Robin Dupre * Houston

Offshore exploration, development, and production activities are on the rise in a number of Latin American nations, and include several new frontier areas as well as traditional resource plays.

From conventional crude extraction to more unconvential developments, the oil and gas sector of this region has gained traction after the discovery of new reserves in Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Peru, and Venezuela. These new assets are changing the relative importance of and the relationships among Latin American countries.

As the oil and gas industry is transformed by new technological developments designed to explore and develop resources, Latin America is considered to be a rich, under-explored hydrocarbon region whose economic future depends on the development of secure energy supplies.

Four countries – Venezuela, Mexico, Brazil, and Argentina – account for 84% of total production of crude oil in Latin America. The region currently produces more than 10 MMbbl and 204 bcm (5.77 tcf) of gas and is expected to reach 12.4 MMb/d and 237 bcm (6.7 tcf) of gas by 2015, according to the US Energy Information Administration.

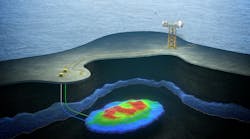

Brazil continues to lead the area in E&P activity with a combination of technology, skill, and investment. It is projected that Petrobras and its international partners are in the process of delineating and producing an estimated 100 Bbbl of recoverable crude from the presalt formations in the Campos and Santos basins.

However, while foreign investment has decreased in Brazil, international oil companies are focusing on other parts of the region to look for the vast amount of unexplored resources expected to be discovered.

New efforts off Colombia

Offshore Colombia is an emerging development area that is gaining traction among a number of oil and gas operators. Anadarko, based in The Woodlands, Texas, is preparing to embark on a major new exploration campaign off Colombia, where it looks to repeat the successes it has achieved in recent years off Mozambique.

Anadarko farmed into Colombia’s Fuerte Sur and Fuerte Norte blocks in 2012, forming a 50/50 joint venture with state oil company, Ecopetrol. This arrangement was soon extended to a wider area, including the Purple Angel and Ura-4 blocks, and block 5, included in the 2012 licensing round.

The company contracted CGG to shoot 2,124 sq mi (5,500 sq km) of 3D seismic in said areas, and this was completed in the second half of 2013. Deemed the largest marine seismic program ever acquired in Colombia, Anadarko is currently conducting a bathymetry and piston coring program in the area.

TheBolette Dolphin deepwater drillship will be brought over from West Africa later this year to begin its Colombian drilling campaign in the deepwater Magdalena tertiary delta turbidite fan. A back-to-back two-well program is scheduled to begin in January 2015, targeting the Calasu prospect on the Fuerte Norte block, and the Kronos prospect on the Fuerte Sur block. Both prosects are large structures that offer multiple potential targets, and could de-risk several adjacent structures in the area, the company said.

“This part of northern South America has a very good source rock, [as witnessed in the] La Luna in Venezuela, and the challenge is to find the structures to trap the hydrocarbons,” Brian Frost, Anadarko’s new ventures manager, told the Latin Upstream conference in Rio de Janeiro.

Anadarko has been offered further encouragement by the Perla discovery in the Gulf of Venezuela [in Venezuelan waters], where Repsol and Eni found 7 to 8 tcf (138 to 226 bcm) of gas and 300 MMbbl of condensates. Perla’s Oligo-Miocene carbonate concept is already being pursued on Colombia’s Tayrona block, where Petrobras is partnered by Repsol, Ecopetrol, and now Statoil. The Colombia play has the potential to match or even surpass the 100 tcf (2.8 tcm) or more of recoverable gas discovered in Mozambique, Frost indicated.

“It’s really unusual to see that many hydrocarbon indicators in such a large area. It can still blow up in your face, of course, but that is the beauty of exploration,” Frost said.

Furthermore, Anadarko was the apparent high bidder on three additional blocks: Col 1, 6 and 7, totaling more than 8.5 million acres [Colombia]. This brings the company’s acreage position in the country to a total of 16 million gross acres. Anadarko is planning a large 3D seismic acquisition program on the new blocks.

Norway’s Statoil also has increased its footprint offshore Colombia through a pair of farm-in deals with Spain’s Repsol. The Norwegian state-controlled player is not getting any operated acreage, but is boosting its presence following an earlier award of acreage in the country’s recent offshore licensing round.

The company is taking a 10% interest in the Tayrona block, which is operated by Petrobras and holds a 40% stake. The deal will leave Repsol with 20% and Colombia’s state-owned Ecopetrol with 30%. The tract covers some 6,371 sq mi (16,500 sq km) and sits in water depths of between 164 and 4,921 ft (50 and 1,500 m).

Block partners are currently drilling the Orca-1 wildcat on the license.

Statoil is also getting a 20% stake in the Guajira Offshore 1 license from Repsol, which will leave the Spanish operator with 30% and Ecopetrol with 50%. The 4,710-sq mi (12,200-sq km) tract is in water depths between 4,921 and 11,482 ft (1,500 and 3,500 m), and the companies have existing 2D seismic data. A round of 3D seismic is set to begin by the end of the year.

In late July, Statoil was awarded a 33.33% share of the deepwater COL-4 block, operated by Repsol with 33.34%, and ExxonMobil with 33.33%. This was Statoil’s maiden splash in the emerging exploration region.

Nick Maden, senior vice president for Statoil’s exploration activities in the Western Hemisphere, said of the Repsol deals: “With the recent award of the COL4 licenses in the 2014 Colombia licensing round and the farm-in agreements with Repsol, Statoil is well positioned in deepwater offshore Colombia. We are gaining access to a vast underexplored frontier area through early access at scale, which is in line with Statoil’s exploration strategy.”

PEMEX ‘puts foot on the gas’ for joint ventures

PEMEX is working to wrap up an initial round of joint ventures by the end of 2014, as Mexico’s state-led oil company seeks to ramp up production in 2015 to counter a recent backslide in output, a government official said.

Edgar Rangel German, a commissioner for Mexico oil regulator National Hydrocarbons Commission (CNH), said in Houston in January 2014 that the company plans in the coming days to submit regulatory requests to farm out 10 high-priority blocks. The joint-venture process, including prime shale and deepwater acreage, was first announced earlier in August, and officially runs through the end of 2015. It is part of a landmark energy reform that aims to open the country’s oil sector to private participation.

But PEMEX appears determined to waste no time, raising its 2015 production target to 2.4 MMb/d. “A lot of the [increased] production is because of those farm-outs,” Rangel said of the company’s output projected in a January 2014 presentation at a luncheon in Houston.

Earlier this year, PEMEX was forced to cut production forecasts to 2.35 MMb/d by the end of 2014 after it was revealed that aging production systems were counting some water as oil. It was unwelcome news as Mexico’s production has been in steep decline from a high of about 3.5 MMb/d about a decade ago.

PEMEX had already cut its output target once this year, saying production would fall to 2.4 MMb/d at 2014 by year-end after appearing to stabilize for a number of months at around 2.5 MMb/d.

The joint ventures – which will be offered on acreage already assigned to PEMEX – will give private players a chance to participate in some of the most closely watched and potentially lucrative areas assigned to PEMEX, such as Trion and Exploratus in the deepwater Perdido fold-belt and the Ayatsil-Tekil heavy-oil complex. While some of the geology is difficult and complex, Mexico also has ample under-developed conventional fields which could help ramp up short-term production.

Furthermore, Sierra Oil & Gas S. de RL de CV, Mexico’s first independent exploration and production company, has secured equity commitments of $525 million. Headquartered in Mexico City, the company plans to participate in exploration, development, and production optimization opportunities made possible by the energy reforms. Additionally, Sierra may consider opportunities in hydrocarbon transportation, storage, and processing.

Under the terms of the transaction, energy-focused private equity firms Riverstone Holdings LLC and EnCap Investments each have committed $225 million in funding. Infrastructure Institucional (I2), Mexico’s largest infrastructure private equity firm, has committed $75 million. All three investors retain the option to double their existing commitment once the initial equity has been deployed.

Additionally, Marine Contracting has received an engineering, procurement, construction, and installation contract from Jord Oil & Gas B.V. to install an interconnecting bridge and tripod support structure for the Cantarell field in the Gulf of Mexico.

The bridge will connect PEMEX’s existing facilities to a jackup with compression facilities. The award is part of Jord’s larger contract with Alher Oil & Gas S.A. de C.V.

Marine Contracting will be responsible for the engineering, design, construction, and installation of the bridge and support structure. The support structure foundation will incorporate suction piles, designed to maintain location under design environmental conditions. Fabrication includes the installation of all required piping, pipe supports, walkways, ladders, and lighting, coating systems, insulation, cables, and cable trays for the bridge.

The design of the structure allows for removal and relocation should the jackup and compression facilities need to be repositioned to a different offshore facility in support of PEMEX’s operational strategies.

Mexico is slated to host its first public auction bid, Round 1 in 1Q 2015, and expects to see international and private oil firms vie for rights to 109 blocks. This sale will cover more than 14 Bbbl of prospective reserves, including a mix of both onshore and offshore areas, totaling 11,004 sq mi (28,500 sq km). The sale will also include rights to 60 fields of proven and probable reserves equaling nearly 4 Bbbl.