Offshore staff

OSLO, Norway – The Danish Energy Agency (DEA) has approved Norwegian Energy Co.’s (Noreco) acquisition of Shell’s Danish upstream assets.

According to Noreco chairman Riulf Rustad, the transaction will make the company Denmark’s second largest oil and gas producer after Total.

The transaction includes proven and probable (2P) reserves of 209 MMboe, based on an independent consultant’s assessment as of end-2017, of which 65% are liquids.

Shell’s share of production from the Danish Underground Consortium (DUC) in 2017 was 67,000 boe/d.

Altinex, a wholly owned subsidiary of Noreco, is the purchaser, and will gain:

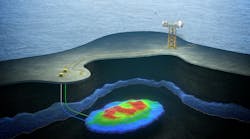

- A 36.8% interest in the DUC, its facilities, wells and interconnecting pipelines

- A 100% interest in Shell Olie-og Gasudvinding Denmark Pipelines, which has a 41.4% stake in the Tyra West – F3 gas pipeline

- A 36.8% interest in the 8/06 Area B license

- 18.4% of the Lulita field unitization and operations, additional to Noreco’s existing 10% share in the field.

05/02/2019