Editor's note: This story first appeared in the November-December 2022 issue of Offshore magazine. Click here to view the full issue.

By Bruce Beaubouef, Managing Editor

Electrification is the new major trend sweeping the offshore oil and gas industry. The industry’s move towards greater electrification comes from four basic needs and imperatives: the drive to lower emissions; reduce topsides footprint and environmental impact; and lower costs.

That drive toward electrification, in turn, is being manifested in several different offshore operational areas: power from shore; subsea production system electrification; topsides power generation systems; power buoys; and power from wind.

Most of these efforts are taking place in the Norwegian and UK North Sea, particularly with regard to accessing offshore wind power and power from shore. Offshore Norway, there are currently nine fields partly or fully electrified and another 20 fields with sanctioned electrification projects.

Norway is set to sanction expenditure of close to $5 billion on the next wave of platform electrification over the next two years, with schemes approved by the end of 2022 benefiting from the current temporary tax terms. Electrification has reportedly led to emissions savings of around 25% and kept absolute emissions flat, despite an increase in activity and infrastructure.

The UK is seeking to emulate Norway’s successes in platform electrification to meet its decarbonization targets. Earlier this year, the UK’s North Sea Transition Deal set a target of a 50% reduction in emissions from oil and gas production in the sector by 2030, leading to the focus on platform electrification.

Electrification of subsea assets is taking place offshore Australia, and elsewhere, operators are looking for other ways of reducing power consumption-related emissions on their production facilities.

Power from shore

Power from shore enables offshore operators to reduce their dependence on gas turbines for power, and thereby reduce emissions. Most notable is Equinor’s Utsira High area power grid, which will provide power from shore to its Johan Sverdrup, Edvard Grieg, Ivar Aasen, Gina Krog, and Sleipner fields.

Originally planned for four fields – Johan Sverdrup, Edvard Grieg, Ivar Aasen, and Gina Krog – the area’s license partners have agreed on maximizing the use of power from shore to the Utsira High area by enabling partial electrification of the Sleipner field center as well.

With the extension of the area solution, an additional six fields will receive power through the Utsira High area solution: Sleipner, Gudrun, Utgard, Gungne, Sigyn, and Solveig. According to Equinor, the overall area solution will contribute to an average annual reduction in CO2 emissions by about 1.2 MM metric tons.

Based on the result of recent negotiations by the license partners, the Sleipner field center, together with the Gudrun platform and other tie-ins, will receive power from shore to meet parts of their power demand. Further cuts in emissions from Sleipner and tie-ins are estimated at more than 150,000 metric tons of CO2 on average per year, according to Equinor.

The Sleipner field center solution calls for Sleipner to lay a power cable to the Gina Krog platform, which will be connected to the Utsira High area solution by a separate power cable by the end of 2022. In certain periods the field’s power from shore demand may exceed the capacity of the area solution. In such periods Sleipner will use gas turbines to cover its shortage.

Offshore wind power

Meanwhile, Equinor is employing offshore wind energy to power its Gullfaks and Snorre fields through its Hywind Tampen project, which aims to supply 95 megawatts to these North Sea facilities. Hywind Tampen is the world’s first floating wind farm to supply renewable power to offshore oil and gas installations. The floating wind farm will consist of 11 wind turbines that will supply about 35% of the annual power demand of the five Snorre A and B, and Gullfaks A, B and C platforms. In periods of higher wind speed, Equinor says that this percentage could be significantly higher. In September, the company reported that the first seven Hywind Tampen turbines would come onstream this year as planned. The final four will be installed next spring.

All-electric subsea

The industry has been working for years to electrify its subsea production systems, but the task has gained new urgency with a heightened emphasis on environment and efficiency. Most subsea well control is still based on hydraulic technology. But moving to an all-electric subsea production system offers several advantages, particularly for an ultra-deepwater field or with long-distance stepouts. Electric motors can maintain a high level of efficiency and full torque capability regardless of water depth, unlike hydraulic pressure, which must overcome seawater hydrostatic pressure. Moreover, use of high-voltage direct current for long-distance power transmission can be more efficient than use of either alternating current or hydraulic pressure. In addition, having higher levels of electric power available at the subsea end of the system offers a greater scope for powering additional tools and sensors such as multiphase flowmeters. It also facilitates the addition of intelligent wells, new sensors, and digital flow-control valves. And, an all-electric system eliminates the possibility of hydraulic fluids being released into the marine environment.

Total E&P Netherlands BV paved the way on this front in 2016, when it installed the world’s first all-electric subsea system as part of a pilot project at its K5F gas field in the Dutch North Sea. There, the company’s K5F-3 well came to incorporate three devices that made it “the world’s first true all-electric subsea well,” including an electric-powered Xmas tree, an electric-powered downhole safety valve, and an electric-powered subsea control module. Plans called for the well’s power supply to be sourced through an 18-km umbilical managed at the company’s K6P/C platform.

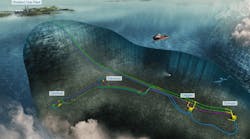

More recently, the Jansz-Io project off Western Australia is the most notable subsea electrification effort. Jansz-Io will feature a subsea gas compression system that includes all-electric control systems and actuators; and a normally unattended floating field control station will send power from shore to the subsea compression station. The project will combine power from shore and variable speed drive long step-out subsea power for the first time. The electrical system will be able to transmit 100 megavolt-amperes over a distance of approximately 140 kilometers and at depths of 1,400 meters. Aker Solutions will deliver the all-electric subsea gas compression system, and ABB will provide the overall electrical power system. Fabrication and construction are ongoing, working towards a 2025 in-service date.

Topsides electrification

According to Wood Mackenzie, around two-thirds of operating emissions come from power consumption related to production, processing, and liquefaction. Thus, looking for ‘greener’ ways of powering these offshore activities has become a key imperative for most offshore operators.

One way to do this is through combined cycle power generation, where the heat from a gas turbine exhaust is used to power a steam turbine-driven electric generator, which enables platform operators to reduce their emissions. Shell has deployed this type of system on its Appomattox platform in the deepwater Gulf of Mexico. Shell says the system has enabled Appomattox to remain well below regulatory nitrogen oxide emission levels while reducing fuel consumption, which it says is one of its biggest operating expenses.

Elsewhere, Brazil’s Petrobras announced that it would deploy a combined-cycle power generation system on its FPSO Maria Quitéria to reduce fuel consumption and thereby reduce emissions. This will be Petrobras’ first platform designed with this type of power generation system.

In Asia, Petronas has announced its intention to transform its conventional onboard power-generation systems with energy efficient, electric, and hybrid power solutions. One of its concepts is a floating power station that could store power from renewable resources and use combine cycle gas turbine generation. It would hook-up via subsea cable to a production platform to provide power on demand, and then move to other locations as needed. It is an ambitious concept that requires more research, but it certainly illustrates the industry’s ingenuity.

Operators are also looking to electrify the compressor and prime mover equipment on their platform topsides as part of their efforts to reduce emissions. Here again, Equinor is leading the way. Last year, it announced that the two gas export compressors on its Troll C platform, currently driven by gas turbines, will be replaced by electric motors.

Wave power

Wave power is still in its early days, but new power buoy technologies are showing promise in their ability to provide supplementary power for minor operations. Eni deployed the PB3 PowerBuoy from Ocean Power Technologies for one year as part of an AUV charging pilot project in the Adriatic Sea. More recently, it redeployed the power buoy to an unmanned, decommissioned gas production platform off Italy’s Abruzzo coastal region as part of a platform conversion project. Eni’s goal with this project is to explore the potential of future life-extension strategies for oil and gas platforms at the end of their productive phase. The project will assess the value of the platform to the ecosystem if left in place, as well as the viability of integrated aquaculture farming, recreational, and other uses.

Challenges to electrification

There are challenges to embracing electrification, particularly in the UK North Sea. Offshore Norway, oil and gas fields have typically had 20 years of remaining life prior to electrification. This has played a key role in Norway’s successful electrification efforts. But in the UK, the associated costs for a minimum remaining field life of 10 years would rule out nearly 50% of fields, while 20 years would rule out more than 90%, according to a Wood Mackenzie report.

Hubs in the UK central North Sea and west of Shetland, where field lives are longer, appear to be the best candidates, but this will still require major investment and swift action to comply with decarbonization targets.

Although carbon prices have increased following the recent gas supply constraints, they remain too low to incentivize electrification, say Wood Mackenzie analysts Lucy King and Neivan Boroujerdi. Without cost reductions or funding support, a carbon price of $250/metric ton would be needed to cover the capital cost of a typical UK standalone electrification project. Therefore, collaboration is a must, the analysts say, with multiple fields and their partners sharing infrastructure. Hub-led solutions could cut costs by 50% on an emissions-saved basis and lower the ‘carbon breakeven’ price to $125/metric ton. Financial assistance from the government, similar to Norway’s NOx fund, could bring it down further.

In the UK there is limited tax relief for such projects compared to Norway. An uplift on capital spend associated with decarbonization could encourage investment, while refunds on tax losses, similar to those for E&A expenditure in Norway, could incentivize companies not in a tax-paying position.

Another issue the UK needs to address is the lack of infrastructure to power offshore electrification, so grid access and regulation around pricing should be prioritized, the analysts suggest. Although taking power from the Norwegian grid is an option, access to offshore wind, the costs of which are coming down, could help drive UK platform electrification forward.