Addax Petroleum proves its model

Eldon Ball, Editor-in-Chief

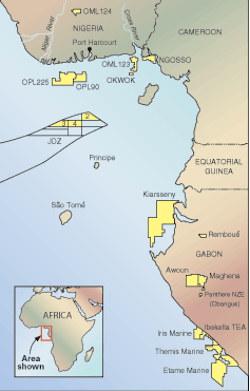

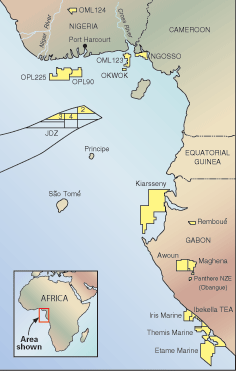

Addax Petroleum is the largest independent oil producer in Nigeria and has increased its crude oil production from an average of 8,800 b/d in 1998 to an average of 80,000 b/d during the first half of 2006.

Addax Petroleum has driven its growth through a philosophy of acquiring oil properties deemed by others to have limited remaining production potential and using in-house technical and operational expertise to grow reserves and production in a cost-effective manner. The company has budgeted capital expenditures in Nigeria of US$772 million in 2006, including its Okwok property but excluding JDZ.

Addax Petroleum’s growth strategy going forward is to build on significant business opportunities in line with the key trends of the Nigerian oil and gas industry, such as:

- A shift of major oil company focus from near shore and onshore properties to larger scale deepwater properties

- The Nigerian government’s drive of gas monetization in conjunction with a gas flare out target in 2008

- The Nigerian government’s encouragement to an increasing participation of indigenous companies in the oil sector.

For this issue’s special report on offshore West Africa, Editor-in-Chief Eldon Ball talked with Jean Claude Gandur, Addax Petroleum’s President and Chief Executive Officer, and their current operations, future plans, and development strategies.

Offshore: You took some offshore acreage that didn’t look attractive to anyone else and turned it into a productive field. How did that come about?

Gandur: When we took the acreage we were producing about 8,800 barrels a day. We are going to produce this year an average of about 85,000 barrels a day. We are currently producing slightly below 100,000. We are at 98,000 b/d. For next year we are planning to produce 100,000 as an average.

We had applied state of the art exploration technology, by doing a lot of 3D seismic, horizontal drilling, and multi-sidetrack appraisal wells, and this has helped to redevelop what our predecessors have left behind them. We have added value by focusing on producing oil from very thin oil sands, which are commonly found in shallow waters. You find them also on onshore property. It’s a peculiarity of Nigeria. They are very thin but they are good prospects for horizontal drilling and you can recover very good percentages of oil.

The other point is that we manage to keep our costs quite low, so that even if the oil price was only $20-$22 a barrel, we could still continue to produce and develop. We have an average per-barrel cost of between $5.50 and $6.50 from the beginning of the appraisal. We spend a lot of money on the capex side, to do more exploration. We are currently holding about 200 million barrels of reserves in Nigeria, compared to 30 million when we signed our two first PSCs, one covering OML 123 and OML 124, and the other covering OPL90 (now converted to OML126) and OPL 225 in 1998. We have been producing so much since we acquired the property that I think we have by now produced at least 40 million barrels from the day we took over.

Offshore: With those fields, are you through developing them or do you have some more wells planned there?

Gandur: In Nigeria, we have four rigs that will be drilling for us next year On OML126 (former OPL90), we have one rig. On OML123, where we have a very active program for next year, we have two rigs. In addition to this, we have a land rig on OML124, our onshore property. For next year, we should drill about six exploration wells in Nigeria.

Offshore: What is the status of the Nda field and what are your plans?

Gandur: In Aug. 2006, the sixth well on the field, the Nda 6, was the first development horizontal subsea well put onstream. We discovered that field in July 2004, so it took us only two years to develop it. Today, we are producing more than 8,000 barrels per day from the Nda field. On Oct 3, we completed Nda 4, and this should add significant production, because we expect to come up to 16,000 barrels a day total. Double the current production rate. From the day we started the operation up to now, we have produced about 2 million barrels. The Nda and Okwori fields average a total of over 38,000 barrels per day.

Offshore: Another property you’re developing is the Owkowk field.

Gandur: Yes, it’s south of OML 123 (AP’s largest producing field) , about 8 miles from our property. We have acquired a 40% interest in June this year,. The operator of this field joint venture is Oriental Energy Resources, an indigenous Nigerian oil company, and we are the technical adviser. We therefore handle the drilling operations.. This year we began drilling to appraise two separate areas of the field. We have just completed our exploration and appraisal campaign and are now ready for testing. We have hit oil, but we don’t know how much yet. This is a shallow-water field in about 30 meters of water.

Offshore: So do you expect the same kind of reservoirs as the others that you have mentioned?

Gandur: Yes we do hope for this because it’s really the same structure. We have been confronted with very high pressures coming from liquid hydrocarbon and not gas. So we were quite surprised to see those reservoirs responding so well and being under such high pressure. So now we are going to start testing those.

Offshore: You also talked about some property off of Cameroon and Gabon. What are your plans for those areas?

Gandur: We shot some 3D seismic offshore Cameroon this year and we are interpreting it as we speak. We expect to drill two wells next year, starting in May. Offshore Gabon, as you know, we acquired Pan-Ocean Energy Corp. (see box), and we have several acreages onshore and offshore. We are not operators on the offshore acreage.

Offshore: Moving on to the Joint Development Zone, I think you have some property there as well that you are looking at. Are you going to do any drilling?

Gandur: We are currently in negotiation with one of two companies that have fifth generation rigs for deep offshore. It is not a very easy task, because day rates are high, as you know. But now, maybe with the oil prices going down, some people will have less interest in drilling deep offshore. So maybe we’ll have some chances for grabbing a slot for next year.

The rig we are presently contemplating could do the job during the second half of 2007. We would really like to get a slot for the fourth quarter of next year. The seismic has been done already, so it’s just a question of interpreting the seismic. We are the operator in block 4, and we hold participation in block 2 and block 3. We expect a lot from that block.

We think a lot of value for the company should come from there. As you know, ChevronTexaco and its co-venturers have made a discovery this year on block 1. Nobody knows exactly the size of the discovery, but the fact that they have announced that they’re going to drill a second well gives us some indication that they’re not too unhappy with what they saw.

Offshore: what are your exploration plans for next year?

Gandur:We plan two exploration wells off Cameroon, two in OML 126 (former OPL90) and OPL 225, three exploration wells in OML123, and five or six offshore and onshore Gabon. Not all of the Gabon acreage is operated by Addax Petroleum. Some wells are operated by partners like Vaalco or Sterling.

Offshore: You emphasize having a great deal of participation by Nigerian people in your company efforts. Do you think that has helped your success?

Gandur: I think that we have been proactive on several levels. We have done a lot of work with the local communities. We have funded the construction of schools, expanded clean water supplies, paved roads, and provided scholarships for primary and secondary schools. I think this has given us a good name in the country. We have been cited by the government as an example for other companies.

Also, we are very advanced in the local content of our work force. Some very senior engineers are Nigerian citizens. They may be located in Lagos or in Geneva. It depends. The common notion of an expatriate is not ours. if we feel that a Nigerian engineer has good knowledge for company fields in the Middle East, we will send him to the Middle East. The philosophy of the company is that we are one company, one team, and one mind. I built this company because I like Africa. That is the reason why I have based my career in Africa. Over 30 years I have traveled to almost all of the countries in Africa. It’s a reward. Our success is a reward of years of investment and of people’s commitment. I think I’ve been very nicely rewarded by the people I work with.

Offshore:Addax Petroleum has an atypical model. Can you expand on what you mean by that?

Gandur:Our model is to have associated the local employees with the success of the company, not running the company only from Geneva. The fact that we started from scratch and became the largest independent in Nigeria is because we have found the best possible people to help us get where we are. So we have a lot of expertise in engineering, seismic interpretation, and drilling operations. Addax Petroleum behaves like a much larger company. We don’t contract a lot of our work. We do a lot of things ourselves.

We have people coming from different experiences. We have a lot of ex-Shell, Mobil, Chevron, Total and others. They come here and we have to meld them together and create a new spirit. So I think we’re quite unique because all of these people coming from different companies are working very well together. Although Addax Petroleum is a public company I’m trying to keep the family atmosphere of the company. Although we’re growing fast and more and more people are coming on board, we work on maintaining a good team spirit amongst the people and not let the management sit on one side and the balance of the employees on the other side.

Addax plans Okwok development

Addax recently revealed that its Okwok field contains medium to light crude oil and the reservoir is of high quality. The company is updating its geological models to evaluate a future appraisal strategy and potential fast-track development plans.

The Okwok field is located south of and adjacent to OML123, Addax Petroleum’s largest producing property, in about 50 m of water. It comprises three major fault block compartments, named blocks 1, 2, and 3. block 1 was drilled by well Okwok-1 in 1967 and block 2 by well Okwok-2 in 1968, both by a previous operator. block 3 had not been drilled prior to the recent campaign. Both earlier wells had discovered hydrocarbons but had not been flow tested.

The Okwok 2006 exploration campaign by Addax Petroleum and Oriental began when the GlobalSantaFe High Island IX jackup drilling rig arrived on location in early July and concluded in late October. The campaign comprised the drilling of wells Okwok-4A and Okwok-4AST1 in block 2 and Okwok-7A and Okwok-8A in block 3. The objectives of the campaign were to appraise block 2, explore block 3, and to conduct flow tests to establish the oil properties and reservoir conditions in both blocks. The primary reservoir objective in the Okwok field is the stacked “Lower D” sandstone sequence of Upper Pliocene/Lower Pleistocene age which, at Okwok, occurs at depths between 3,000 and 4,000 ft subsea.

For block 2, Okwok-4A was drilled approximately 1.3 km west of Okwok-2 to appraise the areal extent of the fault block’s oil accumulations. Okwok-4A encountered 14 ft of net oil pay in its primary target in the Lower D sequence, which was thinner than anticipated but which also encouraged the drilling of a sidetrack down-dip.

Okwok-4AST1 was drilled as the sidetrack to Okwok-4A targeting a more sand-prone area and encountered 95 ft of net oil pay in two intervals within the Lower D sequence. A drillstem test was attempted but was curtailed due to a rupture of the sand exclusion screen that caused excessive sand production into the well. The test produced at a rate of approximately 400 b/d of light 32° API gravity oil. The true flow potential of the well was not reached because of sand control problems during the test; however, Addax was pleased with the high quality of the oil tested and will use the knowledge gained regarding the reservoir conditions in future appraisal efforts.

Following the appraisal of block 2, the rig was moved to explore block 3 and spudded Okwok-7A. The well was abandoned prematurely because of mechanical difficulties after encountering hydrocarbons and abnormally high pressures while drilling in the Lower D sequence. The Okwok-8A well was spudded immediately thereafter, was drilled successfully and encountered 97 ft of net oil pay in two sandstone intervals in the Lower D sequence.

As a precaution against the excessive sand production experienced in Okwok-4AST1, Okwok-8A was gravel packed prior to testing. The well was flow tested at a maximum rate of 1,220 b/d of medium 26° oil on a 32/64-in. choke. Both the Okwok-4AST1 and Okwok-8 wells are currently suspended for potential tie-back to production facilities.

Addax Petroleum and Oriental are incorporating the well data, oil properties, and flow test data into existing geological and engineering models. The new information will be used to evaluate the 2007 Okwok work program, which Addax anticipates will include further appraisal drilling and potentially fast-track development planning. Should additional appraisal efforts prove successful, the Okwok field is likely to be developed through the OML123 FPSO 12 km to the north and first commercial oil production could begin as early as 2008.