Editor's note: This Data section first appeared in the March-April issue of Offshore magazine. Click here to view the full issue.

Only 39 marketed rigs available

The number of marketed offshore rigs available for contracting continues to shrink as operators lock up rigs for their programs. Out of 551 marketed jackups, semisubs and drillships, 455 are on contract as of mid-March, and another 80 have future assignments lined up, leaving only 39 marketed rigs without current or future work booked. Operators that decide to turn to cold-stacked rigs for their programs will need to allow sufficient time for reactivations, which have taken increasingly longer over the past year due to supply chain challenges and limited shipyard space for these projects. Any prospective jobs would also need to offer enough backlog and earnings potential to justify the reactivation cost, meaning short campaigns will not entice a rig out of cold stack.—Esgian

$214B of greenfield investments expected by 2025

The offshore oil and gas sector is set for the highest growth in a decade in the next two years, with $214 billion of new project investments lined up. Rystad Energy research shows that annual greenfield capex will break the $100 billion threshold in 2023 and in 2024—the first breach for two straight years since 2012 and 2013. Offshore activity is expected to account for 68% of all sanctioned conventional hydrocarbons in 2023 and 2024, up from 40% between 2015-2018. In terms of total project count, offshore developments will make up almost half of all sanctioned projects in the next two years, up from just 29% from 2015-2018. These new investments will be a boon for the offshore services market, with supply chain spending to grow 16% in 2023 and 2024, a decade-high year-on-year increase of $21 billion. Offshore rigs, vessels, subsea and FPSO activity are all set to flourish.—Rystad Energy

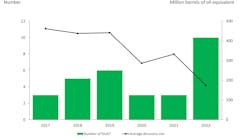

Global increase in offshore wind leases

More countries plan to stage their first offshore wind lease rounds in 2023, according to the latest Global Market Overview from TGS subsidiary 4C Offshore. At the same time, project development and FIDs will slow offshore wind expansion in the short term. The report cites slow permitting, delays in offtake auctions, supply chain issues and extended negotiations with the supply chain due to price uncertainties. However, the industry is expected to make progress over the next few years, leading to a 1-GW increase in the company’s forecast for projects installed or under construction globally in 2030 to 269 GW, compared to the last quarter's predictions. Countries preparing for first offshore wind lease rounds include Norway, Lithuania, Uruguay, Portugal, Australia, Brazil, Colombia, Estonia and Ireland. Many are said to have drawn up terms based on models applied for recent rounds in the UK, US and Denmark.—4C Offshore