Offshore staff

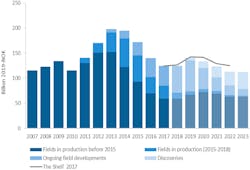

OSLO, Norway – Oil and gas production offshore Norway should increase steadily from 2020-2023, according to the latest forecast by the Norwegian Petroleum Directorate (NPD).

Activity across the Norwegian shelf is at a high level, added NPD Director General Bente Nyland, with strong interest in exploring for oil and gas.

In 2018, 53 exploration wells were spud offshore Norway, up from 36 in 2017, and the government awarded a record 87 new production licenses. A similar number of wells should follow this year.

Drilling in 2017 delivered 11 discoveries, with estimated combined recoverable resources of 82 MMcmoe, higher than the total for each of the three previous years.

However, the resource growth remains insufficient to sustain a high level of production beyond 2025, Nyland warned.

Almost two-thirds of Norway’s undiscovered resources are thought to lie in the Barents Sea, and over time she expected more available capacity to emerge in the area in terms of pipelines and other infrastructure for gas. This should make gas exploration in the region more attractive.

At the end of 2018, Norway had 83 producing fields on the Norwegian shelf, with the newly onstreamAasta Hansteen and the Polarled gas export pipeline opening new infrastructure in the northern Norwegian Sea.

Companies submitted plans for development and operation for three new projects last year, with nine more plans securing approval. Seven of these are for developments linked to existing infrastructure.

“Good exploitation of infrastructure and co-operation across production licenses mean lower development costs and make it possible to develop small and medium-sized discoveries in a way that is profitable,” Nyland commented. “This is becoming increasingly important as the shelf matures.”

Total investments across the shelf in 2018 were similar to those for the previous year at around NOK125 billion ($14.62 billion). Several ongoing field developments, led by Johan Sverdrup andJohan Castberg, should help lift spending in 2019 above NOK140 billion ($16.38 billion), but investments will likely fall back again from 2020-2022 with no major new projects in the pipeline.

The industry has continued to focus on cost control and efficiency to help cut the costs of exploration, development and operations, the NPD added.

Nyland said the lower cost level was reflected in the latest projects that have secured approval. “The general scenario is that the new development projects will be profitable with significantly lower oil prices than the current level.”

Spending on new fields in the next decade will also be dependent on major discoveries, it adds. Exploration costs look set to rise by 10% this year, before falling back over the next few years.

The NPD stressed the need for companies across the shelf to stay focused on cost control to allow further new projects to go forward (greenfield and incremental field developments), taking into account the uncertainty introduced by the recent oil price fluctuations.

01/14/2019