Bruce Beaubouef • Houston

The latest Gulf Permit Index (GPI) finds that the pace of deep and shallow-water permit issuance still lags historic levels, while at the same time showing an increase in the number of days taken to approve plans.

In late August, Greater New Orleans, Inc. (GNO, Inc.) and several partnering organizations released the 32nd GPI to the public. This edition, the 13th GPI+, includes data on deep and shallow-water permit issuance taken from the Bureau of Safety and Environmental Enforcement (BSEE) as well as data on exploration and development plans taken from the Bureau of Ocean Energy Management (BOEM). The two agencies replaced the Bureau of Ocean Energy, Management, Regulation, and Enforcement (BOEMRE) on Oct. 1, 2011.

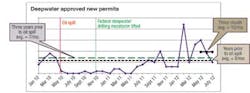

In July 2012, deepwater permit issuance fell from the monthly average observed in the year prior to the oil spill. Five permits were issued, representing a one permit – or 17% – decrease from the average of six permits per month. This number also represents a two permit – or 29% – decrease from the historical average of seven permits per month over the past three years. This also represents a five permit (50%) decrease from the average observed over the past three months.

Shallow-water permit issuance also remains below the historical averages. Through the month, three shallow-water permits were issued. This number represents a four permit – or 57% – reduction from the monthly average of seven permits per month observed in the year prior to the oil spill. This number also represents a 12 permit – or 80% – reduction from the historical average of 15 permits per month over the past three years. This also matches the average observed over the past three months.

The GPI+ also shows a sharp increase in the average number of days taken to approve plans.

The average approval time for a plan was 111 days, compared to the historical average of 61 days. This number represents an 82% increase above historic approval times.

Charts tracking approved new permits for deep and shallow-water drilling are above. In addition, a chart detailing the changes in average approval time can be found above. Raw data on number of permits issued and plans approved is taken from the BSEE and BOEM websites. Research and analysis was performed by GNO, Inc. staff members.

GNO, Inc. says it will continue to monitor permits and plans being reviewed by BSEE and BOEM, respectively.

Isaac aftermath

In the aftermath of Isaac, Gulf of Mexico oil and gas operations are returning to normal as platforms and rigs are reboarded and production restored.

Based on reports made to the BSEE, as of the first week in September, evacuations were still are in effect for 17 of 596 production platforms and 19 of 76 drilling rigs. Further, 58% of daily oil production and 38.5% of daily natural gas production remains shut-in.

At the peak of restrained operations, 85% of the platforms and 65% of the rigs were idle, while 93% of the oil production and 67% of the gas production was shut-in.

The most significant remaining known problem is downstream onshore where flooding has halted operations at a series of processing plants fed by pipelines from the GoM.

Among specific reports by operators, McMoRan Exploration Co. said it has found no damage to offshore facilities and is seeking to reestablish production.

Enterprise Products Partners reports that its personnel have been redeployed to both offshore and onshore facilities affected by Isaac, and that no consequential damage to offshore facilities has been found.

Shell expected to have personnel redeployed to its central and eastern Gulf regions soon, and restarts of production and drilling operations depend upon inspection results. Most facilities were expected to come onstream before mid-September, if the downstream infrastructure was able to take the deliveries of production.

Petrobras seeks deepwater partner

Brazil's Petrobras is seeking a joint-venture partner to invest as much as $4 billion into the company's deepwater drilling operations in the US Gulf of Mexico, according to a recent article in the Wall Street Journal.

Petrobras has reportedly hired Morgan Stanley to seek potential partners for the assets, which the seller pegs at roughly $8 billion. The bank has begun sending out initial financial information to prospective buyers, including foreign and US oil companies.

Petrobras is looking to sell as much as 50% of its Gulf operations in a deal that would allow it to maintain control. The asset sales are part of a previously announced plan by the Brazilian oil giant to raise nearly $15 billion to fund its five-year investment plan.

Petrobras has looked to scale back its investment in the US and in other overseas operations by selling assets including oil drilling blocks in the GoM and Brazil. In July, the company said it has increased its goal for raising revenues from asset sales to $14.8 billion, up from $13.6 billion previously, and reiterated that the sales will focus on overseas assets. The company has provided few details on which assets it plans to sell.

Petrobras, which in Brazil unlocked one of the world's most promising offshore oil provinces, has delved deep into the GoM's most challenging new region, the so-called Lower Tertiary. It found oil there in 2002.

Its Cascade and Chinook development began producing oil in February. It is being closely watched by the industry, as it is the first to pump crude from Lower Tertiary rocks in the far-off Walker Ridge area of the Gulf, an area thick with rival projects. The fields are located about 160 mi south of Louisiana in waters more than 8,000-ft deep.

Production at the Cascade well has been ramping up quickly to 174,554 total barrels of oil in June, up from 85,348 barrels in March. Petrobras owns 100% of Cascade and 66.67% of Chinook, in partnership with France's Total. The Cascade-Chinook development was also the first in the US Gulf of Mexico to pump offshore oil using an FPSO vessel instead of a traditional oil platform.