Cold-stacked or dead-stacked: The future of long-idle drillships

Key Highlights

- The market for cold-stacked drillships is deteriorating, with valuations down approximately 24-26% year-to-date due to oversupply and weak demand.

- Major drilling contractors like Noble, Transocean, and Valaris are selling or recycling their long-idle rigs, with some units being converted for non-drilling purposes to maximize value.

- Reactivation costs are high, often exceeding $100 million per rig, making long-term stacking or recycling more economically viable than reactivation in the current market.

By Sofia Forestieri, Esgian

There is an increasingly pressing issue in the drillship market: What happens to cold-stacked rigs that are unlikely to return to work?

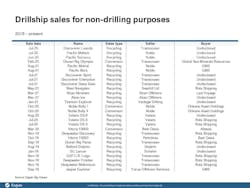

Noble Corp.’s decision earlier this year to sell the Pacific Meltem and Pacific Scirocco for non-drilling purposes, alongside Transocean’s recent announcement of disposing of an additional four drillships after the retirement of the Discoverer Luanda in July 2025, highlight this issue.

With the floater market still showing signs of weakness and contract opportunities becoming scarcer, reactivating these units is proving even more challenging. Esgian Rig Values has adjusted its valuations since early 2025 to reflect these conditions, reducing sixth-generation drillship values by approximately 26%, seventh-generation values by approximately 16%, and cold-stacked rig values by 24% reduction year to date.

Long-term cold-stacked assets’ values were further reduced by 10% to 20% depending on the stacking period. While some of these could technically be reactivated, the high costs and uncertain contract prospects make recycling or conversion a more viable option for this older, long-idle rigs.

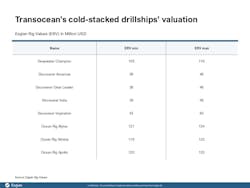

Transocean, which holds the largest pool of cold-stacked drillships, has announced the sale of the Deepwater Champion, Discoverer Americas, Discoverer Clear Leader, and Discoverer India, all cold-stacked for over five years, for non-drilling. Valaris DS-11, stacked since 2022, is another possible recycling/conversion candidate.

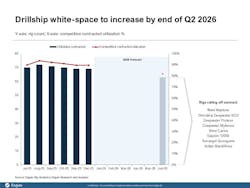

Meanwhile, the demand outlook over the next 24 months remains challenging, with contracted competitive utilization projected to decline from 90% to around 80% by June 2026. With no confirmed contracts for several rigs rolling off contract, owners have little incentive to reactivate cold-stacked assets, especially as doing so would only introduce more competition and pressure on already softening dayrates.

Selling these rigs for drilling purposes would only introduce further competition, potentially bidding against their own fleet in an already oversupplied market. That said, alternatives to recycling are emerging. National oil companies may continue acquiring floaters, as seen when TPAO purchased the Dorado and Draco drillships from Eldorado Drilling. This strategy could provide an attractive solution for owners seeking to sell stacked rigs at substantially higher prices than scrapping, without creating additional competition.

Since 2018, 28 drillships have exited the market, with 24 recycled and four sold for conversion. The most recent drillship taken out of the drilling fleet was Transocean’s sixth-generation Discoverer Luanda, sold for recycling. Meanwhile, Noble recycled, also this year, the seventh-generation Pacific Meltem and the sixth-generation Pacific Scirocco for an aggregated value of $41 million. The year 2021 saw the highest number of drillship retirements, with nine units recycled amid the market turbulence caused by the COVID-19 pandemic.

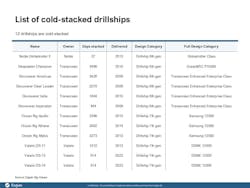

Presently, 11% of the total drillship fleet is cold-stacked. This accounts for 12 rigs, all of which are young and modern, with delivery years ranging between 2009 and 2023, including designs such as the seventh-generation Samsung 12000 and DSME 12000. Two rigs have also never worked: the seventh-generation, 12,000-ft Valaris DS-13, and Valaris DS-14, being stacked shortly after delivery. The pool of cold-stacked drillships is controlled by three companies – Noble, Transocean and Valaris.

Noble holds only the recently cold-stacked Noble Globetrotter II, which is currently for sale in the US Gulf. With this sale, Noble will soon exit the cold-stacked segment entirely. Transocean, however, will remain with the long-idle Ocean Rigs Mylos, Apollo, and Athena, while Valaris continues to face decisions regarding its three idle units. For Noble, this move aligns with its aggressive strategy to cut costs and focus on a more competitive, high-spec fleet, a direction further reinforced by its merger with Diamond Offshore in September 2024.

Transocean has now opted to clear out most of it cold-stacked fleet. This move, however, does not come without financial consequences. Since these rigs book value is much higher than their market value, Transocean is facing a non-cash impairment charge of almost $2 billion. While Esgian’s valuations account for cold-stacked status, selling these rigs for non-drilling purposes (conversion or recycling) typically yields prices 30% or more below assessed values. This implies total sale proceeds for the four drillships under $250 million.

The remaining idle rigs, Samsung 12000 Ocean Rig Mylos, Ocean Rig Athena and Ocean Rig Apollo are valued between $119 and $134 million each. There is little incentive for reactivation in the near-term, as demand in key deepwater regions has shifted into late 2026 and beyond, white-space risk is rising, and reactivation could cost as much as $100 to $150 million per rig. The future of these rigs then could be to simply be left stacked with minimal upkeep or what could best be described as “dead-stacked.”

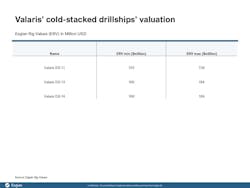

Valaris faces a different challenge with its three cold-stacked drillships. Two of them, newbuilds Valaris DS-13 and Valaris DS-14, were acquired for an aggregate price of $337 million and stacked shortly after. Despite being cold-stacked for nearly a year and a half, Valaris has actively marketed these rigs, indicating that they have been maintained in good condition. As a result, Esgian estimates that reactivation would cost approximately $40 to $50 million and would take about six months to complete.

The Valaris DS-11, on the other hand, was delivered in 2013 and has been stacked for over two years. It could be a potential candidate for recycling or conversion and is currently valued between $125 and $138 million.

With demand softening and being pushed into the future, what does this mean for the viability of long-term cold-stacked rigs?

The current competitive drillship fleet totals 77 rigs. Competitive contracted utilization is 94%, projected to average around 89% by the end of this year, and go to 82% by end of June 2026, with seven drillships rolling off contract by then and no confirmed future contracts so far. Competitive contracted utilization is defined as the number of rigs contracted (current and future) divided by the competitive fleet.

With demand now being pushed into late 2026 and beyond in key deepwater regions such as the US Gulf of Mexico, South America, West Africa, and Southeast Asia, the existing fleet is already facing increasing competition for contracts. This tightening market dynamic suggests that bringing additional capacity online through the reactivation of cold-stacked rigs is not a viable solution in the short term.

About the Author

Sofia Forestieri

Sofia Forestieri is a senior analyst at Esgian, specializing in offshore rig market analysis and energy economics. She has over seven years in the energy sector where she has in that time covered a diverse range of areas energy transition topics, economics modeling, rig market analysis and rig valuation, and energy sustainability issues. Forestieri previously held positions as an upstream Latin American analyst with Rystad Energy and senior field engineer-wireline with Schlumberger.