Offshore rig contracts getting longer as market tightens

Offshore staff

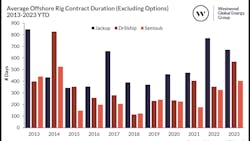

LONDON — Westwood Global Energy Group expects longer durations for offshore drilling rigs over the next year as rig availability continues to tighten.

According to Teresa Wilkie, director of Westwood’s RigLogix service, 10-year tenders have been issued for two drillships for campaigns starting in early 2025. Marketed use of sixth to eighth generation assets is already at 97%, she added.

Further long-term deals are likely for semisubs, especially sixth-generation harsh environment semis, with marketed utilization currently at 100% and with limited availability—free of options—until the second half of 2024.

As for jackups, global utilization is 92% and about 95% for premium, high-spec jackups. RigLogix has identified some requirements for durations of up to five years, but more direct negotiations or new requirements in the future could push durations out even longer.

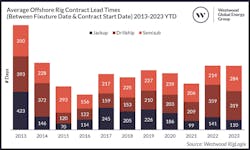

Historically, contract lead times extend when rig availability becomes scarce. The peak came in 2013, when deals for jackups, semisubs and drillships were routinely being fixed at least a year in advance of a campaign getting underway.

The year to date, compared with the 10-year average lead time, is performing almost 9% higher, Wilkie added, but no higher than last year’s record average lead time of 237 days. However, this number remains the longest recorded since the downturn that hit the industry in 2014, when there had been an average 248-day lead time.

As contract durations and rig use continue to grow, combined with decreasing availability and rising day rates, lead times will likely lengthen as operators focus more intently on securing the assets they need for their forthcoming campaigns, she concluded.

This year, drillship fixtures globally are averaging 569 days led by South America (698 days), Mexico (1,080 days), the Mediterranean (500 days), India (451 days) and West Africa (517 days).

For semisubs, the average contract duration is 384 days, with fixtures in South America of 414 days, Mexico at 953 days, the North Sea at 369 days, the Far East 627 days and Australia 309 days.

Jackup demand is driven to a great extent by NOCs, with the biggest demand coming from the Persian Gulf (1,165 days), followed by India (840 days), the Far East (528 days) and Mexico (457 days).

10.24.2023