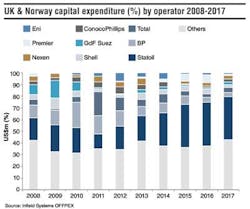

This month, Infield Systems looks at operators that are active offshore the UK and Norway, which encompasses the North Sea area and the Norwegian and Barents seas. Across the 10-year timeframe, a total of 86 operators have or are expected to direct expenditure offshore the UK and Norway. While the percentage share of "other operators" - predominately small independent companies with perhaps only one or two assets - is expected to increase from 32% to 38% during the forecast compared with the historic period. Looking at the major operators over the 2008-2017 period, Statoil remains dominant throughout, with capex expected to be directed toward a total of 99 field developments. The operator is expected to bring onstream key capital intensive global developments such as the giant Aasta Hansteen, accounting for the operator's peak share of capex demand in 2015. Altogether, the Norwegian NOC is expected to comprise 33% of total capex offshore the UK and Norway during the 2013-2017 period. BP's activities within the North Sea are expected to remain strong, despite the UK supermajor's share of overall capex decreasing from a 15% share over 2008-2012 to a 6% share going forward to 2017. One of the key developments for BP is expected to be the Schiehallion Quad 204 project, with an FPSO expected to see installation in 2015. Other operators expected to be featured offshore the UK and Norway include Total, with key developments including Laggan and Tormore offshore west Shetland, while Shell is expected to continue investments across a variety of projects, including the expansion of Ormen Lange.

- Catarina Podevyn, Analyst, Infield Systems Ltd.

Click to Enlarge