Editor's note: This Data section first appeared in the January-February issue of Offshore magazine. Click here to view the full issue.

Middle East most active market for offshore rigs

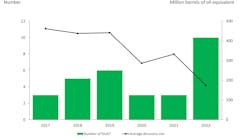

As 2022 concluded, about half of the Middle East region's currently stacked fleet already had future work lined up and moved to drilling status in 2023. Meanwhile, as the global market heats up due to increasing demand, many of the rigs still under construction in the Far East and Southeast Asia regions are expected to be delivered in the next couple of years, with most delivered units likely to move to other regions for work. Globally, expect the number of stacked units to be smaller at the end of 2023 as rigs are reactivated to meet the increase in demand stemming from energy security concerns and higher oil prices.—Esgian

Newbuild rig orderbook tightened as 2022 closed

The drilling rig newbuild orderbook ended 2022 with only 18 jackups and 20 floaters available, down from 28 and 21 at the start of the year, according to Evercore ISI’s latest Offshore Oracle Report. While the majority of jackup sales have been driven by Middle Eastern contractors (ADES, Arabian Drilling, ADNOC Drilling), China’s Sinopec and COSL and Italy’s Saipem have also added to their fleets. There are 16 newbuild floaters scheduled for delivery in 2023 uncontracted, along with 13 jackups, of which the analysts believe less than half are likely to be accepted in 2023 due to ongoing shipyard and labor constraints.—Evercore ISI