More UK decommissioning infrastructure needed, analyst claims

Offshore staff

FAVERSHAM, UK – Between 2017 and 2040, Westwood Energy expects 261 fixed platforms weighing a total of 2.6 MM metric tons (2.87 MM tons) to be removed from UK waters.

According to analyst Ben Wilby, a large amount of onshore infrastructure will be needed to ensure that projects are not delayed, potentially causing cost overruns or use of yards outside of the UK that do present availability.

Following thePioneering Spirit’s removal of Shell’s 24,000-metric ton (26.455-ton) Brent Delta platform and subsequent delivery to a yard in Hartlepool, and Repsol Sinopec’s recent award of a deconstruction contract for the Buchan Alphaproduction semisubmersible to Veolia’s Dales Voe facility in Scotland, the UK’s decommissioning industry is visibly under way, Wilby said, making open, industry-wide, discussions vital.

At least the mindset towarddecommissioning is improving, he added, with many operators setting up dedicated departments, and various political parties making reference to it in their recent UK election manifestos (compared with 2015, when decommissioning was not mentioned at all).

At present, Britain’s government will be liable for around half of the bill, estimated at $28 billion between now and 2040. So all parties need to be actively involved in ensuring that costs are minimized, Wilby claimed, and that the value of decommissioning to the UK in terms of contract awards and job creation is maximized.

At a recent East of England Energy Group event representatives of Shell and Centrica confirmed their companies planned to use UK yards where possible for decommissioning of UK sector platforms.

Time pressures for the building of new yards have come down because the UK offshore market has proven to be more resilient than expected, with many fields that had faced abandonment continuing to produce as opex offshore UK came down.

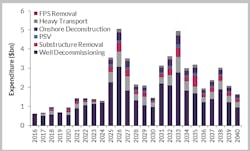

Westwood forecasts that the majority of ‘decom’ expenditure will come after 2025, which should provide sufficient time for the continued development of decommissioning yards across the UK.

However, this will likely require government support, especially in the next few years where the business case for new yards will be weaker. The Scottish government has announced a £5-million ($6.37-million)Decommissioning Challenge Fund to ensure that Scotland’s supply chain benefits from decommissioning, including support for infrastructure upgrades and the developing of business cases for new yards.

Several party manifestos for the election called for adeepwater port to be built specifically for decommissioning, Wilby added.

06/14/2017