Analysis: Readjustment seen in the US offshore wind sector

Offshore staff

NEW YORK, NY – The start of 2024 marks a period where the “readjustment” of the US wind segment is becoming more apparent, according to recent analysis from market analysis firm Intelatus Global Partners.

At a federal level, nearly nine gigawatts (GW) of lease potential in the Central Atlantic and Oregon have passed further hurdles to be auctioned in the next 12 or so months. Along with these two areas, BOEM is committed to leasing further sites in the Gulf of Mexico, and the Gulf of Maine in 2024/2025. When added to the potential capacity of those leases previously awarded, the total potential leased will amount to around 80 GW, of which close to 26 GW is at some stage in the federal permitting process.

At a state level, New Jersey selected 3.7 GW of capacity from the Attentive Energy Two and Leading Light Wind projects. In a sign of the times, Connecticut, Massachusetts and Rhode Island pushed back the submission date for their 6.8 GW of solicitations to March, to allow developers to seek further guidance from the Internal Revenue Service regarding IRA related tax credits, which include the 10% Energy Communities bonus. Tax credit monetization is a peculiarity of the U.S. wind segment and is key to the economics of many projects.

According to Intelatus Global Partners, this issue was touched on in a recent investor presentation by the CEO of Ørsted, the developer of the largest offshore wind portfolio in the United States. Despite remaining focused on Northeast and Mid-Atlantic project development, significant capacity is currently under review due to supply chain capacity, competency and cost inflation, high interest rates and lack of clarity on tax credit monetization. South Fork (2024) and Revolution Wind (2025) are expected to join Block Island to give the company three operational US wind farms.

The development of Sunrise Wind remains contingent on a successful offtake agreement from the New York 4 solicitation due to be announced shortly, and which includes improved financial terms allowing developers to mitigate some of the specific risks associated with US projects. The 4 GW Bay state lease area also remains in development.

In the Mid-Atlantic, Ørsted remains focused on divestment or an “other opportunity for value creation” for Ocean Wind 1 and 2; has withdrawn from its agreements to sell power to Maryland from Skipkack 1 and 2 (although it continues to mature the project); and continues to advance its Garden State lease with minimal spend.

According to Intelatus Global Partners, Ørsted is not alone in questioning the financials of US wind projects. After reorganizing its Empire Wind and Beacon Wind portfolio, whereby Equinor takes full control of Empire Wind and BP assumes full ownership of Beacon Wind, Equinor has put Empire Wind 2 on hold, cancelling several supply chain commitments. However, the company still aims to secure an offtake in the New York 4 solicitation for Empire Wind 1 and to advance the project. While there have been high profile “bad news” headlines, several large projects are maturing, and Intelatus says that it expects to see significant offshore construction to take place in 2024 and 2025.

In a signal of the challenges facing developing domestic floating wind supply chains, California issued a draft report addressing the significant manufacturing, port, construction and logistics vessel and transmission challenges to be addressed in the coming years. More than $10 billion of port and manufacturing infrastructure investment is estimated to be required among other enabling investments.

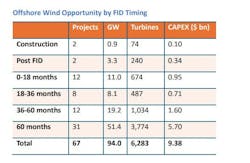

Despite these challenges, Intelatus said: “We maintain our forecast of over 65 projects that will install around 94 GW of capacity in this and the next decade and a total 110 GW by 2050.”

The firm added that the 90 GW forecast capacity will require capital expenditure amounting to around $290 billion to bring onstream, a recurring annual operations and maintenance spend of $9.4 billion once delivered, and over $40 billion of decommissioning expenditure at the end of commercial operations.

02.20.2024