Offshore staff

New York -- To meet the future worldwide demand for energy, investment of some $350 billion is estimated to be needed every year in upstream activity for the next 20 years, according to Andrew Gould, Schlumberger Chairman and CEO.

"With the age of easy oil over, and the consequent higher costs of new supply, the challenges of matching supply and demand are not likely to decrease," Gould told the Barclays Capital CEO Energy/Power Conference 2010 meeting in New York today.

"Longer term, the International Energy Agency tells us that world energy demand will grow by some 40% by 2030." Gould said. "They also tell us that hydrocarbon fuels will continue to dominate the global energy mix with coal, oil and natural gas supplying almost 80% of primary energy needs."

New regions are already characterizing the challenges of new supply with whole new provinces emerging, Gould told the gathering. These include offshore Greenland, and central Sub-Saharan Africa. Extraordinary concentrations of activity exist in Brazil, North Africa, the North Sea, Southeast Asia, Western Siberia and the Caspian area, he said.

"There is also growing interest in Eastern Siberia," he said. "Across these and other areas, including Iraq, the industry will be challenged by more remote operations, deeper waters, more difficult logistics, increasingly complex geological settings, and greater degrees of temperature and pressure. We will also be challenged by more difficult types of hydrocarbon."

We will face an increasingly harder task of turning resources into reserves, and reserves into production, Gould said.

"At $70 plus per barrelmost oil resources except ultra deepwater, oil shales, oils in arctic areas and oils derived from various liquid conversions remain economic—although I would add that the additional control and oversight that deepwater operations in general can now expect following the Gulf of Mexico accident will undoubtedly add cost," Gould told the group.

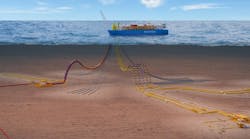

Offshore activities—and deepwater operations in particular—merit significant attention, he said. In the last 10 years, more than half of all new oil and gas reserves discovered worldwide were discovered offshore.

"Partly as a result, offshore oil production is expected to be supplying approximately one-third of the world’s needs late in the next decade," Gould said. "And within that same period, deepwater production will increase steadily to about one-third of offshore supply, corresponding to approximately 10% of global oil supply."

Under these circumstances, the challenges to which technology must respond are two-fold, he said.

"First, offshore operating costs are high—particularly so in deepwater—and we will need technology that can mitigate both technical and economic risk," he said. "Second, the complexities of deepwater operations require sophisticated measurement and modeling to ensure that the right well is drilled, and the right information collected. This is becoming more and more a matter of integration across previously discrete technologies."

9/15/2010