Offshore staff

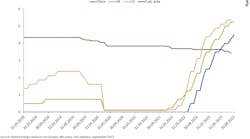

LOWESTOFT, UK — 4C Offshore, a TGS company, has downgraded its forecast for development of global offshore wind capacity by nearly 25% over the next four years.

According to the consultant’s latest quarterly Market Overview Report, steeply rising capital costs, inflation and supply chain disruption are leading developers to delay their projects.

Analysis of 113 offshore wind projects found that a planned 15 GW was under financial stress, in particular for power offtake contracts secured between 2019 and 2022. A further 10.9 GW could also be at risk, although the developers in these cases have not yet signaled concerns.

The situation is delaying projects with a decline in offshore wind projects getting under way for installation between 2023 and 2027. The outlook for 2030 is better, thanks to long-term demand and strong fundamentals.

At the same time, various key indicators remain strong. Among these are:

- Lease rounds and seabed awards: Governments continue to award seabed to developers, with 35.5 GW of capacity already issued in 2023. Although this is some way below the record 53.5 GW awarded during the first three-quarters of 2022, it is close to doubles the annual average of 18.4 GW for 2016-22. And countries such as Estonia, Norway, Portugal, Spain and Uruguay are either staging or planning their first offshore wind lease rounds.

- Construction permits: A record number were issued in Q3 2023, surpassing 8 GW of capacity across five countries.

- Final Investment Decisions: Northland and Orlen have obtained project finance for the 1.1- GW Baltic Power development, so measures introduced by Poland’s government have been successful in this case. And RWE has arranged investment for its 1-GW Thor project, as have Northland/Mitsui for the 1-GW Hai Long.

Richard Aukland, director of Research at TGS-4C Offshore, said, "The delays and cancellations experienced by some present opportunities for others.

“In the supply chain, vessel operators may benefit from shifting timelines, providing valuable installation capacity when existing contractors are unavailable. Additionally, postponed and cancelled projects enable developers to negotiate new terms with recently freed-up supply chain capacity."

10.02.2023