Offshore staff

LONDON — Oil and gas companies have regained their appetite for exploration drilling, according to analysis from Wood Mackenzie.

The consultants’ latest insight "Exploration Quietly Recovering" examined proprietary intelligence and data from the Lens Upstream platform to assess prospects for exploration expenditure over the next five years.

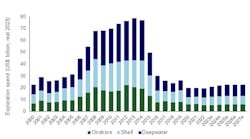

Julie Wilson, research director, Global Exploration, said exploration will not return to the levels experienced during 2006-2014, but expenditure is picking up, with an estimated average annual outlay of $22 billion between 2023 and 2027.

Among the factors behind the revival are:

- Social license to operate: The energy crisis brought on by the Ukraine war has shifted the narrative toward energy security and affordability, with governments softening their stance on fossil fuels.

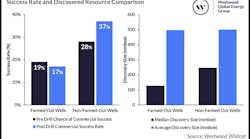

- More attractive economics: Portfolio high-grading, improved spending discipline and choice of prospects coupled with more efficient development have led to full-cycle returns from exploration staying above 10% since 2018, and exceeding 20% in 2022.

- Emerging frontiers: Locations such as Namibia are providing new opportunities, with advances in geoscience and imaging also opening new plays in established basins.

- Economics: Record profits boosting balance sheets and encouraging oil and gas companies to adopt a more bullish approach

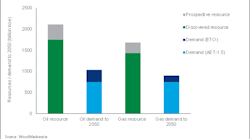

- Demand: The world needs more high-quality, lower-carbon oil and gas, and replenishment of stocks via exploration is critical to companies seeking to strengthen their portfolios.

Wilson cautioned that there will be a ceiling where renewed spending can go, with potential limiting factors including a paucity of high-quality prospects, a result of the budget cuts during 2015-2018 following the 2014 oil price shock.

And although geoscience has made strides, there are far fewer small and specialized explorers to take advantage of advances by working up novel ideas in frontier basins.

Other negatives include a shortage of staff following the layoffs during the 2020 downturn, which hit exploration and subsurface departments hardest. While automation and machine learning help explorers accelerate their activities, they cannot replace human expertise, Wilson said.

Greater demand is pushing up costs throughout the supply chain, and smaller oil and gas companies in particular are having increased difficulty securing finance for their exploration programs as mainstream banks reduce their commitment to hydrocarbons.

In light of these constraints, it remains unclear whether exploration spending will be high enough to allow the oil and gas sector to thrive in an uncertain future environment, the report concluded.

09.22.2023