ABB, Schlumberger focus on key areas in subsea and downhole technology

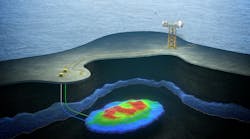

A recent memorandum of understanding signed by the global technology groups of ABB and Schlumberger to pursue a joint venture offers insight into the subsea technologies service companies are focusing on. The scope of the memorandum could include any technologies involved in transporting production from the reservoir to the delivery point. For many competitors, the focus on subsea development has shifted from a question of capability to one of economics.

Economics become key in deepwater and marginal field development. Combining the technology of Schlumberger and ABB will save both companies the time and expense of filling out their suite of products individually and potentially develop into a unique value proposition.

While the risk/reward design of this joint venture is an indicator of things to come, the real question is which key technologies will be the focus of the joint venture. In a press statement, Gôran Lindahl, President and CEO of ABB, specifically mentioned Schlumberger's reservoir evaluation, development, and management experience. He also notes the company's downhole monitoring and control technologies. Lindahl goes on to point out that ABB offers subsea knowledge expertise, including downhole intelligent completions, subsea processing, and power distribution.

Because a definitive agreement will not likely be signed off on until year's end, it is difficult to get many more details. Rod Nelson of Schlum-berger said customers are looking for a complete system approach to flow assurance and system reliability. "As for specific technology that will be combined, it is too early to say what specifically will be involved," he said.

Schlumberger does hold a minority interest in Framo Engineering. Framo has made strides in multiphase pumping and metering. The company supplied the pump module for the Troll Pilot development, which was the first application of ABB's SubSys subsea separation system. Beyond this, it is clear these are two companies coming at the same problem, subsea development, literally from two different directions: Schlumberger from the reservoir and downhole perspective, and ABB from a controls systems and subsea background. A combination of these two might offer the "complete system" Nelson suggests.

Proteus semi design

With all the action in deepwater and the recent surge in activity on the Gulf of Mexico Continental Shelf, one area that has lagged behind is the mid-range depths. Targeting fields in this market is the EDG semisubmersible design Proteus. - The Proteus three-column semisubmersible is a low-cost production solution developed by EDG out of New Orleans.

The concept is simple. Using existing technology, EDG plans to update the semisubmersible production vessel design to offer a cost-effective production solution. The key to opening up marginal fields is to lower the capital expenditures (capex), said Paul Dixon, Project Manager for EDG. This is done by purpose-building a low-cost production vessel.

The three-column semi design offers a number of advantages over conversions or other purpose-built designs. It can be mated with its topsides before tow out, eliminating the need for offshore integration and heavy lifts. It uses a conventional mooring system so it can easily be moved from one site to another. The three-column design is stable at any draft, and it is cost competitive with mini-TLP designs.

This design could also serve as an early production solution because it is easily relocated. This may be an attractive option for operators interested in bringing a field onstream while their long-range production solution is under development. Although the concept can open up opportunities in mid-range water depths, it is viable out to 6,000 ft. As larger fields come onstream in deepwater, the need for a marginal field production system will grow. EDG claims Proteus can be constructed and installed at a 25% savings over existing solutions. If this proves out, it could offer hope to otherwise uneconomical prospects.

SSP may be control buoy option

OPE recently completed the model tests of its SSP floating production/service vessel design. Tests were conducted in Delft, Holland at the Delft University of Technology Model Basin. The SSP is a multi-purpose floating facility with a retractable center column. This column allows the vessel to be fabricated and mated with topsides in any fabrication yard with 30-40 ft. access depth.

During tow-out, the column is partially extended for stability. Once on station, the column is fully extended for additional stability. In model tests, the hull design was found to have outstanding motion response characteristics even during the 100-year storm conditions for the Gulf of Mexico and West Africa.

The primary market for this design would be as a satellite separation facility to provide improved flow assurance and individual well control to subsea trees. The vessel can be moored in water depths from 150 ft to 10,000 ft. Other versions of the same basic design could be used as a mobile early production solution or as a control/service buoy.

Because the vessel uses a preinstalled mooring system and has a retractable center column, it can be rapidly mobilized for early production work. According to OPE, some operators have shown interest in purchasing and operating their own SSP. This vessel could be kept on call for early production work, moving from field to field as long-term production designs come on line.

Though this design is distinct from the Proteus, they share the goal of cutting capex costs to operators and offering a mobile early production option for fields that may otherwise be too marginal to justify development. Such designs could offer an alternative to the popular Mini-TLP design in developing marginal fields of the future.

From the recent surge in low-cost structures, a trend appears to be developing. While the Gulf of Mexico is ripe for marginal field production solutions, other hot areas, such as offshore Brazil and West Africa are still ahead of this trend curve.

As more large discoveries are made in these theaters, marginal fields will also be identified. Once development begins on the bulk of the elephant-size fields, attention will turn to marginal fields. It is clearly this potential, married with the growing current demand in the Gulf of Mexico, that is sparking the trend toward low-cost development solutions. Add to that the promise of early production, and there may be growing interest in a variety of novel designs.