Well completion technologies advance to meet the needs of harsh environments

Bruce Beaubouef, Managing Editor

Well completion – the process of preparing a drilled well for production – has seen significant innovation in recent years driven by the need for efficiency, safety, and maximized recovery in increasingly complex reservoirs.

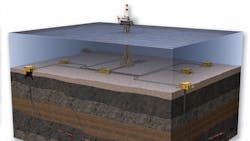

Deepwater completions have historically exposed downhole tools to significant amounts of pressure and temperature. “Intelligent” or “smart” completion technologies thus evolved to provide real-time data on the wellbore and its surrounding reservoirs. These products have been on the market for years. Some of the latest advances on this front include wireless monitoring, electronic control systems, and remote-control systems than enable users to quickly adapt to changing reservoir conditions such as pressure, temperature, or water/gas breakthrough.

But it isn’t just “intelligent” completions that have advanced in recent years. Operators are deploying a range of new well completion technologies in several offshore producing areas, including new autonomous inflow control devices (AICDs), sand control systems, multizone-single trip products, openhole systems, and other systems suited to the high-pressure/high temperature (HP/HT) environments increasingly being found in the US Gulf of Mexico and elsewhere.

Intelligent completions technology

“Intelligent” completion systems have typically integrated downhole sensors, flow control valves, and real-time data transmission systems to monitor and manage production remotely. But while drillers and producers have been using these systems for years, refinements and advancements continue to be made.

Halliburton’s SmartWell system has been on the market for 25 years, but it now features enhanced modularity and digital platforms like Clariti, which allows operators to adjust flow rates and pressure without intervention, optimizing output in real time.

More recently introduced is Halliburton’s DataSphere permanent monitoring suite of tools, which the company says are designed to withstand some of the most challenging and complex offshore environments. With the use of the LinX wireless monitoring system, high pressures and high temperatures can be monitored wirelessly from the caprock, overburden, or directly from the reservoir, providing valuable insight into the formation’s dynamic conditions.

SLB’s intelligent completions technologies also use electronic monitoring (such as flowmeters and pressure gauges) to pre-empt issues like water breakthrough, thereby reducing intervention costs. These types of systems are increasingly important for multi-lateral wells and deepwater projects, where accessing multiple zones efficiently is vital.

Spotlight awards

Intelligent completion technologies were in the “spotlight” at this year’s OTC in Houston, where both SLB and Baker Hughes won Spotlight on New Technology Awards.

SLB won the award for its Electris Completions, which are electric intelligent completion systems that are said to offer advanced control, monitoring, and optimization for well performance. They utilize electric power delivery and bidirectional telemetry for high-precision control of multiple zones within a well. According to SLB, these systems enable operators to manage well performance more effectively and efficiently, leading to improved recovery factors and lower costs.

SLB says that there have been more than 100 installations of Electris completions technologies across five countries. In Norway, Electris completions were deployed offshore to enhance oil production in an extended-reach well. The operator has been using intelligence from the system to determine which zones are contributing to production to optimize oil output and minimize produced water. Controlling water production with Electris completions has decreased the energy needed to lift and then pump treated water back into the reservoir, according to SLB.

Baker Hughes won the award for its SureCONTROL Plus interval control valves (ICVs), an expansion of its intelligent completions portfolio. These ICVs are designed to provide electrical remote operations for better zonal control of subsea and dry tree wells, replacing multiple hydraulic lines with a single electrical line. Baker Hughes says that benefits of the ICVs include simplifying complex installations, reduced rig time, faster times to production and lessened need for costly interventions. SureCONTROL Plus, it adds, can control a higher number of zones than traditional hydraulic ICVs. The digital telemetry system is said to provide continuous data, supporting asset performance management and maintenance of downhole tools.

Automation and digitalization

Automation is transforming completions, with radio-frequency identification (RFID) and digital control systems at the forefront. Weatherford’s TR1P single-trip deepwater completion uses RFID to actuate downhole tools wirelessly, eliminating multiple runs and reducing rig time. Halliburton’s eCompletions ecosystem integrates digital tools for autonomous reservoir control, leveraging AI-driven analytics to optimize settings on the fly.

Sand control and flow assurance

For unconsolidated reservoirs, advanced sand control technologies are evolving. Baker Hughes offers upgraded sand screens and gravel-pack systems, while Halliburton’s frac plugs enable precise multistage fracturing with quicker drill-out times. These reduce solids damage to equipment and maintain flow, critical in shale and offshore wells. Flow assurance is also improving with chemical injection systems and corrosion inhibitors, extending well life in harsh environments.

Expandable technologies

Expandable tubulars and metal expandable packers are enhancing zonal isolation. These tools expand in place to seal off zones, offering robust alternatives to traditional cement or elastomers, which can fail under pressure or temperature swings. These technologies are proving particularly useful in high-pressure/high-temperature (HP/HT) wells and for minimizing environmental impact by reducing intervention needs. An example of this type of technology is Halliburton’s Ovidius isolation system, a new packer that transforms from an engineered metal alloy into a rock-like material when it reacts with downhole fluids, creating a long-lasting seal for improved well integrity. The system could be deployed in wellbore isolation applications, where it would provide the traditional benefits of expanding elastomers with new capabilities to withstand differential pressures and extreme temperatures found in the most challenging high-pressure, high-temperature environments, while providing unparalleled anchoring forces. Halliburton said that the Ovidius isolation system could be used for cased hole, open-hole wellbore isolation, and permanent plug and abandonment operations.

Case studies

As shown in a number of recent case studies (examined in detail below), these technologies are being deployed in the North Sea, the US Gulf of Mexico, offshore Brazil, and in some areas offshore Africa.

The Johan Sverdrup field, one of the largest offshore oil fields in Norway, recently implemented advanced well completion techniques to optimize production. Equinor selected SLB to deploy a number of AICDs in multilateral wells. The goal was to manage reservoir heterogeneity and control water/gas breakthrough. AICDs were employed to automatically adjust flow to balance production across zones, reducing the need for manual interventions. Equinor deployed SLB’s ResFlow AICDs, integrated with real-time reservoir monitoring to optimize flow dynamics in the chalk reservoir. The outcome was increased oil recovery by 10–15% per well compared to conventional completions, with reduced water cut. The completions also lowered operational costs by minimizing workovers.

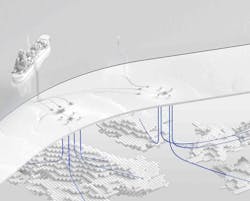

Offshore Western Australia, Shell recently utilized intelligent well completions to maximize production from the Browse basin. Working from its Prelude FLNG facility, intelligent completions with downhole sensors and interval control valves (ICVs) were installed in subsea wells to monitor and control production zones remotely. The HP/HT conditions required robust completion materials, and the ICVs were constructed with titanium alloys to withstand corrosion. The system enabled selective zone production, reducing gas coning and improving ultimate recovery by 8%. Remote control from the Prelude FLNG facility minimized offshore interventions, cutting costs by $5 million annually.

In the UK North Sea, bp recently employed its (low-salinity) LoSal Enhanced Oil Recovery Completion system to enhance recovery on its Clair Ridge project. Wells were completed with perforated liners and downhole chemical injection systems to deliver LoSal water, which reduced residual oil saturation by altering wettability. These LoSal completions increased oil recovery by 6–10% compared to standard waterflooding, adding 40 million barrels to recoverable reserves. The system also reduced scaling risks through precise chemical injection. These efforts showed that chemically enhanced completions can significantly boost recovery in mature fields.

Last year, TotalEnergies deployed advanced sand control completion technologies on its Moho Nord deepwater field offshore Congo. The French operating company faced challenges with unconsolidated reservoirs prone to sand production. Working with Halliburton, TotalEnergies open-hole gravel packs (OHGPs) and frac-pack completions on its subsea wells to manage sand production while maximizing flow rates. Halliburton’s VersaFlex expandable liner hangers and AquaPac packing systems ensured reliable gravel placement in deepwater conditions. The completions reduced sand-related equipment erosion, extending well life by five years and saving $10 million in workover costs. Frac-packs increased initial production rates by 20% compared to conventional methods.

In the US Gulf of Mexico, Chevron recently employed a deepwater multizone completion system on its Jack/St. Malo field. The goal was to utilize multizone single-trip (MZST) completions to access multiple reservoir layers efficiently. But the challenge was that operating in these ultra-deepwater depths (7,000 ft water depth) and high-pressure reservoirs required advanced sealing technologies and real-time monitoring. Employing technology supplied by Baker Hughes, the MZST systems allowed simultaneous completion of multiple zones in a single run, using stacked frac-pack assemblies and intelligent control valves. This approach reduced rig time by 30% (approximately 15 days per well), saving $15 million per completion. The system also improved zonal isolation, enhancing recovery by 12% in the Lower Tertiary reservoirs. The results showed that multizone completions can help streamline operations in high-cost deepwater environments, and that single-trip systems reduce operational risks and costs.

Offshore Brazil, Petrobras’ Buzios field in the Santos basin offered a case study of presalt carbonate completions. These completions were carried out with open-hole systems and inflow control devices (ICDs) provided by Weatherford to manage heterogeneous carbonate reservoirs with natural fractures. Weatherford’s OptiMax ICDs and real-time fiber-optic monitoring systems were used in tandem to provide precise flow control and reservoir insights. The ICDs balanced production across high-permeability zones, increasing oil output by 15% and delaying water breakthrough by two years. The completions also reduced intervention costs by $8 million per well. On this project, ICDs were shown to be effective for managing complex carbonate reservoirs; and fiberoptic monitoring was shown to enhance completion performance in presalt fields.

Enhancing production performance

The above case studies show the range of technologies that have been deployed in the field that have been shown to improve well completion design and enhance production performance. AICDs have been used in both the Johan Sverdrup and Búzios fields to balance production and reduce water/gas breakthrough, improving recovery by 15–20%.

Intelligent completion technologies continue to be deployed by operators to enhance real-time monitoring and control, often cutting intervention costs by 30–40%. For these reasons, intelligent completions are a growing trend in deepwater projects, and have been deployed on recent major projects in the US Gulf of Mexico, particularly on projects that are accessing HP/HT fields – including Chevron’s Anchor, BP’s Argos, and Shell’s Whale projects. Similarly, Petrobras has deployed intelligent completions technologies on its Búzios presalt field. Technologies from providers like SLB, Halliburton, and Weatherford have become standard, with innovations like wireless ICVs and AI-driven analytics enhancing performance.

For sand control, OHGP systems (Whale, Mero), frac-packs (Mad Dog 2, Anchor), and expandable screens (Anchor) have been deployed to manage unconsolidated reservoirs, ensuring long-term flow assurance.

Multilateral well technologies have been applied at the Mad Dog 2 (Argos) and Búzios fields to access multiple zones, boosting reservoir contact by 30–40% and reducing well count.

For HP/HT environments, production teams at the Anchor and Whale fields have employed corrosion-resistant alloys and advanced seals for extreme conditions – a vital point for the type of new fields being developed in the US Gulf of Mexico.