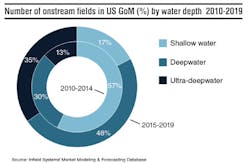

Key operators expected to drive activity in the US GoM's ultra-deepwater market include Shell, Anadarko, BP, ExxonMobil, Noble, and Chevron, together potentially accounting for 84% of ultra-deepwater capex. Noteworthy greenfield developments over the next five years include Shell's Stones and Appomattox oil fields and Anadarko's Heidelberg and Shenandoah oil fields, all four of which could see large amounts of investment over the forecast period. Shell's Stones field will be the world's deepest production facility (2,900 m/9,514 ft). The field will be developed using an FPSO linked to a subsea production system, with first oil production expected in 2016. Anadarko's Heidelberg field is being developed using a replica spar design of the Lucius spar which entered production in January. Heidelberg is expected to start production in 2016. BP could start to develop the second phase of its Mad Dog field, which could require large amount of investment and enter production just after the end of the decade. Examples of ultra-deepwater brownfield developments over the period of analysis include Chevron's Jack and St. Malo fields, which aon re expected to see the installatiof additional subsea infrastructure.

-George Griffiths, Senior Energy Researcher, Infield Systems