Offshore wind energy market increasingly attractive, say SNC-Lavalin officials

Bruce Beaubouef

Managing Editor

While the oil and gas market has rebounded from the downturn of the past few years, offshore operators remain cautious about advancing major new greenfield projects. Operators are continuing to place great emphasis upon capital efficiency, and are examining the best ways of getting more oil out of existing fields, and developing their newer fields in the most cost-effective manner.

It is in this context that SNC-Lavalin is looking to bring new designs and concepts to the offshore marketplace that will help operators advance their greenfield and brownfield projects. SNC-Lavalin, a Canadian headquartered company with over 50,000 employees globally, was founded in 1911 and operates in the oil and gas, mining and metallurgy, infrastructure, clean power and nuclear markets.

In recent years, the company recognized that they needed to rejuvenate their legacy oil and gas business. After reviewing their portfolio, in 2014 management made the decision to acquire Kentz, a UK-based engineering construction company. After that, the legacy SNC-Lavalin oil and gas operations were combined into Kentz to create a new oil and gas business.

The PC Semi uses column pairs to increase safety, lower cost, and improve project delivery time. (Courtesy SNC-Lavalin)

Still, the company recognized that it needed to further expand its oil and gas capability. It did this in 2017 by acquiring Atkins, another UK-based engineering and consulting business. By acquiring Atkins, SNC-Lavalin also acquired Houston Offshore Engineering, which has been engaged in offshore field development, engineering and design for more than three decades.

Recently, Offshore met with Christian Brown, President-Oil & Gas, SNC-Lavalin, and Martin Grant, Executive Vice President Engineering, SNC-Lavalin, to discuss these acquisitions; the latest technology and design advances; and the opportunities they see in the offshore oil and gas market going forward.

Offshore: What’s your view on the state of the offshore oil and gas market today?

Brown: The Middle East continues to be a key source of supply due to its low cost of capital and low cost of production, but we believe that production is going to need to ramp up in other areas to meet global demand in the future. The US also benefits from low cost of capital and low cost of production, so we see production ramping up from politically and economically stable regions like the Gulf in the future.

I think we’ll see a balancing of where the capital is spent. We’re starting to see more confidence, more discussion. It’s not yet to the point of contract awards, but certainly leaning towards a path of more rewards. We believe that the need for greater production going forward will drive the offshore market again.

When we talk to our Gulf of Mexico clients, it becomes clear that their goal is to reduce the overall cost to build offshore platforms and production facilities. In many cases, they have moved forward with these goals. And, there’s a move toward greater standardization. – Christian Brown, President-Oil & Gas, SNC-Lavalin

Offshore: What other trends are you seeing?

Brown: When we talk to our Gulf of Mexico clients, it becomes clear that their goal is to reduce the overall cost to build offshore platforms and production facilities. In many cases, they have moved forward with these goals. And, there’s a move toward greater standardization. Because of these trends, we think that there will be more investment coming into the offshore marketplace in the next few years.

Offshore: As part of that process, Atkins/Houston Offshore Engineering has introduced at least two new facility designs, including a new spar concept that is designed to help operators monetize smaller fields (see May 2018 Offshore), and a low-motion semisubmersible concept (see July 2017 Offshore) that is designed to broaden deepwater development options. Can you talk more about the larger goal here?

Grant: The big picture is that we see a production gap coming, and we think that gap will need to be filled by offshore production. But any new facility designs will have to work at around the oil price that we have now. There’s a lot of pressure to get costs down, and these new concepts are designed to comply with that. This is not a time, by the way, to do radical technology. There is still an air of uncertainty about moving offshore projects forward coming out of the downturn. So we are focusing on designs that we know will work, and we are making them a bit smarter and more efficient. We have a group of professionals working on this who have spent the last 20 to 30 years designing TLPs and semis for use in the Gulf of Mexico. They are taking that knowledge and looking for ways to design offshore production facilities in a more cost-effective fashion.

One example of this effort is the Flat Plate 40 (FP-40) spar, which has been a great example of us working with the local fabricators to develop something that’s pretty simple and easy to fabricate and can be conveyed out into the Gulf and installed relatively easily. Another example is the Paired-Column Semisubmersible (PC Semi), an innovative alternative to the conventional semi. It uses column pairs to increase safety, lower cost, improve project delivery time, and be riser friendly. Importantly, the design reduces the amount of steel required for the platform.

The FP-40 spar has been designed around shipyard construction capabilities and production line efficiencies, and can be installed in less than 24 months after project award. (Courtesy US Spars)

Offshore: How do these new designs emerge? Are they developed on the operator side, or are you proactively suggesting these new designs to your clients?

Grant: It’s a great question, because we think that paradigm is changing. Historically, the thinking was done on the operator side. They might have their research organizations in this area, and then would say to the engineers: “We need you to build something that looks like this,” and then we would detail it up. Now, we’re taking the opportunity to get ahead of the curve, and say, “you know, this is what we have learned, and this is the direction we should be going.” We’re participating in various competitions now where clients are not saying “this is what it ought to look like.” They’re just saying, “look this is a reservoir that we need developed as efficiently as possible.” And they’re open to new ideas. So, I think that the old model is changing, and for the better.

Offshore: At the same time, operators are looking for new ways of extending the productive lives of their existing offshore platforms. What are you seeing on this front?

Grant: The key here is to have a fundamental understanding of how a structure ages, and how you keep it safe. It’s also important to have a fundamental understanding of how you deploy a workforce to do maintenance and repairs. These are the skillsets that allow an operator to get 10 to 20 years of additional service from a floating production facility. The extensions you can get with the proper approach can be quite significant. We have “re-lifed” facilities up to 60 years now. These platform life extensions can be important, even when the original field has been depleted, because the facilities can serve as hubs for tiebacks and pipeline connections. Even in an improving market, we believe that there will continue to be a focus on brownfield projects.

The big picture is that we see a production gap coming, and we think that gap will need to be filled by offshore production. But any new facility designs will have to work at around the oil price that we have now. – Martin Grant, Executive Vice President Engineering, SNC-Lavalin

Offshore: What are your biggest markets for platform life extension projects?

Grant: Perhaps not surprisingly, it’s the areas where offshore production has been going on for the longest time – the US Gulf of Mexico and the North Sea. But, we’re beginning to see interest for these types of services in the Middle East as well, offshore Saudi Arabia and Abu Dhabi. These are all good markets for us in terms of brownfield and life extension projects.

Brown: I think anywhere where you saw extensive capital being deployed in the 1970s is an opportunity for life extension. There’s a large number of facilities that were installed in the 1970s and 1980s, and they’re coming upon their 25- to 30-year lifetimes now. That’s the opportunity.

Offshore: You have also been focusing on the marginal field development market. What technologies and opportunities are you seeing there?

Grant: One of the things we’re working on now is the issue of de-manning platforms. To be sure, the concept of an unmanned platform is not new. But if you go back 20 years, an “unmanned” platform was one that still needed to be visited twice a week. Now we are developing designs that only need to be visited once a year. Obviously, advances in instrumentation technology have played a large role in enabling the concept of the unmanned platform, and the related advances in digital technology are enabling remote operation.

And, while hardware is more reliable than it was 20 years ago, our plan is also to reduce the amount of equipment on the facility. With less equipment, there’s less need for monitoring, less need for backup equipment, and fewer things that can go wrong. But, interestingly, there’s a real need for design discipline in this process. On the client side, some might be tempted to say “we’ve been talking to this department, and they would like you to add this.” Sometimes it’s tough to say no. It raises the question: Can the industry actually hold its nerve and produce something that’s really, really simple? It’s not a safety thing because there’s not anybody there. It’s going to be environmentally proper, because we’re putting quite a bit of effort into that. The big thing for us is demonstrating to our clients just how much they can save during the operational phase.

Subsea oil storage in steel tanks, as applied at the Solan field in the North Sea, provides a development option for fields with no local pipeline infrastructure. (Courtesy SNC-Lavalin)

Offshore: What’s the biggest driver here – cost, safety, difficulty in finding skilled labor?

Brown: It’s pure cost. But it’s a virtuous circle. If it’s simple and easy to build, relatively speaking, the capex comes down and the opex comes down because you don’t need to manually intervene in any given scenario. It is just simply a cost thing. We talked about the coming production gap. Offshore E&P will have to step up to meet that gap, but any proposed solution has to be feasible at $70/bbl. In this case, we are going to demonstrate that it works at $50/bbl. We have that confidence that the oil price will be there, but we can reduce costs for these types of facilities, and we can do it without compromising on safety and environmental protection.

Offshore: Moving on to another topic – it’s my understanding that SNC-Lavalin is developing technologies that will enable operators to store produced oil offshore. Can you talk about what’s happening here?

Grant: Sure. The driver, as you know, is when you have an oil development that is not near any pipeline infrastructure. The field may be economically viable, but still not large enough to warrant a long-distance, large diameter subsea pipeline. We are seeing this type of situation with the Solan field development project, in the west of Shetland area in the UK North Sea. The developers are looking at an initial production rate of 24,000 b/d. It’s sizable, but not enough to justify a pipeline. The technology is pretty simple; it’s just a big steel tank that sits on the seabed. There was some debate about whether to use steel or concrete. Again, that’s driven by economics, but in this instance the industry was eager for this type of technology, so we got a good price to build the steel tank. Essentially, you send your production into the storage equipment. The initial oil resides in the top of the tank, and as the oil comes down under pressure, it displaces the water below. Basically there’s an oil/water interface there. The oil floats, residing on water in the tank. You produce into the tank, and thereby push the interface down. Once you have filled it up, then you have to halt production. The oil then gets offloaded into an FPSO.

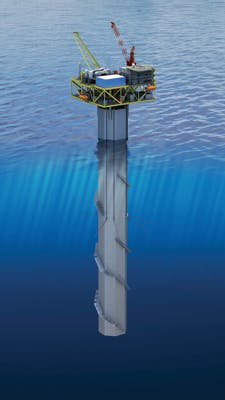

SNC-Lavalin says that it is bringing its platform engineering and designing experience to the growing offshore wind energy market. (Courtesy SNC-Lavalin)

But even though the concept is relatively simple, there’s a lot of knowledge required in the engineering design, in terms of how you design the storage structure. There’s some unusual loading forces that can act upon the storage equipment during transportation; then also during installation; and then during the cycle of filling it up with oil. The waves produce a sort of pressure differential on it, so there’s a fatigue issue that we have to deal with, but a year into the program, things are working out quite well.

I should mention that when thinking about this type of facility, an operator can set the production facilities on top of the tank, or he can site the tank separately. BP did this with their Harding project a while back. In that case, they used a concrete tank, and a jackup structure sat on the concrete tank, but with Solan we have it sitting to one side. It’s a really simple, cost-effective solution, and we think this is a good time to re-introduce it to the industry. If an operator is facing the problem of stranded oil reserves, this is a way of unlocking them – typically at a relatively low lifting cost.

Offshore: The other big topic we are seeing in the offshore marketplace is wind energy. I believe that SNC-Lavalin is investigating the opportunities in this segment as well.

Brown: The offshore wind industry is something we’ve followed for a long time. We’ve been working on it for seven to eight years now. It’s an industry where the cost per megawatt hour has really started to fall. It’s becoming economic without the subsidy against conventional forms of power generation. We see interest growing and the marketplace expanding in terms of geography. First it was Denmark, and then Germany, and now we see significant developments off the UK as well. They now have more installed capacity offshore than everybody else, something on the order of five gigawatts now. We’re also excited to see that the US has a number of projects that are likely to go forward, particularly off the Northeast coast. We see interest in Taiwan, Japan, and China as well. These are areas where you have a concentration of people in the coastal regions, so wind energy makes sense in these locations. So, we see the offshore wind energy industry really taking off. We responded to the growth of this market by moving a lot of our offshore oil and gas skills into the offshore wind arena.

Grant: With our experience in engineering and designing offshore production facilities, it was natural and logical to bring that expertise to the offshore wind energy market. But to engage in the offshore wind market, you need to know about marine installation techniques and procedures. That’s what offshore oil and gas does. To date, the focus has been mostly on fixed jacket structures. The concept of floating wind energy structures is more recent, and still under development, but actually might be something we see more of going forward. It makes more sense when you go out into deeper waters, obviously, it’s the same as oil and gas. When you start looking at much bigger turbines, these will be located further offshore for environmental reasons. If you go back 10 years, an offshore wind turbine was often a one-megawatt step through. We’re now up to eight megawatts. In 10 years, it’s probably going to be 50 megawatts. That will need to be further offshore, and then you’re looking at floating installations for deepwater. That will be technology of tomorrow. •