Offshore projects are starting to become competitive again, says analyst

Offshore staff

OSLO, Norway– While the oilfield service market in shale is the place to be in 2017, there is clear evidence that offshore projects are still being prioritized by E&P companies, according to analyst Rystad Energy.

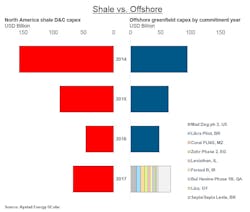

For every dollar that is invested into the North American shale market in 2017, the analyst firm says, a dollar is also earmarked for the development of new offshore resources. Both sources of future production, shale and offshore, will receive around $70 billion each of planned capex.

In both 2014 and 2015, E&P companies looked at North America and the shale industry for where they would invest in new production capacity. In 2014, $160 billion was invested into drilling and completion of wells and $20 billion on infrastructure, while only $95 billion was committed to unlock new offshore resources. For 2015, 40% more was directed toward shale. Both 2014 and 2015 were the result of offshore projects pricing themselves out of the competition of providing oil to the market.

However, with two years ofcost cutting programs in the offshore value chain, 2016 and 2017 are showing full competitiveness within these two sources of supply, Rystad Energy says. This shows what the offshore industry has worked with during the downturn. In a time when many thought that offshore projects could not compete with shale, offshore operators managed to turn uncommercial projects into highly competitive projects with the help from service companies. Offshore projects that were uncommercial at $110/bbl in 2013 are now commercial at an oil price of $50/bbl.

The top 10 offshore projects in 2017 make up almost 70% of all of the committed capex and it is only the best-in-class projects that will pass the decision gate in 2017. One of the key efforts has been reviving projects such asMad Dog Phase 2, Coral FLNG, and Leviathan. For the suppliers that win the contracts for these projects, most of them will need to wait until 2018 before seeing increased revenues.

One of the reasons for offshore projects starting to become competitive again is the strong deflation of unit prices which is actually higher for offshore than onshore. In 2016, unit prices for offshore developments have been reduced 27% from the peak in 2014 for awarded contracts.

One of the key segments, which have helped the offshore cost to come down, is related to the immense pressure on day rates fordrilling rigs. Here, prices have come down more than 50%. For other segments, the cost is down more in the range of 20-30%, where subsea is on the upper end.

On top of the unit price deflation, comes efficiency gains, currency effects, and changes to design which have helped total breakeven prices to come down. However, with surging activity increase, both within shale and offshore this year, inflation will take its toll going forward.

The analyst says the time window of low service prices has started to shrink, but it will stay open longer for offshore activity due the longer contract durations and lead times. This will impact even more the 2018 volumes of activity and also benefit service companies on their top and bottom line.

02/17/2017