Offshore staff

LONDON – Wood Mackenzie’s upstream Middle East North Africa (MENA) team has identified various developments to watch for over the coming year.

It forecasts upstream capital investment across the region of $85 billion, with spending on oil-related projects up 9% in theMiddle East at $56 billion.

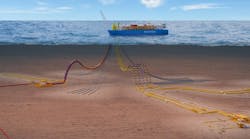

This includes Saudi Arabia’s efforts to maintain capacity, partly via brownfield expansions in shallow water to step up production at the Safinayah, Marjan and Zuluf fields offshore Saudi Arabia, and Qatar’s offshore Bul Hanine development.

However, with 12 Bboe of projects sanctioned across the region last year, and a further 5 Bboe-plus this year, the supply chain may be hard pushed to take on all the extra work, the consultants claim.

North Africa spending looks set to dip by 25% to $12 billion in 2019, mainly due to the tail-off in investment at Egypt’s deepwaterZohr and West Nile Delta gas fields.

Various major projects will spur growth in gas production, headed by Zohr in the eastern Mediterranean. Here output is poised to increase from 2 bcf/d to 3 bcf/d as the stage 2 wells and gas processing modules are commissioned.

BP’s West Nile Delta should add around 400 MMcf/d as Phase 2 ramps up, taking in development of the offshore Giza and Fayoum fields, and the Raven field also starts production.

These increases will likely move Egypt’s gas balance to a surplus in 2019. Much will be absorbed by domestic demand, with excess gas supporting increased exports from Egypt LNG and a re-start of the mothballed Damietta plant on the north coast.

Offshore Israel,Noble Energy should deliver first gas from the deepwater Leviathan development in late 2019 via a large fixed platform with 1.2 bcf/d capacity. At least 350 MMcf/d is contracted for delivery to Egypt.

Commissioning of phases 13 and 22-24 of Iran’sSouth Pars gas field in the Persian Gulf should add 4 bcf/d of production capacity. Wood Mackenzie foresees problems with the associated condensate, with US sanctions restricting exports.

One of the main opportunities in the region, principally for the majors, will be Qatar’s planned LNG expansion. The selected partners should be known ahead of a final investment decision in 2020.

Qatar Petroleum aims to raise the country’s LNG export capacity from 78 MM to 110 MM metric tons/yr (86-121MM tons/yr) over the next decade through four new 8 MMt/yr liquefaction trains, the gas coming from new facilities on the North Field.

As for exploration, potentially high-impact wells include Eni’s Nour-1 in the shallow water eastern Nile Delta offshore Egypt, targeting a multi-tcf carbonate prospect, and Dana Gas’s deepwater well on a prospect in a similar play on its North El Arish block.

Last year BP joined Eni in exploration in Libya and drilling here will likely resume during the second half of the year.

A Total-led partnership should spud Lebanon’s first ever offshore exploration well on block 4, and there could be appraisal drilling on Bahrain’s offshore unconventional gas discovery,Khalij al Bahrain.

Offshore Oman, Eni will survey its recently awarded block 52, and further bid rounds are in the offing in this country and offshore Israel. Egypt could open bids for frontier Red Sea and West Mediterranean acreage over the next few months.

01/21/2019