Iran, emerging markets provide opportunities for oilfield services, says analyst

Offshore staff

OSLO, Norway – A recent update from Rystad Energy contains optimistic news for the oilfield services sector.

Recent analysis found that the low oil prices “have not affected closed and emerging markets to the same degree” as other markets during the global pricing crisis, providing opportunities for service companies.

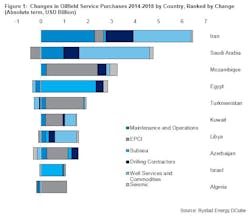

Rystad Energy expects a $30 billion growth from 2014 to 2018 to be realized for 20 countries around the world.

There are several exciting potential growth opportunities in more than 20 countries worldwide, it continued. Saudi Arabia is growing purchases in most segments, except engineering, procurement, construction, and installation (EPCI), to maintain production capacity, andMozambique’s purchases will ramp up as the country prepares for offshore gas developments. Egypt and Turkmenistan’s purchases are mainly driven by field development at Zohr, West Nile Delta, and Yolotan.

However, Iran is expected to have the largest growth, increasing its purchases by more than $6 billion from 2014 to 2018 to realize its production targets. After UN sanctions were lifted in January 2016, the country’s oil and gas industry has been gradually opening up again for foreign service companies, unlocking a large market potential.

The easing of sanctions has resulted in a sought for market for a service industry searching for growth opportunities, Rystad continued. Iranian officials have proclaimed that they would take investments of $85-$120 billion in the upstream sector during 2016-2020 to increase crude production, according to their ambitious plans. In total, $150-$185 billion, or 50 upstream and midstream projects, could be committed before 2020.

The analyst firm foresees that production growth will face challenges due to investment hurdles and decline at existing fields, and assumes around $100 billion of investments in the upstream sector from 2016 to 2020.

Approximately half of the $100 billion spending purchases will be directed toward the offshore market, which is expected to be at $9 billion this year and grow to $11 billion in 2020. The majority of the market consists of EPCI contracts.

Five new platforms will be commissioned in 2017 atSouth Pars phases 20 and 21, and more to follow at the $4-billion South Pars Phase 11 as well as at Farzad B discovered by an Indian consortium.

An increased number of active platforms, together with aging facilities that have lacked investments during the sanctions, will force a rise in the maintenance and operations purchases. Demand for drilling contractors as well as well service and commodities is picking up in the coming years since many of the offshore projects under development will go into pre-drilling.

Roughly 25% of the investments are well-related costs; with 22 wells to be drilled over the next 30 months at South Pars Phase 14 and additional infill drilling to commence at the producing field, these services will rise in the next few years.

06/16/2016