New research by UK oil and gas consultancy Petrologica indicates that there is potentially a bright future for the recovery of the deepwater oil and gas industry in the US GoM. Although the relatively high E&P costs in the region lead to a preference for near-field exploration and expansion as development options - only Anchor and Vito are currently considered for development as standalone projects while other large developments (such as Chevron’s Big Foot) are ‘hub class’ projects - the US GoM is not short of potential for the discovery and development of new prospects.

The study, entitled “US Deepwater: A Glass Half Full or Empty?,” notes that only 33% of the technically recoverable reserves have been produced, with 48% remaining undiscovered. The USGS estimates that 51% of these technically recoverable undiscovered resources - some 37.7 Bboe - are economically viable at $50/bbl oil price.

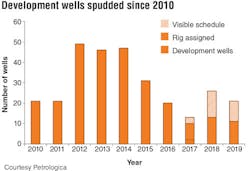

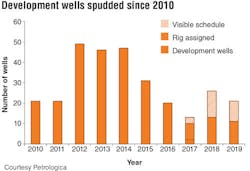

When considered alongside the current and potential regional rig market, where 21 of the 43 deepwater rigs currently stationed in the US GoM are under contract with possibly 12 more rig contracts still to come, there is evidence for growth in exploration and development, and room for the industry to expand, the study said.

Explorers require a higher margin to offset the risk of dry holes, the study acknowledges. Visible wells have been submitted to the BOEM by the operator, but this is no guarantee that they will be drilled when scheduled. Companies vary their activities according to a variety of factors, including oil prices and internal scheduling. The study’s authors say that their development forecast takes these factors into account in forecasting future rates of activity.

The potential for the economical discovery and development of a prospect in the US GoM remains, as evidenced by the two ‘hub class’ projects due online in 2018 (Big Foot and Stampede) as well as last year’s sanction of BP’s Mad Dog Phase II development. The study’s forecast for exploration and development activities in the GoM shows levels bottoming out in 2017 and 2018, and then continuing to recover over the next several years. But constrained by high costs, near-field exploration and expansion will continue to be the preferred development option, with only Chevron’s Anchor and Shell’s Vito being considered as for development as standalone projects.

Projects that are being developed and future development projects currently scheduled are set to bring onstream less than half of the average annual capacity over the next six years that was added each year in the previous 17. Some slowing of capacity additions is to be expected as the US GoM matures, but if the US is to remain a deepwater production powerhouse, exploration and development will need to increase, the study commented.

Otto Energy raises cash for SM-71 project

Australian oil and gas company Otto Energy Ltd. says it will raise $8.2 million for its SM-71 oil project in the Gulf of Mexico, according to the Maritime Herald.

The company will raise the cash through an issue of secured convertible bonds. According to the report, the company already signed binding agreement with the main shareholder for the issue of convertible notes, but final decision will be taken at the general shareholder meeting, scheduled for July.

The cash will be used to develop the company’s oil project located in the South Marsh Island 71 license (SM-71) offshore Louisiana. The construction of the platform is reportedly underway and production is expected to start by the end of 2017.

“We are very pleased that an existing major shareholder, Molton Holdings Limited, has agreed to financially support the SM-71 development in the Gulf of Mexico through to production,” said the Managing Director of Otto Energy, Matthew Allen. “The issue of convertible notes with the conversion price set at a substantial premium to the current share price demonstrates the growth potential from the SM-71 development and future exploration,” Allen was quoted to say in the report. “With the SM-71 development funded, Otto can now utilize some of its existing cash reserves of $14 million for the next stage of growth through participating in exploration drilling of conventional new ventures in the Gulf of Mexico, and in onshore Louisiana and Alaska.”

According to estimates, the initial flow rates from the completion of the first development well at SM-71 project are expected to be 1,500 to 2,000 b/d of oil.

BSEE provides update on tropical storm impact

On June 22, the Bureau of Safety and Environmental Enforcement (BSEE) Hurricane Response Team provided an update on Gulf of Mexico oil and gas activities impacted by Tropical Storm Cindy.

Based on data from offshore operator reports, the BSEE indicated that personnel had been evacuated from a total of 39 production platforms, representing 5.29% of the 737 manned platforms in the Gulf. The bureau also reported that personnel had been evacuated from one rig non-dynamically positioned (DP) rig, equivalent to 6.67% of the 15 rigs of this type currently operating in the Gulf. No DP rigs were moved off location out of the storm’s path, the BSEE said.

From operator reports, it was estimated that approximately 16.47% of the current oil production in the Gulf of Mexico had been shut-in. It was also estimated that approximately 0.01% of the natural gas production in the GoM had been shut-in. The production percentages were calculated using information submitted by offshore operators in daily reports. Shut-in production information included in these reports was based on the amount of oil and gas the operator expected to produce that day. The shut-in production figures therefore are estimates, which BSEE compares to historical production reports to ensure the estimates follow a logical pattern.

The BSEE said that the production facilities would be inspected once the storm has passed. Production from undamaged facilities will be brought back on line immediately once all standard checks have been completed. The bureau noted that facilities that sustained damage may take longer to bring back online.