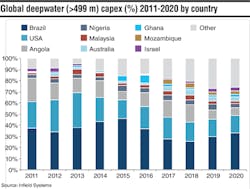

Offshore Mozambique, Infield Systems expects for a CAGR of 89% between 2016 and 2020 in deepwater expenditure demand. Prospects within the Rovuma offshore Areas 1 and 4 drive forecast demand, with Anadarko, Eni, and recent entrant CNPC expected to lead development. Anadarko is expected to hold the largest share of deepwater expenditure demand as a result of its development on the Prosperidade complex, while Eni/CNPC-operated prospects within Area 4, such as Coral, Mamba North, and Mamba South fields are also expected to require significant investment.

–George Griffiths, Senior Energy Researcher, Infield Systems