Karen Boman, ODS-Petrodata Inc.

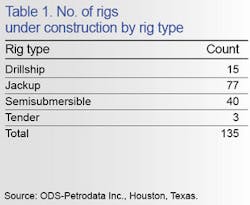

As of late June 2007, 135 mobile offshore drilling units were under construction or on order worldwide, and another 93 were in shipyards, including a number being readied for rebuilding and upgrades of varying magnitude. Twenty-seven of the rigs under construction or on order have been ordered since the first of the year, and more orders for new rigs are expected. The offshore industry has not seen a construction boom like the current one since the early 1980s.

Noteworthy is the fact that the offshore rig construction boom is being funded in large part by companies engaging in speculative orders; the bulk of the rigs on order or under construction do not have contract commitments in place. The total cost of the rigs currently under construction or on order exceeds $25 billion.

There are more jackups under construction than any other rig type. In addition to the boom in new construction, major upgrades are under way or planned on four drillships, three jackups, eight semis, and two tenders, while minor upgrades are underway or planned on five jackups, 12 semis, and an arctic rig.

With this level of activity, shipyard space remains at premium as it was a year ago. Asian shipyards continue to draw the majority of rig construction work. Singapore leads the pack with 53 newbuild projects. China is next with 23 projects, followed by Korea with 22.

The United Arab Emirates (UAE) has attracted significant interest from drilling contractors looking for shipyards for construction and upgrade work, and 27 such projects are under way in UAE yards. US yards have not missed the boat either. As of late June, nine rigs were under construction in US shipyards, and 21 upgrade and rebuilding projects were under way.

With even more new rig orders expected, will new rigs flood the offshore rig market and sink day rates, which are at record levels for some rig classes at present? Probably not. ODS-Petrodata forecasts that rig demand will exceed supply beyond 2008, particularly in the deepwater market. However, with 77 units under construction, the jackup market may hit a slight bump along the way as the new capacity is absorbed into the fleet.

Average day rates are up everywhere but the Gulf of Mexico, where the jackup market continues to feel the effects of low domestic natural gas prices. Demand remains strong in the world’s other offshore rig markets, and rig owners are reaping the benefits.