Royalty in value versus royalty in kind

Marshall DeLuca

Business Editor

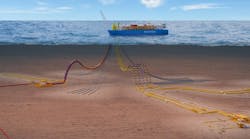

The US government wants a new way of calculating royalty due from operators in the Gulf of Mexico. Shown is a drulling unit drilling next to Coastal platforms in West Cameron 498. (Photo courtesy of ANR Pipeline)The US government wants to change the rules of production royalty sharing, and further, wants back payments for all the years oil producers have operated under previous rules. The changes are critical for the petroleum industry, not only because of the size of back payments, but because the US government wants the industry to bear much of the cost of selling government's shares in an open market.

Royalty problems are not new to producers. Royalty and tax re-calcuations are part of the risk structure in doing business around the globe. Changes in government administration or budget shortfalls are the most frequent reasons for royalty changes. What makes the US government action onerous to the industry is that it is retroactive.

Recently, the US Justice Department accused four oil producers of knowingly underpaying royalties for oil produced on federal and Indian lands, and is looking into the production sharing calculations conducted by 10 other producers. The complaint, filed in US District Court in Lufkin, Texas under the Federal False Claims Act, alleges that four oil companies underpaid royalties by calculating them based on "fraudulently deflated wellhead prices."

The four companies - Amoco, Burlington Resources, Conoco, and Shell Oil - are alleged by the government to have undervalued hundreds of millions of bbl of oil in fields in the Gulf of Mexico, California, New Mexico, and Wyoming, from 1988 to the present.

This complaint against the four stems from an earlier private lawsuit filed against 14 producers accused of underpaying royalties.

The US government decided to file actions against the four, but has not, as of yet, decided on actions against the remaining 10. The other 10 include BP, Chevron, Exxon, Kerr-McGee, Oryx Energy, Oxy, Pennzoil, Phillips Petroleum, Unocal, and USX-Marathon.

The four cited companies say they have properly paid royalties according to law and have been in full cooperation with the government. A Shell spokesperson contends that the MMS previously had validated the company's method of valuing oil and regards the government claim as "meritless".

The Justice Department has not disclosed an estimate at the size of the royalty underpayments. However, a US counsel in private royalty-related litigation has estimated that the actual royalty underpayment is at least several hundred million dollars, with added damages and statutory civil penalty in excess of $5 billion. If the government suit is successful, federal law permits recovery up to three times the losses suffered plus penalties.

Royalty in value

According to the current regulations, whenever an oil company operates on federal land or offshore water bottoms, it must pay the government a royalty for the produced oil or gas based on a percentage of the value of their production at or near the lease. This is referred to as paying royalty in-value.The controversy involved with this method stems from the producers having to find a buyer and then write a royalty check to the government based on that price. This problem was evidenced in 1995 when eight oil companies, including Amoco and Shell, were sued for basing their royalties on internally produced "posted prices." The government claimed that companies could set artificially low prices by selling to an affiliated company, and in turn, base the royalty on that low price instead of the market value.

This suit has resulted in Chevron, another participant in the suit, paying more than $13 million to the state and to hundreds of private royalty owners of Chevron oil production in Texas. Chevron must also use a royalty valuation that is tied to the price for West Texas Intermediate (WTI) crude that results from trading on the New York Mercantile Exchange, and to prices for WTI and West Texas Sour assessed in Platt's Oilgram Price Report.

In an attempt to resolve this issue, the MMS has published a proposed rule that would amend the regulations establishing the value of oil from Federal leases. The proposed rule is the culmination of two earlier rules, industry comments, and several workshops.

Proposed rule

The proposed US government rule states that the royalty value is based on the gross proceeds received when oil is sold under an arm's-length contract and on index pricing or other benchmarks in cases when oil is not sold under an arm's-length contract. The rule is intended to be more simplistic and certain than the previous regulations. It is based on five basic principles of royalty valuation:- Royalty must be based on the value of production at the lease.

- For arm's-length contracts, royalty obligations should be based on gross proceeds.

- For other than arm's-length contracts, index prices are the best measure of value in most areas of the country.

- The lessee has a duty to market at no cost to the lessor.

- Customized regulations for unique producing areas are preferable to a "one size fits all" approach.

However, the Independent Petroleum Association of America (IPAA) has expressed disapproval of the proposed rule calling it "the most administratively burdensome and complex method available to the government today."

Royalty in kind

The IPAA supports a different kind of royalty system known as royalty in-kind which has been developed by the Clinton administration. Royalty in-kind involves taking an actual bbl of oil instead of a royalty check. This ensures that a fair royalty payment is being received.Using this method, private marketers will be hired to sell oil and gas in-kind which will likely result in increased revenues to the government and obtaining the best price possible. According to the IPAA, this method will provide certainty and simplicity, solve the problems and concerns with over valuing federal royalties, and save taxpayers money.

The IPAA claims that the MMS has recently attacked the royalty in-kind method as a "diversionary tactic on the valuation issue," and that MMS has earlier suggested that the in-kind system would be cost-effective, providing certainty and simplicity to its royalty staff. Whatever the final result to the current royalty trials may be, it is certain that it will not resolve the issue permanently.

MMS going after US Gulf safety violators

A flurry of new operators in the US Gulf of Mexico, some with little background in offshore operations, and the fear of a major oil spill that would impact all operations, has induced the MMS to begin acting on recurrent safety violations.

About every 10 years, a major accident takes place somewhere. In 1958, the US Gulf witnessed a large blowout; in 1968, there was a blowout off Great Yarmouth in the North Sea; in 1978, a problem developed on Ekofisk in the North Sea; and, in 1988, the Piper Alpha disaster occurred. Now, it is 10 years later, and no major event has occurred yet. The MMS, feeling vulnerable, is taking action.

Proposed rule

The proposed rule intends to update the existing regulations dealing with postlease operations in federal waters. The Title 30, Code of Federal Regulations, Part 250, Subpart A provides authority to MMS to grant an easement and a right-of-use for an Outer Continental Shelf (OCS) tract to a state lessee.The rule also clarifies the distinction between granting and directing a suspension, and the consequences of each. However, the most provocative implication of the proposed rule deals with the criteria to disqualify an operator with repeated poor operating performance from acquiring any new leaseholdings or upon severe cases, revoke operator status. Theoretically, upon approval, MMS will have the authority to ban operators from the Gulf - permanently.

MMS feels that with exploration activities increasing in frontier areas, such as deepwater, and other new advances being made, the existing regulations do not really address everything that needs to be addressed and improvements could be made. This proposed rule is a step towards the margin of improvement needed to address these needs.

MMS states that no specific accident or company spurred the inception of the proposed rule. It was simply the result of the high level of activity and increased density in the Gulf that could result in a higher proportion of accidents.

Safety monitoring

Under the existing regulations, MMS has an inspection program already in place to ensure that safety is being met in offshore operations. The government mandates MMS to inspect every platform in the Gulf at least once a year.Every day, 53 inspectors go offshore (weather

permitting) using 14 leased helicopters to inspect offshore operations. During 1997, the MMS conducted 1,380 drilling inspections, 3,950 production inspections, 1,208 pipeline inspections, and 3,542 measurement inspections. The inspectors inspect such things as the proper use of equipment, and to ensure that proper techniques are being followed to maintain control of the well to prevent blowouts, spills, and accidents.

If an operator is found in violation of a safety or environmental requirement, a citation is issued requiring that the problem be fixed within seven days. If the violation is found to be a "knowing and willful" violation, the matter is referred to the Department of Justice for criminal prosecution. Between August 18, 1990 and December 31, 1997, MMS collected $1,398,820 in fines from civil penalties.

Comments from the public on the proposed rule will be accepted for 90 days. A public meeting was held on the 24 of March to consult with industry on establishing the criteria for the disqualification provision in the proposed rule. Results were not available by press time.

In conjunction with the rule, MMS is also planning to post a safety subject on the MMS website (www.mms.gov) this month. This section will feature civil penalties and accidents, and accident investigations that have occurred in the Gulf OCS region. This information was only previously available through the Freedom of Information Act. This was conceived to open the safety issue to the general public.

Copyright 1998 Oil & Gas Journal. All Rights Reserved.