Editor's note: This article first appeared in the 2023 Executive Perspectives Special Report, which published within the November/December 2023 issue of Offshore magazine.

By James West, Evercore ISI

The global offshore oil and gas markets are heating up and will be the largest drivers of E&P spending growth in 2024 as the industry quickly runs out of available modern offshore rigs, vessels and aviation assets to support the surge in activity.

Major oil companies, national oil companies, international independent operators and some US independents are getting in on the action. The majors and NOCs recognize the need to replenish baseload, low-decline rate oil production while international independents are attacking prospects divested by the majors in prior years. There is also a shift toward increasingly targeting natural gas—in the Middle East to replace oil in electricity generation and in many other regions to supply the major LNG facilities currently under construction. Energy security concerns are a driver of this trend as well as the desire for lower carbon fuels.

The industry that is back in focus is one that recently finished a very tough decade. The push into US oil shale from 2010 to today kept offshore spending at bay, which led to a painful downturn. Following the go-go early 2000s and the massive expansion of offshore assets, especially in deep water, the industry found itself extremely over-leveraged, deconsolidated and in need of a serious restructuring. While some restructuring occurred in 2018-2019, it was the COVID-19 downturn that pushed the majority of the offshore industry into insolvency. Almost every publicly traded offshore asset-heavy company went through a bankruptcy and debt restructuring.

What emerged in late 2020 and 2021 was an industry with fewer assets that quickly consolidated. No longer are rig and vessel companies fighting for utilization to drive cash flow to service debt. The new industry is leaner, meaner and focused on returns on invested capital and returning capital to shareholders. The industry has matured. We believe the sins of the past are unlikely to be repeated.

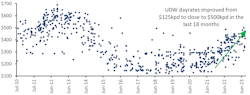

As a result of the surge in activity, there is a scramble for assets underway, which is playing into asset-owners’ hands. In the deepwater rig market, day rates that bottomed in the low-$100,000s are now closing in on the $500,000 level. Standard modern jackups that experienced day rate declines to $60,000-$70,000 are achieving day rates near $150,000. Utilization of floating rigs that fell into the low 60% range are now close to 80% utilized, with marketed utilization closing in on 90%. The jackup market, where utilization fell below 60%, is now in the low 80% range. Marketed jackup utilization is above 90%.

In the supply vessel market, where total annual capacity to construct vessels once approached 1,000 vessels, this is estimated to have fallen to about 350. Industry leader Tidewater’s vessel margins are quickly approaching prior cycle highs.

Like a phoenix from the ashes, the offshore oil and gas industry is back. Demand for assets and services continues to rise. Management teams are focused on generating returns, returning capital to shareholders and providing the safest, most efficient operations to customers. The world needs more oil and gas, and the offshore arena is one of the best arenas to source these resources.