Deepwater market expected to rebound in 2018

Analysis indicates that worst may be over

Jon Fredrik Müller

Rystad Energy

Sanctioning of offshore developments is currently moving at a slow pace. However, in order to deliver on projected demand into the 2020s, significant offshore volumes, includingdeepwater, need to be sanctioned over the next couple of years. With unit costs dropping and projects being re-engineered, increased sanctioning activity is expected from 2017.

Low oil prices

At the time of writing, the global oversupply of oil, combined with market sentiment, is such that the oil price is trading around $35-40/bbl. The lowest closing pricing for Brent Blend in this downturn was the $26.01/bbl from Jan. 20, 2016. It is this author’s opinion that the worst, in terms of oil price, is behind us now. Moving toward the 2020s, the market needs a substantially higher oil price in order to balance supply with the common views of demand communicated by agencies such as IEA and EIA. One can argue that the oil price is unsustainably low at the current levels. There are a a few basic factors underlying this conclusion.

First, at $35/bbl (Brent), the average realized price for the operators globally is equal to the forecasted incurred costs for 2016 (capex, opex, and gross taxes like royalties). At these levels, the industry as a whole is not making any money from operations. If you add financing costs such as interest rates and dividends on top, the industry is cash negative and will need to borrow money to fulfill its obligations. Over the last 30 years oil prices have been lower in absolute values than what we are currently observing. However, the oil price is now at an all-time low relative to the cost level in the industry.

Second, although there is an oversupply in the market at present, activity levels are far below what will be needed to balance the market longer term. In 2015, the global market consumed about 34 Bbbl of liquids, but the industry only sanctioned development of 7 Bbbl. Similarly, the industry only discovered 13 Bbbl. This means that the industry only discovered 1/3 of the volumes and only sanctioned 1/5 of the volumes that were consumed. In the short term, this has little effect, but in the long term the volumes discovered and sanctioned need to replace the volumes consumed.

Third, a marginal cost of supply approach indicates the there is a need of an oil price around $95/bbl by 2020 in order to stimulate sanctioning of enough fields, both offshore and onshore, to meet projected demand. Of the new production needed by 2020, approximately 45% is forecasted to come from shale, 40% from offshore and 15% from conventional onshore. If we look further into the future, offshore is forecasted to surpass shale as the most important source of new liquids. By 2025, approximately 45% of the new production needed is expected to come from offshore, while shale accounts for 30% and conventional onshore and oil sands for 25%.

Offshore expenditures

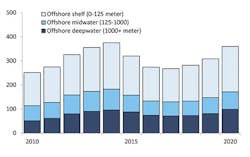

New offshore developments will continue to be an important source of liquids supply over the next ten years. However, in the same way as most other segments, offshore expenditure is currently falling with reduced activity globally. After several years of double-digit growth, the offshore market reached $375 billion in 2014. In 2015, the market contracted by 15%, and it is forecasted to contract further by 14% in 2016. After an estimated flat market development from 2016 to 2017, the market is expected to return on a growth path in 2018, reaching $360 billion in 2020. From 2017-2020, it is the offshore deepwater segment that is forecasted to grow the most, with a CAGR of 12%, compared to 11% for shelf and 7% for midwater.

Deepwater hot spots

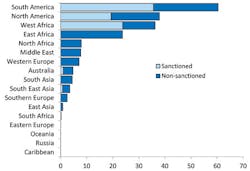

The “Golden Triangle” of deepwater developments - the Gulf of Mexico, Brazil, and West Africa - will continue to be the main market for deepwater activity toward 2020. Of potential investments of close to $200 billion, the “Golden Triangle” accounts for approximately 70%. However, there is a new region that could potentially become a new hotspot - East Africa. Large deepwater gas discoveries in Mozambique and Tanzania may bring significant deepwater investments. However, so far, none of the potential projects have been sanctioned.

South America (Brazil) will continue to be the largest market for deepwater developments over the next five years. Investments of $35 billion have already been sanctioned and the first phases of Lula, Buzios, and Greater Iara Cluster (all Petrobras) are moving toward first oil. The pilot phase of Libra is estimated to bring $7 billion of investments from 2016-2020, but is still to be sanctioned. The giant field is estimated to contain between 8-12 Bbbl and is to be developed in several phases using FPSOs. Although plans are currently under development, Petrobras envisions 12-18 FPSOs over a period of 30 years to develop the entire area.

Deepwater developments in North America is limited to the US Gulf of Mexico in this decade, potentially totaling close to $40 billion. There is a potential also on the Mexican side of the Gulf, but further exploration activity is needed. Any deepwater development in Mexico is unlikely before the 2020s. Projects progressing in the US include, among others, Stampede (Hess) and the Appomattox (Shell) development sanctioned in 2015. Going forward, some of the most interesting fields to be sanctioned include the Mad Dog Phase 2 (BP), Vito (Shell), and Shenandoah (Anadarko).

In third place is West Africa; but the region has larger volumes sanctioned than North America. The sanctioned projects are dominated by Total (95%) with its large ongoing Egina, Kaombo, and Moho Marine Nord developments. Among the fields to be sanctioned, there is a lot of industry interest regarding Shell’s potential Bonga Southwest development, especially after Maersk’s Chissonga development has been delayed and Cobalt started the process to sell the Cameia discovery to Sonangol.

In East Africa, the projects in Mozambique (Eni and Anadarko) seem to be moving faster than in Tanzania (Statoil and Shell/BG). The most promising of these projects is Eni’s Coral FLNG concept in Mozambique. The large onshore facilities might be delayed as the large capex commitments can be difficult to push through in the current investment climate.

Outside of the top four regions there are several large potential deepwater projects. Eni has the giant Zohr deepwater gas development in Egypt. Noble Energy’s recently filed a new PDO with a fixed platform concept, instead of the original planned gas/condensate FPSO, for its Leviathan field in Israel. The troubled Gendalo-Gehem development offshore Indonesia might also bring significant investments if it finally commences development.

The author

Jon Fredrik Müller is a senior project manager within the consulting department of Rystad Energy. His main area of expertise lies in the oil field service segments and particularly within offshore related services. He holds an M.Sc. in industrial economics from NTNU, Norway, with specialization in mechanical engineering and finance, including a graduate exchange program at University of Calgary. Jon Fredrik works for Rystad Energy’s Oslo office.