by the Russian government last June. Front end engineering design is ongoing for all phases of the project, McVeigh added, with an environmental impact assessment submitted this February. Public hearings on the project's impact have recently been staged throughout the island. Last August, bids were invited for the oil export facility. Other packages are about to go out to bid. Assuming final shareholder approval this summer, development should proceed, leading to the first LNG shipment in 2006.

"We believe LNG is our best option for delivering this gas to Asia," McVeigh said. "Forecasts suggest Asia-Pacific demand growing by 30 million tons/year by 2010, with potential rollover of 8 million tons/year in existing volumes. We have close proximity to buyers in Taiwan, Korea, China, and Japan. There is also a potential market in North West America, via Alaska.

"Our scheme is fast and flexible ellipse We can rapidly build up sales volumes among buyers across several countries, thereby enhancing the project's economics. The 800 km onshore pipeline also facilitates early use of the gas by domestic users both on the island and on the Russian mainland, as envisaged in the PSA. The oil alone would not justify the cost of a line to the south of the island." No sales contracts have so far been clinched, but the consortium was confident of getting enough to anchor the first of the two trains, McVeigh added.

Platform constraints

AMEC Offshore Services in the UK was awarded the definition-engineering contract for the offshore facilities in December 2000. Prabhat Garga, Project Director at AMEC for this work, outlined the difficulties in his paper at the conference. These include severe environmental conditions in the Sea of Okhotsk - very low temperatures, crushing ice for six months of the year, high waves during the summer months, and high risk of earthquakes. However, in Anniva Bay in the south, where the oil tanker loading unit will be located, conditions are less harsh, with only thin ice formation in the winter. Conventional tankers should therefore be able to operate there year-round.

Main technical considerations for the two platforms will be:

- large topsides with high throughputs, large drilling rigs for deep wells and maintenance manpower demands,

- low temperatures necessitating winterization of all facilities, leading to sizeable heating and ventilation requirements,

- ice crushing forces must be countered with large, gravity-based substructures and enclosure of conductors, risers, and caissons within columns,

- large topsides mated over shallow water gravity structures will require addition of large buoyancy towers for safe and secure operation prior to set-down in the field locations,

- large platform hydrocarbon inventories in enclosed modules, leading to high blast over-pressure loadings,

- oil-offloading hose reels that can withstand long spells of immersion in icy waters.

Other restrictive factors include the current lack of suitable logistics, supply, and maintenance facilities on Sakhalin Island, which would necessitate high spec plant with low maintenance. There is also a lack of suitable local fabrication sites (no graving docks). Additionally, construction and commissioning at the final offshore sites may have to be minimized due to the inability to site conventional construction support vessels during the winter.

Mating of the large topsides to the substructures for the two platforms will be effected by the floatover method in calm, deepwater conditions. The mated platforms will be towed to their final locations, then ballasted down using water and solid ballast to form stable, gravity-based structures.

Limited synergies

Under the PSA terms, Sakhalin Energy and Exxon Neftegas were obliged to explore opportunities for common use of infrastructure. According to McVeigh, the two discussed sharing export systems, but both declined, "ellipseessentially because each project is driven by different time-scales. Exxon's scheme is for oil with a later gas phase. We're not sharing gas facilities, as we're both competing for the same Asian markets. We continue, however, to look at other ways of cooperating with Sakhalin I, such as sharing camps, airports, and oil spill response," McVeigh said.

Anxious to counter criticism in the Russian press that the Shell-led project lacked sufficient Russian content, McVeigh said, "They're suggesting that we don't want it, or we're not promoting the need for it. But we're committed in our PSA to achieving 70% Russian content over the life of the project, subject to Russian enterprises reaching certain criteria. This was formally agreed to by the government. The Russian content will ultimately be measured by man hours and material volumes. In Phase I of this development, we awarded 5,000 contracts to Russian companies. We did not take on an obligation to build a Russian industry that does not yet exist. We're confident we'll meet, or even beat, the 70% Russian content target over the life of the project."

To this end, the LNG modules, which weighed 2,000 tons in the original design concept, have been downsized to 800 tons maximum, which is more in line with the capability of Russian contractors, he claimed. "In the latter stages of the project, our main cost will be OPEX - then we may be able to achieve 70% Russian content in dollar terms."

Slowdown elsewhere

Prospects for authorization of other new projects look dim, admitted Galina Pavlova of the Oil and Gas Complex Department for Sakhalin Oblast. The Sakhalin III PSA, which has been under negotiation for several years, stalled completely in 2001, she said, due to reorganization of the federal authorities responsible for controlling and managing PSAs.

"The Kirinsky Block PSA has been in a state of lengthy deliberation by the Negotiations Commission for eight years," she added, "while Ayashky and East-Odoptu blocks have still not been included in the list of subsurface areas to be developed on a PSA basis." Progress on Sakhalin IV remains slow, due to an ongoing "inventory check" by Russia's Ministry of Natural Resources - this PSA license area may also be split up into further blocks.

Only ZAO Petrosakh, which operates a small onshore oilfield and refinery, was successful in gaining a license for exploration of two promising offshore structures within the Sakhalin VI area - Kerosinnaya and Rymnikovskaya. Currently SMNG and OGUP SNK are negotiating for exploration of structures on the Veninsk block, within the Sakhalin III offshore acreage.