Facility maintenance, modification market set to rebound in 2018

Matt Adams

Douglas-Westwood

The offshore oil and gas industry has fallen on tough times since 2014, however, market sentiments appear to be improving - on the back of the coordinated OPEC and non-OPEC production cuts. The first major floating production system (FPS) order since mid-2015 was made in early January 2017, with several other high-profile orders expected to be made in the coming months. However, despite an anticipated uptick in expenditure in 2017, the market still has a long way to go to offset the effects of one of the worst downturns in recent memory, according to Douglas-Westwood’s (DW) latest outputs.

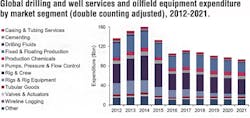

The combined capex outlook from DW’s oilfield equipment (OFE) and drilling and well services (DWS) data shows a persistent decline in expenditure through to 2021, after adjusting for double counting, following a 6% increase in spend in 2017. Much of this decline in expenditure can be attributed to a poor outlook for new mobile offshore drilling unit (MODU) orders. A significant build cycle in the years prior to the downturn saw a total of 211 MODU orders across jackups, semisubmersibles, and drillships. Associated expenditure for these rigs, phased equally over the period from order to delivery, peaked at $27 billion in 2014, but fell away rapidly as new orders dried up as oversupply and low utilization swept the rig market. Despite an improvement in market sentiments, the analyst is not expecting any increases in MODU construction related capex through to 2021 in its base case - as drilling activity remains suppressed throughout the forecast period. Consequently, the rigs and rig equipment market, formerly accounting for 19% of total DWS and OFE capex in 2014, will account for just 5% of total capex by 2021 should DW’s base case materialize.

A similar story can be seen in the analyst’s fixed and floating production capex outlook, which also sees expenditure by asset phased equally between order and installation year. Due to a dearth of new project sanctioning over 2015-2016, expenditure in the segment fell from $33 billion in 2014 to just $23 billion in 2016. However, as a result of the improving macroeconomic climate and a handful of projects having been ordered - or expected to be ordered - in 2017, DW’s fixed and floating production capex figure will increase 16% this year. A significant proportion of this increase can be attributed to a large number of fixed platforms which form part of Saudi Arabia’s brownfield re-development plans in the Arabian Gulf, while high profile orders such as Mad Dog Phase II also contribute.

Post-2017, however, the analyst expects fixed platform ordering activity to once again dry up, on the back of an anticipated increase in the crude oversupply which will continue to dog the industry over the coming years. An additional 2.4 MMb/d of crude is expected to come online in 2018 - 42% of which from offshore fields - pushing the oil market from a balance in 2017 to a 1 MMb/d oversupply in 2018. Approximately 1.7 MMb/d of additional production is expected to come from OPEC member states such as Iran, Nigeria, and Saudi Arabia. Meanwhile, 0.7 MMb/d will come from non-OPEC states, with large additions from Brazil, the UK, and Kazakhstan. Consequently, DW’s outlook for new offshore infrastructure orders will remain bearish through the rest of the decade, particularly in more mature oil focused regions.

For the analyst’s rig and crew market segment, the capex allocated to the rental of drilling rigs and their crew is also set for a decline in expenditure through to 2021, although only a -2% CAGR is expected. While the offshore drilling outlook remains suppressed, relative to 2014 levels, the majority of the decline in expenditure is due to expectations of sustained deflationary pressure on MODU day rates. The combined effects of falling drilling activity and the vast number of deliveries of MODUs ordered prior to the downturn have resulted in severely depressed rig utilization rates. Consequently, DW expects a continued squeeze on day rates to be felt by rig contractors, with the average day rate of rigs on contract likely to fall consistently through to 2021. Despite an anticipated uptick in deepwater drilling in the early 2020s, this is unlikely to result in an increase in overall rig and crew capex, given the strong competition for contracts which is likely to be seen.

Away from the drilling-led markets, the prospects for global maintenance, modifications and operations (MMO) expenditure through to 2021 are notably more positive, according to DW’sWorld Offshore Maintenance, Modifications and Operations Market Forecast. The MMO market is driven by ongoing operations at the global population of offshore fixed and floating production platforms. While the downturn hit the market both through headcount reductions and supply chain pricing pressures, the scope of these were notably less severe than in drilling-led operations - particularly onshore.

The global modifications market looks set for a particularly prosperous period of growth through to 2021, due to the anticipated return of previously delayed workscopes. This service line includes the necessary replacement and/or modification of accommodation blocks, communications units, gas treatment modules and other key production phase facilities. Much of these workscopes have seen deferral since 2014 as operators tightened budgets in order to maintain positive cash flow. However, with the improving macroeconomic environment, the analyst expects such works to now go ahead, with a surge in modifications expenditure expected in 2018.

Other MMO services, such as asset services (which include the maintenance of electrical, mechanical, process and rotating equipment, fabric maintenance and specialty services) have been relatively sheltered to the headwinds of the downturn, due to their necessary nature. As a result, declines seen over 2014-2016 was predominantly driven by contract renegotiations and other cost pressures on the supply chain. These pressures are expected to remain in place for the rest of the forecast period, with DW expecting operators to maintain cost pressures on the supply chain regardless of the improving macroeconomic environment.

On support services, which comprises opex associated with deck crew, hotel services (catering, cleaning, etc.) and admin and other services, reductions in persons on board (PoB) fixed and floating platforms have dented revenues. However, a return of confidence in the oil market this year is likely to lead to increasing PoB on producing assets, thus driving a revival in support services expenditure through to 2021, with an expected year-on-year growth rate of 1%. While an anticipated return of the crude market oversupply may threaten this outlook, the analyst deems it unlikely that further headcount reductions will be seen, particularly as operators will look to consolidate cash flow from existing operations before investing in large scale greenfield developments.

In conclusion, the improvement in market sentiments in 2017 will undoubtedly have much needed positive impacts on the offshore oil and gas industry. However, the pain is not over yet. A persistent oversupply of MODUs will continue to suppress new rig orders and maintain the extreme pressures on rig and crew costs. While there is expected to be further fixed and floating production orders this year, a return of the crude oversupply in 2018 will limit the scale of new fixed platforms orders being placed - with phased expenditure in this sector to continue to decline after an uptick this year. Despite this, the oilfield services supply chain can be cautiously optimistic on the MMO sector, which is expected to see a marked recovery in fortunes over the coming five years as operators look to consolidate and improve returns from existing assets.