Offshore staff

SAN DONATO MILANESE, Italy/SANDNES, Norway — Eni and its majority owned Norwegian subsidiary Vår Energi have agreed to terms for acquiring London-based E&P company Neptune Energy Group.

Neptune has mainly gas-oriented assets and operations in Western Europe, North Africa, Indonesia and Australia. Sam Laidlaw, formerly with Amerada Hess founded the company in 2015.

Currently, Neptune is owned by China Investment Corp., funds advised by Carlyle Group and CVC Capital Partners, and certain management owners.

Eni will acquire the group’s entire portfolio other than its operations in Germany and Norway. Vår will take the Norwegian operations under a separate share purchase agreement.

Under the agreed terms, the Neptune Global Business will have an Enterprise Value of about $2.6 billion, and the Norway Business an Enterprise Value of c.$2.3 billion.

Eni said the transaction would complement its main areas of geographic focus and help reach its targets of increasing the percentage of natural gas in its global production to 60% and attaining net zero emissions (Scope 1+2) from its Upstream business by 2030.

As of Dec. 31, 2022, Neptune had 2P reserves of about 484 MMboe of which close to 386 MMboe will transfer to Eni, with about 80% of this natural gas.

The transaction will also add about 130,000 boe/d to the Eni and Vår portfolios.

Eni CEO Claudio Descalzi said, “The geographic and operational overlap is striking, adding scale to…Vår Energi; bringing more gas production and CCUS opportunities to the remaining North Sea footprint; building on Eni’s leading position in Algeria—a key supplier to European gas markets; and deepening Eni’s presence in offshore Indonesia, supplying the Bontang LNG plant and domestic markets.”

In 2022 Neptune produced 15,000 boe/d, mostly gas from the Cygnus Field in the southern North Sea. The company expects to bring the Seagull tieback development to bp’s ETAP complex in the central North Sea later this year.

Eni itself produced 44,000 boe/d in the UK last year, mainly from the non-operated Elgin Franklin and J-Block in the central North Sea.

In the Netherlands in 2022, Neptune produced 18,000 boe/d, mostly gas. The company is the sector’s largest producer in volume terms, Eni added, operating various offshore hubs with opportunities to add new reserves and production through infill drilling and tiebacks.

Offshore Indonesia, Neptune’s production last year of more than 20,000 boe/d came entirely from the Eni- operated Jangkrik and Merakes fields, which supply gas to the Bontang LNG facility and domestic customers. Eni's 2022 production in the country was 62,000 boe/d.

In northwest Australia, Neptune has an interest in the offshore Petrel project in the Bonaparte Basin offshore Australia. Development options are under review, but there could be an option to tie into existing infrastructure including at the Eni (100%) Blacktip Field, which produces and processes gas offshore for delivery to shore.

Through acquiring Neptune’s Norway portfolio, Vår Energi will gain ownership in 12 offshore producing assets, three operated by Neptune and seven by Equinor. This would also strengthen the partnership between Vår Energi and Equinor, the co-venturers in the Goliat oil field development in the Barents Sea.

Neptune Norway produced 67,000 boe/d in first-quarter 2023 and at the last count had ~265 MMboe of 2P reserves with numerous near- and medium-term growth opportunities. Gas accounted for 62% of its production in first-quarter 2023.

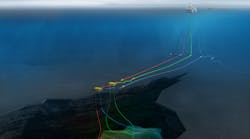

The transaction brings ownership in the Snøhvit gas field in the Barents Sea and Melkøya LNG plant in Hammerfest and the sole gas export infrastructure in the area; an increased presence and ownership in the Njord, Fram and Gjøa areas of the Norwegian Sea and North Sea; various early-phase development projects including Dugong, Blasto, Echino South; and numerous infrastructure-led exploration opportunities around existing hubs.

The portfolio is also said to benefit from low opex and limited near-term capex and decommissioning costs. Vår Energi expects to achieve ~$300 million in synergies over time.

The Neptune package would “add production of high-value barrels and an asset portfolio supporting long-term sustained value creation and underpin our plan to increase production by more than 50% by end-2025, while significantly reducing unit production cost," Vår Energi CEO Torger Rød said. "The acquisition will strengthen our position in core areas, support continuous asset optimization and increase operatorships, while providing attractive early phase projects and exploration opportunities. We will also bring together two strong teams to realize our full potential.”

Proforma estimated figures for Vår Energi and Neptune Norway combined show production of 281,000 boe/d of oil in first-quarter 2023 and year-end 2022 2P reserves of ~1.3 Bboe.

Neptune Norway will be merged into Vår Energi with all its employees also transferred.

06.23.2023