This year begins with a great deal of uncertainty regarding future oil prices and the resulting impact on the oil and gas industry. At the time of writing, oil prices were trading at a five-year low. Without a bottom in sight, price volatility will continue until oil supply and demand reaches equilibrium. Fortunately for offshore players, particularly those in deepwater, it's the medium to long-term oil prices that influence investment decisions. Also, considering the lead times of deepwater projects, there is incentive to maintain the development schedule. Upstream spending cuts are expected, but it is likely that deepwater, despite its high costs, will suffer less than other plays.

In this month's special forecast report, Gaffney, Cline & Associates (GCA) shares the results of an economic analysis that suggests a deepwater project can still be viable in a low oil price environment. The analysis compares the costs, investment levels, and returns for two investment scenarios – one in the deepwater Gulf of Mexico, and the other in an onshore unconventional shale play. Each is allocated $1 billion for capital expenditures. The scenario for the GoM project assumes that most of the capital will be spent at least five years before first production. Thus, it is the expected oil price in 2020 that is critical, not the price in 2015.

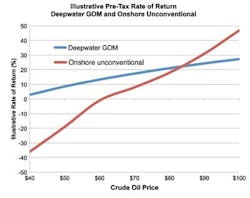

Using the same two scenarios, further analysis by GCA finds that the deepwater GoM project becomes more attractive than the onshore project at less than $80/bbl, and at $60/bbl it is considered marginal or uneconomic.

GCA's full economic analysis and oil price outlook begins onpage 58.

Also in the report, Rystad Energy makes the case that ultra-deepwater (>1,500 m water depth) developments may even be in a better position than deepwater projects to withstand the impacts of this downturn. Compared to deepwater, many ultra-deepwater fields have larger reservoirs and higher oil/gas ratios that out-weigh many of the inherent costs. Over the next five years (2015-2019), about 65% of the ultra-deepwater reserves to be brought onstream come from fields larger than 1 Bboe. This compares to 30% for deepwater. Moreover, close to 70% of ultra-deepwater reserves that are estimated to come onstream during the next five years are oil. For deepwater, the oil ratio is about 40%. Rystad adds that there is a greater share of ultra-deepwater resources with break evens below $60/bbl compared to deepwater in all three five-year forecast periods.

Rystad Energy's complete offshore analysis begins onpage 40.

This issue includes the annual Gulf of Mexico activity outlook, which is, according toOffshore managing editor Bruce Beaubouef, expected to remain robust despite falling oil prices. The actively marketed US Gulf drillship fleet, as of late November 2014, was almost fully booked for all of 2015, with about 98% of available days contracted, according to data by IHS Petrodata. In addition, the semisubmersible fleet is nearly 84% booked for 2015. Meanwhile, with new deepwater projects ramping up, production is expected to reach a new peak of 1.9 MMboe/d in 2016.

Beaubouef's comprehensive GoM market outlook and accompanying deepwater discoveries survey begins onpage 44.