Greater New Orleans, Inc. and its partnering organizations have released the thirty-fourth Gulf Permit Index (GPI) to the public. This edition, the fifteenth GPI+, includes data on deep- and shallow-water permit issuance taken from the Bureau of Safety and Environmental Enforcement (BSEE), as well as data on exploration and development plans taken from the Bureau of Ocean Energy Management (BOEM).

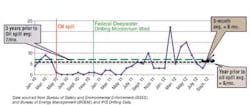

In September 2012, deepwater permit issuance rose above the monthly average observed in the year prior to the oil spill. Seven permits were issued, representing a 1-permit - or 17% - increase from the average of 6 permits per month. This number also matches the historical average of 7 permits per month in the three years prior to the oil spill. This also represents a 1-permit (17%) increase from the average observed over the past three months.

In October 2012, deepwater permit issuance also rose above the monthly average observed in the year prior to the oil spill. Nine permits were issued, representing a 3-permit - or 50% - increase from the average of 6 permits per month. This number also represents a 2-permit - or 29% - increase from the historical average of 7 permits per month in the three years prior to the oil spill. This also represents a 3-permit (50%) increase from the average observed over the past three months.

Through the month of September, three shallow-water permits were issued. This number fell below the monthly average of 7 permits per month observed in the year prior to the oil spill. This number also represents a 12-permit - or 80% - reduction from the historical average of 15 permits per month in the three years prior to the oil spill, and is below the average observed over the past three months.

Through the month of October, six shallow-water permits were issued. This number fell below the monthly average of 7 permits per month observed in the year prior to the oil spill. This number also represents a 9-permit - or 60% - reduction from the historical average of 15 permits per month in the three years prior to the oil spill, but exceeds the average observed over the past three months.

The GPI+ also shows a sharp increase in the average number of days taken to approve plans. In September 2012, the average approval time for a plan was 113 days, compared to the historical average of 61 days. This number represents an 85% increase above historic approval times. In October 2012, the average approval time for a plan was 117 days, compared to the historical average of 61 days. This number represents a 92% increase above historic approval times.

Callon sells Habanero field interest to Shell

Callon Petroleum Co. has closed the sale of its 11.25% working interest in the Habanero field in Garden Banks block 341. The company sold its interest to Shell Offshore Inc., a subsidiary of Royal Dutch Shell plc, for an estimated $39.5 million.

Callon says it will use the proceeds to fund its efforts onshore in West Texas. "The sale of our Habanero interest enables us to pay down a significant portion of our revolving bank debt and strengthen our balance sheet as we focus our efforts on the Permian basin," said Fred Callon, chairman and CEO. "This additional financial flexibility will position the company to pursue horizontal program development of our Southern Midland assets while continuing to evaluate our Northern Midland position for future development operations."

Transocean settles federal Macondo claims

In January, Transocean Deepwater Inc. agreed with the U.S. Department of Justice to resolve certain outstanding civil and potential criminal claims arising from the accident in the Gulf of Mexico involving theDeepwater Horizon drilling rig.

Transocean has agreed to plead guilty to one misdemeanor violation of the Clean Water Act for negligent discharge of oil into the Gulf of Mexico, and pay $1.4 billion in civil and criminal fines, recoveries, and penalties, excluding interest. For its part, the Department of Justice will conclude its criminal investigation of Transocean and settle its claims for civil penalties relating to the spill.

Under the civil settlement, the Transocean defendants must observe various court-enforceable strictures in its drilling operations. Examples of these requirements include certifications of maintenance and repair of BOPs before each new drilling job, consideration of process safety risks, and personnel training related to oil spills and responses to other emergencies. These measures apply to all rigs operated or owned by the Transocean defendants in all U.S. waters and will be in place for at least five years.

Anadarko and BP settled claims between the two companies late this past year.

Helix Energy reports Green Canyon discovery

Helix Energy Solutions Group has announced that its Wang exploration well has produced an oil discovery in the Phoenix field, located in Green Canyon block 237.

The well, 93 mi (150 km) offshore Louisiana, found more than 100 ft (30.4 m) of net pay. It was drilled to TD of 18,300 ft (5,578 m) in 2,300 ft (701 m) of water. It is being completed and will produce via a subsea tieback to theHelix Producer 1 FPU in 2Q 2013.

"Preliminary data from downhole test tools confirmed oil in the Wang well with over 11,800 psi of bottomhole pressure. We are moving ahead to complete the well," said Johnny Edwards, president, Energy Resource Technology GOM, a Helix subsidiary.

ERT is operator and holds a 70% working interest in the well. Sojitz Energy Venture Inc. owns the other 30%.

Technip to install Discovery facilities

Technip has won a contract to install the Discovery System's South Timbalier block 283 junction platform and related pipeline systems. Technip will perform the project management, engineering, transporting, installing, and pre-commissioning.

The pipeline will run between existing facilities in South Timbalier 280 and Ewing Bank 873 and the new block 283 platform. It includes 15.8 km of 12-in. pipe and 13.9 km of 30-in. pipe. Water depths range from 83 to 244 m (272 to 800 ft). Installation is scheduled for 2013 using theG1200 as the primary vessel.

"This award is the largest-diameter pipelay contract for Technip in the Gulf of Mexico, thanks to the acquisition of Global Industries," said David Dickson, Technip SVP, North America. "This 30-in. pipeline will also be the largest diameter lines installed by the G1200 vessel to date."

Williams Partners owns 60% of the Discovery System and operates it. DCP Midstream Partners owns the other 40%.