Crude oil production in the federal Gulf of Mexico is expected to continue to rise over the next two years, according to a recent report issued by the US Energy Information Administration (EIA).

Because of the long timelines associated with Gulf of Mexico (GoM) projects, the recent downturn in oil prices is expected to have minimal direct impact on GoM crude oil production through 2016, the report states.

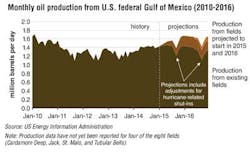

EIA projects GoM production to reach 1.52 MMb/d in 2015 and 1.61 MMb/d in 2016, or about 16% and 17% of total US crude oil production in those two years, respectively.

The forecasted production growth will be driven both by new projects and the redevelopment and expansion of older producing fields, says EIA. Five deepwater projects began in the last three months of 2014: the Stone Energy-operated Cardamom Deep and Cardona projects; the Chevron-operated Jack/St. Malo fields; the Murphy Oil-operated Dalmatian project; and the Hess-operated Tubular Bells project.

Also occurring at the end of 2014 was the redevelopment of Mars (Mars B) and Na Kika (Na Kika Phase 3), both of which are mature fields. Cardamom Deep, Jack/St. Malo, and Tubular Bells were slated for a late 2014 start-up as well. The EIA did note that while industry press releases have indicated these fields have started producing, their production data have not yet been reported to the Bureau of Safety and Environmental Enforcement (BSEE) under the US Department of the Interior.

The relatively high number of fields that came online in 2014, and are scheduled for first oil in 2015 and 2016, reflects the revival of interest and activity in the GoM following the Macondo incident and subsequent deepwater drilling moratorium. While the moratorium officially lasted from April 30 to October 12, 2010, there were relatively few field start-ups in 2011 through 2013, the report notes.

Thirteen fields are expected to start up in the next two years, eight in 2015 and five in 2016. The report also noted that the high cost of surface structures limits their application to large fields. Those fields with reserves not large enough to justify the necessary capex are expected to use subsea tieback systems to connect to nearby existing platforms. More than half of the projects starting up in 2015 and 2016 will be subsea tiebacks to existing production platforms. These new projects, combined with continuing production from the developments brought online in late 2014, are forecast to add 265,000 b/d by the end of 2015. The production estimates for 2015 and 2016 include adjustments to account for seasonal shut-ins from hurricanes.

The current low oil price adds uncertainty to the timelines of deepwater GoM projects, says EIA, with projects in early development stages exposed to the greatest risk of delay. In an effort to reduce this risk, producers are collaborating to develop projects more cost-effectively, to shorten the time to final investment decision and first production, and by sharing development costs. For instance, Chevron, BP, and ConocoPhillips recently announced a collaborative effort to explore and appraise 24 jointly held offshore leases in the northwest portion of the Gulf of Mexico's Keathley Canyon.

Displaying 1/2 Page 1,2Next>

View Article as Single page