Richard D' Souza

Granherne

Demand for oil and gas is forecast to increase steadily for the next several decades. Increasing supply from new deepwater developments will be essential to satisfy this demand, and the growing complexity of future deepwater developments, together with persistent inflation in capital and operational expenditures, has resulted in a dramatic increase in E&P spend by operators in the last five years.

The confluence of increasing project complexity, capital inflation, and the recent plunge in oil prices has created a perfect storm that has roiled the deepwater industry. The upshot has been the cancellation, deferral, or recycling of many deepwater projects. It is clear that business as usual is no longer an option.

While the industry has had considerable success finding large hydrocarbon reservoirs in deepwater, it is spending more each year to develop them while producing less. The complexity, scale, and costs of developing these reservoirs profitably are taxing industry capabilities and causing operators and contractors alike serious financial duress. Operator investment returns have fallen from 25-30% to 10-15%. It has become abundantly clear that the industry has to fundamentally reassess how it goes about the business of developing complex, capital-intensive upstream projects in general and deepwater projects in particular, especially in what could be a substantial period of low oil prices.

The goal here is to address recent trends in deepwater field development that are the root cause of these challenges, and their consequences. Proposed solutions to the more vexing challenges will be presented.

Deepwater trends

A decade ago escalating oil and gas prices were the rising tide that lifted all boats. It essentially bailed out many floundering projects, masked poor project performance, and bred profligacy and complacency.

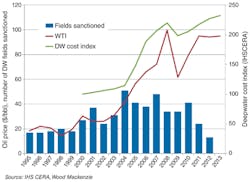

In the last three to four years, deepwater development capex inflation has been outpacing inflation of oil and gas prices, which have plateaued and dropped by half in the past year. Capex of many deepwater projects routinely exceed $5 billion, driving them into the so- called "mega project" category. Even major operators and contractors with sophisticated project management processes and capabilities are struggling to achieve acceptable commercial results in these circumstances.

Cost inflation of goods and services has accounted for much of the capex and opex inflation since 2004. However, geographic, geologic, and geopolitical trends also conspire to significantly drive up the cost, complexity, and unpredictability of today's deepwater projects.

Geologic trends

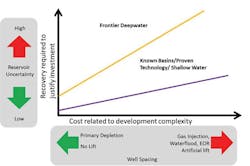

From 2000 to 2010, the industry has discovered and successfully produced hydrocarbons in deepwater reservoirs in the Gulf of Mexico, West Africa, and Brazil. Water depths have increased from 4,000 ft to 8,000 ft, and the technologies to develop these deepwater projects have kept pace.

More recently, the industry has discovered large oil and gas reservoirs in deep and ultra-deepwater in Brazil (presalt) and the Gulf of Mexico (Lower Tertiary). These reservoirs tend to occur deep (>25,000 ft) below the mudline or are overlain by massive salt canopies that significantly impact reservoir characterization and increase well construction complexity and cost. They tend to have low permeability, resulting in well productivities that are significantly worse than those of younger reservoirs, which have accounted for most deepwater production to date.

Many of the deeper reservoirs tend to have very high pressures and temperatures that exceed the industry's current ability to produce them. In many cases, the industry lacks production analogues for these reservoirs, which has greatly increased uncertainty in predicting well performance and ultimate recovery, and variables that are fundamental to ensuring the commercial success of a project.

Deepwater challenges

As a consequence of escalating complexity and uncertainty of frontier deepwater projects, the industry is struggling to quantify and manage project complexity, capex, and risk required to achieve predictable project outcomes. A recent analysis examined a sample of 130 oil and gas mega projects executed since 2003, and concluded that only about 1 in 5 could be reasonably defined as successful (measured by how well sanctioned cost and schedules are met). The rest were unimpressive with average cost and schedule overruns of 30%. Most deepwater projects today fall into the mega project category.

Recently, many major international and national oil companies (Statoil, Shell, BP, Petrobras, Chevron, Total) have announced that they will keep a lid on capital spending in the short to medium term in an effort to drive capital efficiencies and improve profitability. In addition, onshore unconventionals are competing fiercely for capital allocation, further increasing pressure on operators to improve capital and execution efficiency of deepwater projects.

Stretched supply chain

The supply chain that delivers a deepwater project is vast, global, and encompasses multiple suppliers that include oil field service companies, drilling contractors, lease-operate facility providers, shipyards, fabrication yards, installation contractors, and subsea vendors. In recent years, the demand for their services has escalated dramatically as a result of a massive surge in the number of sanctioned deepwater developments. Contractors in the supply chain are being overwhelmed by the volume, pace, and complexity of these demands. As a consequence, the demand and supply equation is completely out of kilter and this imbalance is a major contributor to capex inflation, project delays, and cost overruns.

Solutions

So what does the industry have to do to get back on the track of producing profitably in deepwater in an environment of increasing project complexity and uncertainty and plunging oil and gas prices? The focus will be on five areas that, if properly addressed, will go a long way toward achieving this goal.

Managing geologic uncertainty

This is at the very core of a successful deepwater development. In frontier deepwater regions, it is imperative for an operator to take the time and spend the capital required to mature reservoir definition and optimize the reservoir recovery plan. Spending the capital required to mature reservoir definition, enhance well performance, and reduce ultimate recovery uncertainty prior to committing major capital outlays will go a long way to prevent project train wrecks. The risk of under or over designing a surface facility can also be managed by configuring a facility layout and size to allow future expansion or debottlenecking, to deal with changing reservoir conditions. Extended well tests, early production systems, and phased developments are other strategies to successfully manage reservoir uncertainty.

Improving capital efficiency

This is a topic that has been endlessly dissected, and many strategies and fixes have been proposed to better predict project costs and schedules at sanction; then executing projects to stay within sanctioned budgets.

The most fundamental admonition, which has been demonstrated time and again, is to not fasttrack project schedules. It has been repeatedly shown to destroy more value than it creates. Accelerated schedules inevitably shorten the appraise, select and define project phases, and therefore increases uncertainty in everything from predicting reservoir recovery to capex and schedules. This is especially shortsighted for complex frontier projects with high local content requirements.

Therefore, the first step to ensure deepwater project success is to take the time necessary to do a proper front-end loading and define the right project. Planners must also reduce uncertainties in predicting reservoir performance and project costs, and develop a robust execution plan. Understanding the capacity and availability of the supply chain is critical to success. This requires patience and discipline to ensure that qualified contractors and project teams are contracted to execute the project.

Improving efficiency of facility topsides without sacrificing production throughput, safety, or availability is low-hanging fruit, since topsides weight drives facility costs. The industry can no longer afford the luxury of "we have always done it this way," and must reassess and rationalize design philosophies, specifications, and contracting approaches. Standardized topsides design strategy has been effectively incorporated by certain operators (Shell, Anadarko, ExxonMobil) to realize significant savings in project costs and cycle times. Operators are beginning to change their mindset for bespoke over-engineered designs by opening up to more standardized and simplified designs.

In mature basins, existing infrastructure with declining production can be utilized to enhance recovery or produce reservoirs within subsea tieback distance. These brownfield or expansion projects provide the biggest bang for the buck with significantly reduced risk. Much of the future capex is being targeted for such projects.

Host country requirements

Many deepwater developments are in the golden triangle that includes Brazil and West African nations, particularly Angola and Nigeria. These countries have been steadily increasing local content mandates. In Brazil, for instance, contracts for blocks acquired in the 2013 auction require 37% local content for goods and services in the exploration phase, rising to 55% in the development phase. While local content requirements can and have delivered major benefits to a host country, unrealistic demands have a damaging effect by adding significant costs, increasing bureaucracy, and fostering corrupt practices.

Local supply chains have some combination of inadequate capacity, low productivity, and high labor costs which conspire to inflate costs by 100% or more, causing substantial project delays and increasing HSE risk. It is imperative that host countries recognize the consequences of onerous local content mandates and reset requirements to achieve a more sustainable cost premium that provides host country benefits without jeopardizing project viability.

Production-sharing contracts and tax regimes are getting progressively more disconnected from the capital intensity and risks undertaken by operators. Certain countries are moderating tax regimes to incentivize rather than inhibit new production. Host countries also need long-term policies that are not subject to change after every election cycle.

Technology development and adoption

The development of enabling technologies has been a critical factor in unlocking resources from deeper waters and more difficult reservoirs. The industry has progressed from producing hydrocarbons in 1,000 ft of water to 10,000 ft of water in a span of 30 years. The technical challenges of the recent tranche of deepwater projects calls for significant investments in surface and subsurface technology. The investment in enabling and enhancing technologies must be broad and sustained if the industry is to bring on new deepwater production.

Key technologies have to be identified early and advanced to an appropriate technology readiness level before they can be deployed in the field. The development cycle takes many years and is capital intensive. Key technology categories to enable more profitable deepwater production are:

- Reservoir characterization and well placement

- Drilling and completion efficiency

- High-pressure and high-temperature equipment

- Improved enhanced recovery

- Subsea processing and boosting

- Innovative floating platforms and riser solutions

- Cost-effective subsea well intervention.

All of these are being developed to varying degrees by the industry. The key message is that the industry must accelerate the pace of development and adoption of these technologies by adequate and sustained capital commitment.

Bridging the skills gap

A major challenge facing the industry today is the growing chasm between the rising demand for oil and gas production in deepwater and the growing shortage of technical skills to meet this demand. This is exacerbated by the "great crew change" that is under way. The acute shortage of skilled workers with 20 to 25 years of experience will remain.

The industry is addressing the skills gap from many angles - industry, government, education and training providers - to make a difference in the mid to long term. There are many initiatives under way where academia, industry, and regulators are teaming up and investing in research and training to provide technology and needed skills.

To ensure a sustainable pipeline of talent, the industry can no longer persist in playing the zero sum game of poaching and cannibalizing each other's employees. Instead, it must invest in recruiting, training, and nurturing new talent.

Conclusions

The growing demand for oil and gas will require more deepwater production. Until recently, the industry has had great success in developing deepwater fields. The industry is now on an unsustainable track where capital spending for deepwater developments has increased but production and profits have been falling, while oil prices are forecast to remain depressed for several years.

Additionally, deepwater developments are having to compete for capital allocation with the unconventional market, which has been booming until recently. Operators have reacted by canceling, delaying or recycling new deepwater projects and reducing capital outlays in an effort to rein in costs.

The industry will need to look for ways to manage reservoir uncertainty, improve capital efficiency, and continue to invest in new technologies. It will also need to work with government officials, regulators, and educators to rationalize local content requirements and bridge the skills gap. Many of these initiatives are well underway. The oil and gas industry has always responded to grave challenges that arise periodically, and is at its best when it has its back to the wall.

Acknowledgment

Based on a paper presented at the Deep Offshore Technology International Conference held in Aberdeen, Scotland, Oct. 14-16, 2014.