Offshore staff

NEW YORK CITY – The pace of offshore project FIDs is expected to remain strong this year despite a relatively slow rig contracting cycle in 1Q 2024, according to Evercore ISI’s latest Offshore Rig Market Snapshot.

The report notes that “recent developments in Saudi Arabia” have to some extent eroded “sentiment on the offshore growth story.” These developments have included Aramco’s announced plans to reduce capex by ~$40 billion between 2024 and 2028, which in turn has led to a suspension of jackup activity across various drilling rig contractors in the region. Evercore says that it thinks approximately 25 jackup rigs will be affected.

But the firm’s report also comments that “we continue to believe in the longevity of the long-duration offshore upcycle, and dayrate momentum will extend, although there will be a slight pullback on the strong dayrate progression we have been experiencing in the jackup market.”

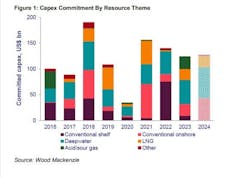

Evercore projects that FID activity will remain strong in 2024, in line with 2023 levels, totaling ~$125 billion to develop 14 billion BOE. The report notes that the majority of FIDs announced in 2023 were deepwater, and adds that “we continue to anticipate [that] deepwater [will] dominate expected investment in 2024, with Latin America accounting for almost a third of reserves.”

The firm cited a report from Wood Mackenzie, which said that 13 deepwater projects are expected to reach FID in 2024 – five in Latin America, four in Africa, two in North America, one in Europe, and one in the Middle East.

The five projects in Latin America include two in Brazil, one in Guyana, one in Suriname, and one in Trinidad and Tobago, totaling ~$33 billion.

04.15.2024