Super-deep subsalt well encounters many challenges

William FurlowThe greater Llano area in the US Gulf of Mexico could contain oil reserves in excess of one billion bbl. These prospects lie in five blocks on a trend in the East Garden Banks area between the prolific Auger and Bald Pate developments.

Technology Editor

Terry Prater, Senior Drilling Engineer for EEX, said the company has been involved for several years with production in this area of Garden Banks. EEX Corporation took Exxon's Cooper GB 388 prospect to production. This is a shallow field in the eastern end of the area. It initially consisted of two oil wells in GB 388. GB 387 subsea satellite development added two oil wells and a gas well to the system. Further GB 388 development increased the total well count to seven. Cooper production is separated and produced to Eugene Island 315 where it is processed for sales.

The GB 388 and GB 387 wells were primarily drilled into the Pleistocene horizon rather than the deep lying Lower Pliocene/Miocene sands. These wells were not in areas that had good structural position for reaching these deep sands. The Cooper prospect featured productive wells, Prater said, but EEX's interest was in gaining access to the Miocene sands where one would encounter what is believed to be the bulk of the formation's oil reserves. Prater said EEX was anxious to test the Miocene level sands in these wells because it was at this deeper level that Auger encountered world-class pays.

Llano No.1

To test this theory EEX chose a new location, GB 386, to drill what would be the Llano No.1 discovery well. Using the Diamond Ocean Voyager, a semisubmersible with a 10,000 psi stack capacity, EEX and its partners set out to drill to a total depth (TD) of 24,750 ft beside and under a salt overhang. In December of 1997, the well reached a measured depth (MD) of 25,342 ft and 24,511 ft true vertical depth (TVD). Drilling torque and drag was approaching equipment limitations making it difficult to drill, and well control procedures required increasing the mud weight to a level which allowed no further kick tolerance.The original planned depth had been surpassed, but to reach the necessary horizon the well would have to go deeper. A 7-in. drilling liner was set and a casing evaluation log indicated the 9-5/8-in. full string was worn. The 7-in. liner was tied back with 7-3/4-in. casing which was hung off in the subsea head. Prater said the Voyager had performed well, but it would take a 15,000 psi BOP stack to drill deeper.

The well was temporarily suspended. EEX waited about a month until the Sedco Omega, which featured a 15,000 psi stack, became available.

Changing out rigs

In February of 1998, EEX worked out a deal with Oxy for use of the Sedco Omega drilling unit. The well continued, despite some rig startup problems. After doing some in-depth calculations, it was decided that the well would be drilled slimhole, using 4-in. WT-39 drill pipe below the mudline and 5-in. drill pipe in the drilling riser. This arrangement allowed ample pressure and flow capacity for drilling to 28,000 ft without exceeding the tensile or torsional capacity of the drill string.Drilling progressed to 27,864 ft (26,978 ft TVD). All parameters were running well within equipment limitations, except for the surface pulsed MWD, with the bit at over 5-1/4 miles from the rig floor. The added circulating densities at this depth were 1.4 to 1.5 pounds just circulating enough mud to clean the well with a 6 hours bottoms up circulating time. With the 14.6 lb/gas synthetic mud and PDC equipment, they could make as much as 40 ft/hr. But, drilling blind with mud returns that take 6 hours, the operators held back to 20-25 ft/hr.

Deep gas kick

At 27,864 ft, the well took a strong kick. The well was killed by walking up the mud weight in steps from 14.6 to 15.8 pounds. The well stabilized, but the mud was too heavy to circulate. After killing the well, the drill string became stuck while pulling out of the hole just under the 7-in. casing shoe, at 25,145 ft. Schlumberger had designed special charges to cut drill pipe under these intense hydrostatic conditions. They were able to shoot the pipe in one try.The well was then sidetracked via whipstock around the severed pipe, and back through the main pay horizons to 26,750 ft (25,772 ft TVD). The driller was able to get mud pulsed MWD data on the sidetrack.

Because of the tremendous depth of the well, the weight of the logging wire could actually crush itself on the drum, and approached its tensile capacity. Schlumberger used a capstan pulley system to relieve some of the weight on the drum. Even with this configuration, very little overpull capacity was available to retrieve logging tools.

To overcome this limitation, the operators used Schlumberger's push log tool, for Tough Logging Conditions (TLC), which was run on drill pipe, making this the deepest vertical wet connects ever. From the sidetrack, wellbore, the operators were able to recover fluid pressures and samples from zones of interest. However, they were unable to gather sidewall cores.

The operator was able to set a 5-in. liner into the 5 7/8-in. hole at 26,750 MD and cement with full returns. The cement job went well, according to the bond log, and the well was then suspended with the 5-in. liner across the production zone.

"When you stop and think about the technical challenges here it's pretty mind boggling," Prater said. "By that, I mean (setting a) 5-in. liner inside a 5 7/8-in. hole; you are trying to put 30 bbl of cement into the right place, from five miles away."

Prater said the appraisal well will be drilled updip from the exploratory well under the salt dome over hang. Prater said the well data suggests several wet horizons encountered in the first Llano well may be oil filled in the appraisal well. EEX is in the process of proving up a model of the greater Llano area that includes not only the Llano discovery well but a number of others located in contiguous blocks.

The Ocean Voyager is presently scheduled to spud the Llano No. 2 appraisal well very shortly. The outcome of this well, and a number of others will dictate the development plan for the whole field.

Development options

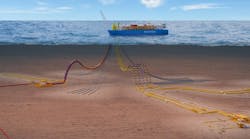

Currently, EEX is exploring two options with regard to development. Without sufficient data on the size and nature of the finds, the company cannot say if it will pursue a fast-track development, or hold off until it can bring additional production on line through a more substantial installation.The Cooper template in the Northwest corner of GB 388 has been producing from seven wells since 1995. Production from this subsea template is processed by the Enserch Garden Banks platform, which is tied into the Eugene Island pipeline. Unfortunately, it would be impractical to tie all the anticipated production back to this template because Cooper's capacity could only be expanded by 40,000 b/d.

Todd Hubble, Senior Petroleum Engineer for EEX, said field size and architecture will ultimately determine the development strategy. There are a number of options for development. He said the ideal scenario would be a system that would allow early production from Llano, and later be expanded to take on additional production from other wells in the area. The goal would be to minimize throw away costs, while not investing too much up front without knowing what the long-term potential will be.

Possible floating development plans include a spar, semisubmersible, FPO (floating production and offloading) vessel, a mini TLP (tension-leg platform), or several mini TLPs tied back to a central processing host. The mini TLP design would require a large initial capital outlay, meaning the project would have to prove out huge reserves to offset the expense.

The possibility that Llano might be the first application of a floating production, storage, and offloading (FPSO) vessel in the US Gulf of Mexico is remote, according to Hugh Gray, EEX Vice President of Deepwater Development. He said the easy access to substantial infrastructure nearby would preclude the need for an FPSO-based solution. Regardless of the regulatory hurdles, the expense of such a system would not be justified this close to processing facilities. "We've got pipelines within five miles," he added.

Reserve figure

As far as the possibility of this being the next billion bbl giant, Gray and Prater agree the potential looks good. "We've got a known hydrocarbon source," Prater explained. "We've got a good looking structure on seismic. And, we have a very strong reason to believe it will be productive as well. If you start totaling up the areas we could physically map, it could be a billion bbl," Prater said.EEX and its partners hold an interest in nine contiguous blocks in the Llano area; containing five prospects; Travis, GB 387; Rex, GB 386-387; Huey, GB 390-346; Bowie, GB 388; the Llano discovery, GB 385-386; and Llano appraisal well GB 385-386. "All those lie in a direct line between Bald Pate and Auger," Gray said.

Hubble cautioned that with only one data point it is impossible to state as fact that this will be a billion bbl play, but he agreed it is a distinct possibility. Based on the results on the Llano appraisal well, there may be another appraisal well drilled next, or another exploration well in one of the other named prospects in the area. If the Llano appraisal well is successful then a second appraisal well might be drilled.

"The owners pretty much agree; it will take three appraisal wells to know what we've got," Gray said.

Copyright 1998 Oil & Gas Journal. All Rights Reserved.