Editor's note: This cover story first appeared in the November-December 2023 issue of Offshore magazine. Click here to view the full issue.

By Per Hjorth Gren, Solomon Associates

Digitalization is perhaps the buzzword of the decade. Today, you cannot open a newspaper or read an online article without seeing topics on digitalization, automation, robots, artificial intelligence (AI), and data analytics. The trend of digitalization continues into the upstream oil and gas industry. Operators are now considering the benefits that digitalization can have on their operations.

For many upstream operators, one of the initial areas of focus for digitalization has been their maintenance operations. The typical upstream operator spends between 25–35% of their operating budget on maintenance to secure asset reliability. For reference, the total operating budget is usually 3–4% of the overall value of the operation, namely the value of the produced oil and gas. In 2021, the global production of oil was 90 million of barrels of oil equivalent (MMboe) per day and gas was 70MMboe/day. The average oil price was $80/boe. These numbers mean that the upstream oil and gas industry is spending about $80 million on the maintenance of their oil assets worldwide, and an approximate value of $600 million on maintenance of their gas assets. In addition, it is estimated that routine maintenance and turnarounds add an average production loss of about 1.5% or a total of $500 million for oil and around $350 million for gas. Therefore, the market value of the upstream oil and gas industry’s surface maintenance and repair is on the order of 2.25 billion annually.

The potential market is a notable reason why many leading AI and automation companies are targeting the upstream business. Even a five percent reduction in maintenance cost would establish a solid business case for most potential projects. But are these cases genuine or are the result of overly optimistic marketing campaigns?

Defining predictive maintenance

Digital maintenance can be divided into two categories: condition monitoring and predictive analytics. Predictive maintenance analyses data from a piece of equipment or a process, in an attempt to predict incidents and breakdowns of the equipment before they happen.

The first predictive model was developed by C.H. Waddington in the 1990s. Waddington’s first attempts to implement predictive systems resulted in a twofold increase in breakdowns, instead of the intended reduction. To cope with this increase, condition monitoring was introduced as a constant survey of the equipment’s operational data, such as monitoring vibrations, temperature, and other conditions surrounding the equipment in scope.

The continued measurement of equipment’s data and the data around incidents and breakdowns established the foundation for building a statistical preventive system that recognizes patterns around failure, and can warn of potential breakdowns before incidents occur.

The first predictive maintenance systems were created for the aviation industry, where equipment reliability is crucial to secure the safety of flights. Today, this system has led to a massive amount of data collected, enabling relatively safe and reliable predictive algorithms to be calculated to secure the safety of operation with support from condition monitoring.

Predictive maintenance analytics

Predictive maintenance has not always been efficient and successful, especially in the aviation industry, where both efficiency and safety of operation on major rotating equipment has been improved. However, overall, the use of predictive maintenance is considered to have a positive effect. More recently, consultants and advisors documented business cases with many benefits by introducing predictive analytics to the upstream oil and gas industry.The advantage can be categorized as improved operations and reduced costs.

There are solid business cases for using predictive maintenance in the aviation industry and the same type for major rotating equipment used on offshore facilities. But it has proven to be quite challenging and complex to implement the same models on major rotating equipment in the upstream industry.

Estimating digitalization value

Consultants have not lost hope in underlining the potential opportunities within digitalization. Recently, a consulting company noted a potential savings of $72 billion for the European upstream oil and gas industry by utilizing digitalization within operation. This is a relatively bold figure, as the 2022 overall cost of operation for the upstream oil and gas in Europe, including Russia, was around $155 billion ($68 billion for oil and $87 billion for gas, based on data from Global Data). There is no business case attached to this consulting company’s estimate.

The World Economic Forum has said that there is a $1 trillion digitalization opportunity for the upstream oil and gas industry, based on asset life cycle management, collaboration, and customer engagement. The annual production of oil and gas worldwide represents a total cost of $740 billion ($435 billion on oil and $305 billion on gas). Even though the estimate from the World Economic Forum includes increased production due to life cycle management, it still seems like a bold estimate.

One global equipment manufacturer estimates a reduction of staffing for offshore operations up to 80% based on digitalization and a 15% improvement of revenue. This company’s business case is driven by the following:

- HSE improvement through CCT analytics and drones

- Opex reduction through a 60–80% reduction in manpower, 15–20% increased meantime between overhauls, 5% reduction in energy, and 10–15% savings in chemicals

- Improved production efficiency of 5–10 days of availability

- Improved reliability of 2–5%.

In 2014, an article estimated that increased production efficiency within oil production, driven by automation, could improve production efficiency by 10%, adding an incremental profit of $220 to $240 million in the North Sea sector. The indicated value is equivalent to 5.5 million barrels per year or 10% of the North Sea upstream production.

It seems evident that expert marketing strategy is the driver behind the published numbers. With the average production efficiency in upstream operations within the North Sea relatively stable around 90%, it raises questions about the estimated 10% improvement.

An 80% reduction in staffing for offshore operations, through the use of digitalization, also seems exaggerated. There are significant opportunities to relocate offshore staff to onshore positions, but human interaction with the process is still crucial, as well as the maintenance. Even if a full shift from schedule-based maintenance toward predictive analytics is executed, an 80% reduction seems unrealistic.

Benchmarking studies

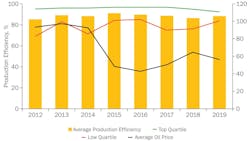

From 2012 to 2019, Solomon’s benchmarking studies for offshore upstream operations showed an average production efficiency, including scheduled shutdowns due to turnaround and repairs, at around 89 to 92%.

It is worth noting between 2012 and 2019, Solomon did not see any consistent improvement in production efficiencies from benchmarking data. The data showed a consequence of the decline of oil prices around 2014, affecting the production reliability with a two to three-year delay following the decline in production efficiency for low quartile performers. The declining production efficiency is likely an effect of a reduced effort in surface repair and maintenance, affecting overall reliability and resulting in a decline in production efficiency.

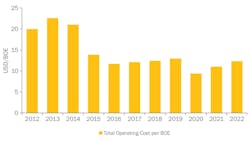

Solomon’s researchers saw a rapid decline in total operating costs per boe from 2014 to 2016. However, this decline is more likely the effect of a drop in global oil prices, an increased effort to minimize operational costs, and a reduction of development activities on the most expensive reservoirs. During 2015 and 2016, several high-cost operations were abandoned because they were no longer deemed economically viable with oil prices hovering around $40/boe. From 2016 to 2022 Solomon saw only a drop in operating costs in 2020, likely based on a decrease in activities due to COVID-19.

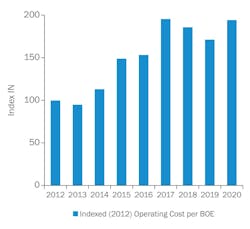

When looking at Solomon benchmarking data for indexed operating cost, it is even more clear opex investments are increasing. This includes a continued increase in direct operational costs from 2012 except for a slight decrease in 2018 and 2019. The data shows a similar picture of the indexed costs in 2012 for surface repair and maintenance, with an even higher investment in surface repair, especially around 2018 and 2019. The higher investment in surface repair is likely an attempt to catch up on the reduced amount of maintenance in the 2014–2015 time period. The data indicates that despite a focus on digitalization for upstream operations since at least 2014, Solomon has yet to see results of these investments.

Benchmarking top performers

For over 40 years, Solomon has been collecting data on operational performance and best practices within the industry; we use this data to classify operators and create a category of world class assets. These assets consistently produce world class performance in terms of production efficiency. The top performer category only includes assets that have obtained top quartile performance for more than four benchmarking cycles.

Top-class performance is established through high and consistent reliability and driven by an adequate investment in maintenance and staffing. These parameters mean top performing assets do not pursue cost leadership in the two cost categories of maintenance and staffing, but instead aim for a cost profile within the second quartile. By doing so, the operator can secure a continued high production efficiency and therefore lower their operating cost per boe. Further, the data shows that top performing operators invest in well servicing activities to continually drive their production performance.

The best performers’ results are achieved by investing in the reliability of the asset, not chasing total cost efficiency. Solomon’s data demonstrates the correlation between maintenance and mechanical availability and how they are the core drivers of performance. In addition, the data also makes it clear that any enhancement of performance driven by digitalization must have a sustainable business value.

Lack of data

The reason that digitalization has not added more value to the upstream oil and gas industry to date is the lack of data. First, there is a lack of historical time-series data. Although most offshore installations have some type of historical data storage from platform sensors, the usage has been limited, with random or no checks on data quality; and relatively few sensor signals have been stored. It is possible to retrofit sensors to improve the data being collected, but historical data is important to build accurate predictive models and to predict failures from patterns in the data.

Upstream oil and gas is not the first industry to utilize digitalization. The aviation industry has a long tradition of collecting and sharing data with vendors, even data from incidents. And, in contrast to the upstream oil and gas industry, the aviation industry has been able to build more accurate predictions through the use of digital products.

Second, there is a lack of data on failures. Since the millennium there has been an increased focus on safety and processes in the upstream industry, due to several severe incidents that occurred in the 1990s. To decrease these incidents, the industry implemented a rigid preventive maintenance system, with annual/biannual turnarounds and scheduled maintenance on business-critical equipment. Therefore, relatively few incidents have data available for building the predictive model, causing the predictive system to be limited to analysing the provided operational time-series data.

Third, the lack of standardized equipment has prevented digitalization from adding more value to the upstream industry. Other industries use highly standardized equipment, giving these industries an advantage in the digitalization process. Being able to copy preventive models across the industry leads to improved predictive analytics. However, in the upstream industry, especially in the offshore arena, there is more variety in installed equipment. Not only are there several vendors of major rotating equipment, but there are also various technologies in use, such as various compressors. The variety of equipment, vendors of major rotating equipment, and the variety of technology used has resulted in a decreased ability to share preventive models and data across installations and operators, leading to more unreliable predictive models.

Fourth, digitalization is not adding more value to the upstream industry since the industry’s operating environments are so dissimilar. Operation of an offshore asset in the Middle East is different from the operation of a similar asset in the northern part of Norway. The physical environment of an operation affects the equipment and creates an issue when building predictive models, where the physical conditions must be included in any model.

Lastly, the process system influences digitalization, adding value to the upstream industry. All upstream equipment is part of a large process system. This means that the entire system is at risk when operating and due to the rigid preventive maintenance system in place on major equipment, it is more common to see failure on minor processing equipment, such as valves. This observation suggests that a more complex digital twin is needed, including minor equipment in the model, to secure continued uptime of an operation.

Pilot projects

The digitalization business has been dominated by the concept of pilot projects. Pilot projects are a great way to prove new concepts and document potential business value. However, pilot projects also come with a high risk of failure.

Pilot projects often suffer because they do not drive cultural change. They lack collaboration with the rest of the organization, which forces the projects to be judged by the part of the organization standing on the sideline. Often the outside part of the organization also considers the initiative as temporary, whereafter the day-to-day work can return to business as usual.

Further, the foundation of a pilot project is to see whether there is benefit and added value. However, it sometimes happens that those in the organization executing these projects perceive the projects as having limited impact. In these cases, they therefore tend to lack motivation for the project and often abandon their project responsibilities.

Pilot projects are often focused on what the organization considers low hanging fruit, and the genuine value is perceived as low. These factors, combined with pilot projects often being carried out on simple parts of the business, establishes a fundamental resistance in the organization and eventually kills a full-scale implementation.

Finally, it may be difficult to estimate the overall value of a full-scale project, based on a pilot project, due to the complexity in evaluating the scalability.

In the upstream oil and gas industry, there has been a great focus on digitalization; so much so that operators sometimes have 10–15 pilot projects running at once. This abundance of simultaneous pilot projects is excessive, and therefore has no benefit to the evaluation, perception within the organization, or the implementation of a pilot project in full scale.

Strategic focus

The major reason why there is a shared amount of digital pilot projects is due to the lack of a comprehensive digitalization strategy from executive management. Many digital initiatives appearing within departments are being sanctioned by executives based on the relatively low cost of executing a pilot project. However, there is often no strategic focus or willingness to fund a large-scale project beyond the initial pilot project.

To be successful with digitalization, it is crucial to build a corporate digital strategy with set goals and a clear focus on the areas where an operator wants to pursue digital solutions. That strategy should include reliable indicators on the business value expected from the solutions.

If digitalization projects are to succeed, it is vital to have corporate ownership and a willingness to invest. More than that, there should be a clear understanding from executives on where digitalization can benefit the operation and the overall business strategies.

The author

Per Hjorth Gren is Solomon Associates’ Upstream Performance Solutions Manager. He has more than 25 years of upstream operations industry experience and over 35 years working with performance excellence. His expertise ranges from extensive work within digitalization of offshore operations, Industrial Internet of Things (IIoT), Big Data, advanced analytics and heading multiple benchmarking projects from an operator’s side. Gren holds a Bachelor of Arts in Business Economics from the University of Southern Denmark and a Master of Science in Business Administration and Economics from the Aarhus Business School in Aarhus, Denmark.