Britain's government has awarded 134 licenses spanning 252 blocks to 81 companies under the UK's 28th Seaward Licensing Round. More awards will follow pending environmental assessment of plans for a further 94 blocks.

According to oil and gas advisory consultants Hannon Westwood, the result makes this the fifth most successful round in terms of the number of applicants and block awards. However, the commitment to drill a total of five exploratory wells is the lowest since the 22nd Round in 2004 when the Brent crude price was much lower, at around $40/bbbl. Four of the five wells are in areas that could involve high-pressure/high-temperature (HP/HT) operations. The offshore seismic acquisition commitment should lead to five new 3D and three 2D surveys, all in frontier areas or regions near mature basins where coverage is minimal.

The number of frontier licenses issued is down by two-thirds compared with the previous round, although areas opened up include the barely explored west of Hebrides region off northwest Scotland, where Statoil is among the new acreage holders. At the same time the number of promote licenses has tripled – these provide a low-cost way for small companies to work up acreage and then attempt to bring in a larger partner to finance the program, ahead of a decision on whether to convert to a full license. But as the consultants point out, may of these licenses have been relinquished without conversion due to the increased difficulty in attracting funds.

This year UK exploration and appraisal drilling could sink to a new low, in contrast to Norway where well numbers have increased at a record pace, inspired by a regular stream of discoveries. However, the UK Chancellor's December budget statement was expected to include fiscal incentives to stimulate exploration.

BP, GDF Suez confirm rare UK discovery

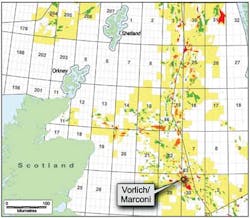

One region that has attracted the interest of the major operators is the HP/HT corridor of the UK central North Sea. Here BP and GDF Suez E&P UK have confirmed a commercial discovery extending over two blocks in different licenses, referred to as Vorlich on BP's side and Marconi on the GDF Suez side. The well, drilled by the jackupTransocean Galaxy on behalf of both license groups, flowed up to 5,350 boe/d on test.

In this case, the reservoir depth appears to be relatively shallow compared with some of the more extreme conditions associated with deeper-lying gas/condensate finds such as BG's Jackdaw. Earlier in the year, BG appeared to be gravitating toward a multi-platform/hub development. Now, however, the company and its partners have decided to delay sanctioning the project to allow for more time to scrutinize lower-cost solutions, including a tieback of Jackdaw to nearby infrastructure.

Johan Sverdrup plan goes before parliament

Statoil has submitted the environmental impact assessment for Johan Sverdrup in the central Norwegian North Sea, Norway's largest new development project this century. Assuming approval from the country's parliament next spring, first-phase production could start in 2019, building to a peak in the 315,000-380,000 b/d range. The longer-term target is 550,000-650,000 b/d, according to partner Det Norske Oljeselskap, pushing full-field development costs to potentially $25-32.4 billion.

Elsewhere in the North Sea, Statoil is moving closer to redevelopment of the Snorre field. The company has commissioned Wood Group Mustang to perform a pre-front-end engineering and design study for a proposed second TLP on the field. According to analysts ScanBoss, this could be used to drill an additional 40 wells, accessing 300 MMbbl of reserves, with oil enhanced by injecting imported gas into the reservoir.

Next year Statoil expects to install and hook up to the Gullfaks C facilities the world's first subsea wet gas compressor station. Following mechanical commissioning, OneSubsea was due to perform final system integration tasks at Horsøy in Norway to verify that all components functioned as planned. The 1,070-metric ton (1,179-ton) station was developed in cooperation with Framo (since integrated into OneSubsea), should increase production from the Gullfaks South reservoir by 22 MMboe. Aside from saving space and weight on the platform, compared with a conventional topsides compression module, the wet-gas equipment brings the advantage of not requiring treatment of the wellstream prior to compression. This allows for smaller modules and simpler construction on the seabed, Statoil claims.

Mixed fortunes for Lundin, Statoil in Barents Sea

Lundin's run of exploration successes in the Barents Sea continues, with the first well on the Alta prospect discovering a potentially large oil and gas accumulation. The semisubmersibleIsland Innovator drilled the 7220/11-1 wildcat 20 km (12.4 mi) northeast of Lundin's 2013 discovery Gohta, which opened a new play in the Loppa High region. The location is 160 km (99 mi) from the northern Norwegian mainland in license PL609, in a water depth of 388 m (1,273 ft).

The well, testing Permo-Carboniferous and Triassic targets, encountered oil in good-quality carbonate rocks. Lundin estimates the potential recoverable resource in the range of 125-400 MMboe, and now plans wells on the Borselv and Neiden prospects to the north which could be equally large.

Statoil concluded its rolling 2013-2014 drilling campaign in the Barents Sea last month with a dry hole. Results over the two years were below expectations with only moderate new finds, including the Drivis oil discovery that will be included in the Johan Castberg multi-field development. But the three wells drilled in the Hoop area this summer – the northernmost on the Norwegian continental shelf at more than 300 km (186 mi) from shore – did confirm a working petroleum system.

The company had better luck in the North Sea with a new oil discovery in the Heimdal formation 7 km (4.3 mi) from its producing Grane field. The D-structure could hold 30-80 MMbbl recoverable, the company claimed. For Total, the semisubLeiv Eiriksson successfully appraised the Garantiana discovery, 30 km (18.6 mi) north of the Visund field in the northern Norwegian North Sea. A subsequent side track of the well into the Akkar prospect also encountered oil – partner Spike Exploration assesses combined resources at 50-105 MMboe.