Floating offshore wind grid designed to power multiple North Sea platforms

Editor's note: This article first appeared in the July-August 2023 issue of Offshore magazine. Click here to view the full issue.

By Jeremy Beckman, Editor, Europe

Earlier this year Crown Estate Scotland awarded exclusivity agreements under its Innovation and Targeted Oil and Gas (INTOG) leasing round. This was designed to attract developers to invest in novel offshore wind projects that could power North Sea oil and gas platforms in Scottish waters, helping the operators to reduce emissions in line with their commitments under the North Sea Transition Deal between the industry and the UK government.

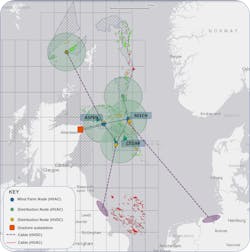

Among the successful bidders was London-based ‘green infrastructure’ developer Cerulean Winds, which over the past few years has been working on a proposed North Sea Renewables Grid (NSRG). The aim is to develop an offshore integrated green power and transmission system in the UK North Sea driven by floating offshore wind parks that would connect to oil and gas platforms. In partnership with Frontier Power International, the company secured INTOG exclusivity agreements to develop three 333-sq km seabed sites that would feature hundreds of floating turbines generating multiple gigawatts of electricity. Each of the sites would be located within 100 km of the others and would be connected to form an offshore ‘ring main’ around the UK central North Sea.

The planned high-voltage alternating current (HVAC) system would be engineered to maximize generating uptime and would also allow for offtake to other parts of the North Sea, including countries in mainland Europe, via a new high-voltage direct current (HVDC) network. Assuming the project passes further planning, consenting and finance milestones leading to the award of full 50-year seabed leases and the signing of option agreements (currently expected in 2024), the partnership, working with a consortium of five major offshore engineering groups, would be ready to embark on the development.

Offshore spoke to Dan Jackson, Cerulean Winds’ Founding Director, to learn more about the company’s proposals.

Offshore: The board of Cerulean Winds (CW) brings decades of experience in offshore floating infrastructure. Can you provide some background?Jackson: Frontier Power was an easy first choice to partner with for this project. Their founders are both ex-[UK] National Grid senior executives and they have an impressive track record of delivering large transactions in the power sector, with over £1.5 billion [$1.92 billion] of offshore transmission assets under management. They have already delivered an interconnector between the UK and Germany and are developing a UK to Netherlands HVDC link. The wealth of knowledge and experience they have accumulated assures us that they have the capabilities and prowess to facilitate power transmission on a mammoth scale.

Identifying and achieving regulatory and statutory changes, along with an in-depth insight into the UK grid access process from the team’s time working with the National Grid, provides us with great insight into how to seamlessly roll out grid access for clients across the North Sea. The strength of an integrated offshore transmission and floating wind development team is the key to success.

Offshore: And how did the consortium for the North Sea Renewables Grid (NSRG) come together?Jackson: We brought our delivery consortium together early as having a suite of tier-one industrial partners to develop, supply and install the NSRG provides more certainty on scheduling and cost. NOV, Siemens Gamesa, Siemens Energy, DEME and Worley all bring a unique skill set to the project that will enable us to fast-track phase one of building out the grid. Each of our partners has experience delivering large-scale projects for the offshore oil and gas industry in the North Sea. Their understanding of the region and supply chain are invaluable in allowing us to deliver such an ambitious project at pace. The vast amounts of infrastructure required will provide a pipeline of work over many years and provide the opportunity for UK ports and yards to invest now in expansions ahead of ScotWind, getting the market ready to deliver.

By creating an estimated 10,000 jobs, this type of ambitious renewable project will help scale Scotland’s green economy. It will make a material impact on the country’s emissions, removing millions of tonnes of CO2 a year to support a just transition. In total, the three windfarms alone will contribute over £12 billion [$15.35 bilion] GVA to the UK’s economy.

Offshore: Increasingly, floating offshore wind developers are highlighting the importance of port assembly and logistics investments to accommodate their projects. Is that an issue too for the NSRG?Jackson: To accommodate and deliver the scale of offshore wind in the UK pipeline, ports will need to upgrade in order to maximize local content potential. The NSRG has been developed around the philosophy of low draft floaters to maximize the number of ports available with suitable facilities ready to support their scaling up.

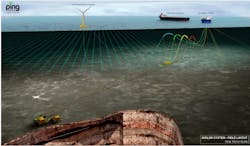

Offshore: Could the consortium work also on more individual greenfield projects such as the Avalon oilfield development in the UK central North Sea? (Last year Malaysian operator Ping Petroleum signed an agreement with CW for the consortium to construct and install a large floating offshore wind turbine with a power connection to Avalon’s circular FPSO to reduce the facility’s CO2 emissions by up to 20,000 metric tons annually).Jackson: Avalon will have the ability to take power from NSRG when phase 1 is delivered. The NSRG approaches the oil and gas emission abatement targets with a basin-wide approach. If there was extenuating interest by an operator to electrify an asset ahead of the INTOG close-out date then the consortium could potentially consider this as part of the wider INTOG supply, but with an accelerated delivery.

Jackson: The NSRG is designed to be a basin-wide solution. It can cover all assets in the central UK North Sea, as well as being able to provide electrification distribution to the West of Shetland and northern UK North Sea. Cerulean has been actively engaged in talks with operators to support their electrification. We recently held a well-received engagement session in Aberdeen with 15 North Sea UK operators to discuss the NSRG and basin-wide emissions abatement.

Offshore: Who would be responsible for engineering the power links to the platforms and platform topside modifications to receive the power?Jackson: The NSRG brings green power local to the offshore assets, essentially delivering the onshore grid offshore. Operators are able to install a power link from their asset to the NSRG, which enables them to align their green electrical connection with their own brownfield modification schedule. There is however an opportunity to support this scope with the synergies in cable procurement and installation. The consortium would control and maintain the facilities to be able to provide robust, reliable power as a service to the operators, all within the terms of a Power Purchase Agreement (PPA).

Offshore: Realistically, how soon could work on the NSRG start, given the current problems facing investors in the UK offshore sector due to high petroleum taxes and the slow sanctioning process for both oil and gas and offshore wind developments?Jackson: Work could start as early as 2026 with the target of delivering green floating offshore wind power to oil and gas assets by early 2028.

Offshore: It will take several years for your infrastructure to be built and operational, so presumably it has to be targeted at offshore oil and gas facilities that will remain in service for a decade or more, rather than those facing decommissioning by 2030?Jackson: The NSRG provides a service for the operators to enable them to electrify. This ‘shared infrastructure’ is a market enabler for assets where installing their own cable to shore is cost prohibitive. It enables consolidation of onshore grid connections and delivers value from scale. This ensures all operators, no matter their size, have the opportunity to abate their offshore emissions. Assets can connect to the service for however long suits them until their individual cessation of production (COP).

The operators have signed up to the principles of the North Sea Transition Deal, which requires a 50% reduction in production emissions by 2030. We recognize that to achieve meaningful reductions at the pace required, a basin-wide solution is necessary. By taking this integrated approach, we are offering organizations a reliable and flexible power source which they can plug into once they have completed any necessary brownfield works and are ready to make the switch to renewable power.

Having hundreds of turbines in place over three locations provides the baseline required to build out the grid with a level of consistency that is demanded by the oil and gas industry, and this provides redundancy in supply. The basin-wide scale allows us to be reactive, while maintaining lower pricing and supply robustness. For the oil and gas companies, the diversity of offtake through the HVDC network provides robustness to the scheme and further lowers their offtake costs through simple economies of scale. The intent is to minimize the ‘infill’ power from the grid when the wind is not blowing, and the scale of the wind farms provides this.

Jackson: We are working closely with the supply chain to understand their constraints, and provide transparency in the project to help support their capacity investments. Having our tier 1 consortium aligned early on has provided a clear runway for supply chain engagement.

Offshore: Do you have a ‘standard’ floating offshore wind park design in place for the three 333-sq km sites?Jackson: There is a common design for synergies in fabrication, installation, operation and maintenance. We are using the NOV GustoMSC Tri-Floater coupled with a 15-MW WTG. Siemens Energy is providing the transmission as part of the company’s standard portfolio. The design of our floater allows it to be manufactured in the UK and it is ideally suited to shallow water.

Offshore: The NSRG investment is estimated at up to £20 billion [$25.6 billion]. Does that cover all current scenarios, including the power link to other parts of the North Sea, and export to Europe? And how much of the finance required is actually in place, once you get the go-ahead to start development?Jackson: The sum covers all phases including the transmission link to Europe. The finance is privately raised from the markets, so does not require the operators to pay for infrastructure works.

Cerulean will deliver floating wind through an infrastructure project finance construct with integrated delivery and finance that is proven for the offshore floating environment. The company has a fundamental understanding of the risks for floating infrastructure and has devised an appropriate allocation of these risks among its partners. The quantified risk profile allows for a strong, stable and long-term investment return at scale: the advantages include an accurate definition of the schedule, capex, opex and project risk from the start of the lease application phase. The process should reduce the time from lease application to first electrons while providing schedule and expenditure certainty to start-up.

About the Author

Jeremy Beckman

Editor, Europe

Jeremy Beckman has been Editor Europe, Offshore since 1992. Prior to joining Offshore he was a freelance journalist for eight years, working for a variety of electronics, computing and scientific journals in the UK. He regularly writes news columns on trends and events both in the NW Europe offshore region and globally. He also writes features on developments and technology in exploration and production.