Offshore suppliers to be stung again by 2017 market reductions, says analyst

Offshore staff

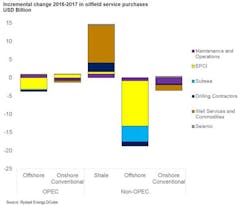

OSLO, Norway–Rystad Energy analysis shows that the struggle for offshore suppliers will continue next year, with the overall offshore market to be reduced by $19 billion in 2017 compared to 2016.

EPCI and subsea purchases were found to be the most effected, with more than $12 billion and $4 billion of reduced spending, respectively.

Audun Martinsen, VP Oilfield Service Analysis at Rystad Energy, said: “2017 will follow a lot of the trends seen in 2016, with more market consolidation and tighter collaboration between service companies and operators. However,OPEC production cuts will turn the needle on the FID for many projects in shale and offshore, which will eventually generate more transparency on future activity and revenue.”

On the other hand, the analyst firm found that service companies with shale exposure will be better positioned, with as much as $15 billion in increased spending to flow into the non-OPEC shale market in 2017. Non-OPEC shale well services are best positioned with an estimated $10 billion of additional spending, followed by drilling contractors (assuming 10,000 wells are to be drilled and completed).

12/07/2016