Geophysical companies cope with further uncertainty

Low E&P levels continue to disrupt seismic activity

Sarah Parker Musarra

Editor

Years have now passed under the dark cloud of one of the industry’s worst-ever downturns, which began in 2014. Companies have begun looking toward a recovery that is now seeming to take shape, but what will this year bring for those in the marine seismic sector?

Since the start of 2017,Offshore has been speaking with numerous company leaders in the marine geophysical sector as well as other industry experts in an effort to understand how the segment will fare in the upcoming year.

With offshore E&P’s renaissance not yet expected for some time, the picture is not entirely clear, however, what is clear is that most, if not all, experts interviewed for this story believe that 2017 will be better than the brutal market many experienced in 2015 and 2016.

Many, including TGS CEO Kristian Johansen, believe that the first indications of improvement are appearing, even if the market will likely not experience a full turnaround for some time.

“I think the worst is behind us and that 1Q 2016 marked the trough of this cycle,” said Johansen. “I think we are going into a recovery cycle, but it is going to take some time before we get back to a healthy market again.”

A review of some of the previous year’s tumult will make more apparent why 2017 is being seen by some in the industry as a transitional year.

Year in review

As the oil and gas industry continued to limp through one of the worst crude busts in modern history, 2016 likewise stumbled right out of the gate. Oil prices hovered south of $30/bbl and hopes of a possible production deal with the Organization of the Petroleum Exporting Countries (OPEC) eventually soured. However, 2016 ended true to the “transitional year” moniker many had given it: Over the 12-month period, oil returned to $50/bbl, US production began slowing, and the staunch cabal of OPEC member countries finally produced the long-awaited output deal with just weeks to go.

The term “cautious optimism” was employed by industry experts more and more frequently as over 4Q 2016, as several indicators began to point to a brighter 2017. In October, World Bank raised its 2017 oil price forecast to $55/bbl from $53.

A December study from Wood Mackenzie, “Global Exploration: What to look for in 2017,” found that exploration would return to profitability after the last five years of slim returns. Then, in January 2017, Wood Mackenzie’s global upstream outlook for the year saw confidence beginning to return to the sector, with exploration and production spend set to rise by 3% to $450 billion.

Evercore ISI’s annual Global E&P Spending Outlook, released in December 2016, reported that exploration spend had bottomed, and projected global E&P capex to increase by 1.7% in 2017. A similar outlook from Barclay’s in January 2017 was more bullish, forecasting a 7% growth in global E&P spend. The report’s author, Senior Analyst J. David Anderson, PE, CFA, noted that the increase corresponded to the two previous market recoveries: in 2003 (up 10%) and 2010 (up 11%).

Offshore E&P in 2017

While analysts’ outlook for 2017 were positive for the overall oil and gas industry, offshore was last to depress, and will therefore be the last to rebound. Barclays found in its Global E&P Spending Report that offshore spend will take a hit in 2017 once again, despite the forecasted growth in E&P capex.

“We expect offshore spend to fall around 20-25% in 2017, following declines of 12% and 34% in 2015 and 2016, respectively,” Anderson wrote in the report.

This finding is consistent with a reality that many, such as CGG, recognize: Any recovery for marine seismic sector has yet to arrive.

“At this point in time, we do not expect to see any market improvement in 2017,” Christophe Barnini, said. “The first half of 2017 will be very similar to 2016. The second half of 2017 will depend on our clients’ confidence in the recovery of oil prices.” Barnini is the seismic giant’s executive vice president, Geomarket Sales, Marketing & Group Communications.

Many oil companies have turned toward the North American land plays, in need of the quick returns promised by short-cycle shale plays. James West, senior managing director and partner, Oilfield Services, Equipment & Drilling for Evercore ISI wrote in the firm’s annual survey that: “North America will rebound first and the strongest, followed by the international markets, where the rebound will be more methodical. Offshore markets will likely be the last to recover.”

Companies throughout the geophysical sector feel the strain and uncertainty.

“In the third year of the downcycle, the worst is behind us on the commodity price front, but there is still a tremendous amount of volatility and uncertainty in the market,” FairfieldNodal’s CEO Charles W. Davison said.

Both Anderson and West pointed to 2018 as the year offshore would really recover. Evercore ISI’s West toldOffshore that although overall exploration spending was believed to have bottomed, offshore activity was still in the process of bottoming. “Companies had been keeping themselves busy on projects under development, but low reserve replacement ratios would suggest exploration activity is forthcoming, not in 2017, but probably in 2018,” he said.

Spectrum Geo Ltd.’s Neil Hodgson, executive vice president, Geoscience, acknowledged the flat exploration spending, but pointed out that some of the grimmer aspects of the current climate might soon lead to more positive market moves.

“The market indicators are clear - the demand for oil is growing by 1 MMb/d irrespective of oil price; consequently, there is good support for a steady oil price.

“We see that 2017 exploration spending will be flat comparing to 2016. In the downturn costs of exploration and development have reduced to a fraction of those previously and oil companies may use this opportunity to stabilize drilling and seismic capacity to get some of their offshore work programs firmed up in 2017 and 2018,” he said.

Further, he reminded that seismic was the first to detect activity, underpinning exploration efforts in mature and frontier basins, which he referred to as “the bellwether for the upturn,” he said.

Following years of depressed exploration, companies could rely on quality seismic data to help manage their risk.

“The downturn has generated a hole in discoveries and developments that the industry will race to fill to prevent supply shortages in the future,” Hodgson said. “As oil companies are leaner and more considered in their drilling investments, and they will rely ever-more on modern high-quality seismic to reduce the risks on prospectivity.”

Barclay’s Anderson similarly concluded that oil companies were not “showing any sense of urgency” to indicate they were running out of inventory in their development projects, thereby needing to up their exploration spending. In addition, he said that offshore exploration spend was at the low-end of the typical range, which is 10-20% of a company’s budget. One in-field example of this reduction could be seen in the number of exploration wells expected to be drilling in the Gulf of Mexico. In 2013, the year before the downturn, 50 of these wells were planned; currently, there are 20.

He also pointed out the “continued reticence on behalf of the IOCs” to invest in offshore after years of bad returns while weathering the downturn.

“This is all about balance sheets and dividends, and you’re continuing to see these companies are just not putting money into the ground, in particular offshore,” he said, pointing to Chevron as an example. “They do not plan on [making any final investment decisions] for their major projects this year. They are continuing to focus on the Permian. Short-cycle returns- that’s what they’re looking for.”

Oil prices are still a topic of concern, despite 2016’s pricing gains. Anderson said that some offshore projects could be economical in the $50/bbl range, just like onshore developments. However, these offshore project still could not offer the same short production cycle. He said a sustainable $60/bbl price was really necessary to get offshore moving again.

TGS’ Johansen said despite the oil price rebound, levels are still relatively low in a historical context.

“If you compare it to two years ago when the oil price was between $100 and $120/bbl, we are still at a very low level and it’s going to take some time for our clients to be able to reduce their cost base to cope with that,” he said.

State of industry

The drastic, prolonged downturn has fundamentally changed the industry and how it operates, which Halliburton Landmark’s, Alex Page, manager of Geology, pointed out.

“From what I am seeing, there are some very positive signs, but for the most part, there are equal measures of realism too,” Page observed. “Our industry has been through a massive transformation over the past two years. For those of us lucky enough to still be involved, we have been forced to face a new reality.”

Page continued: “Though rigs counts are starting to show an upward trend, and other indicators like an uptick in the sales of multi-client seismic studies [support that], many industry experts still believe we face a rough road ahead. The key to this feeling of general insecurity as an industry is based on the uncertainty of not knowing exactly how we will reinvent our business models and practices to meet the challenges of the ‘new normal,’” he said.

Another one of the more deleterious effects of the downturn on the seismic and other service providers right now has been the steep drop in pricing over the last few years, Anderson said. An average spread that might have cost around $10 million per month a few years ago would now cost about $2 million.

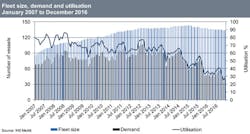

In addition, the market is over-saturated with vessels, a fact upon which both Anderson and Craig Hunter, Seismic Editor, Marine, for IHS Markit commented.

“If the market does show signs of improvement this year, which it may well do, then these companies will just have the option of adding the vessels back to the market,” Hunter toldOffshore. “In terms of price, in terms of day rates, or company profit, you cannot expect to see them changing much. I think that the price will be kept down by the ability to just reintroduce spare capacity.”

Many of the vessels laid-up around the world are less than 10 years old, he said.

Hunter’s assertions were consistent with the opinion of Shearwater GeoServices’ Vice President, Processing & Imaging, Simon Telfer. GC Rieber Shipping and Rasmussengruppen AS established Shearwater as a 50/50 jointly owned marine geophysical company in October 2016, injecting $60 million through new equity to fund operations. The transaction closed a few months later in December.

“It has been terrible; a huge amount of capacity was removed from the market,” Telfer said. “To be honest, we do not really see a full recovery in 2017. We do see stability at the moment, and a small increase in tenders, but no increased demand beyond the current capacity.”

He commented that he did not see a need for the number of vessels that were currently cold-stacked, but noted that those working “should be fairly stable.”

While some might consider a downcycle market as an unusual time to introduce a new player to the market, Telfer said that Shearwater’s two parent companies had a long-term vision. They are also mindful of the short-term - that customers would want to take advantage of the current low market prices.

“They (GC Rieber Shipping and Rasmussengruppen) felt like it was a great opportunity and that now is the time to establish a solid and well-funded geophysical company - during the downturn, so that they are ready for the market improvement and ahead of the curve,” he explained.

The two parent companies have been in or around the marine seismic market for decades. GC Reiber entered the seismic market in the 1960s, and Rasmussengruppen has a long history in the Norwegian offshore and marine sectors.

“They do not really see themselves as ‘entering’ the market now given the established track record of the fleet, but they do see that Shearwater is a new vehicle for them to be able to build upon, providing high-quality services to that seismic market… Shearwater has a young fleet, and has processing and software all integrated and owned by the company. We have a competitive cost base because of the way the company is structured,” Telfer said.

Shearwater GeoServices has been busy, most recently signing an agreement with TGS in January for two seismic surveys offshore Norway.

Hunter said that he expected to see some stabilization this year; however, he noted a couple of unknown factors that could still affect the industry as it regains its footing. One example he gave was oil prices; the other was uncertainty surrounding the potential policies and decisions of newly inaugurated US President Donald Trump, particularly speculation that he might change or lift sanctions against Russia.

Hopeful signs

TGS recently experienced one important indication of a turnaround. The company reported a 4Q revenue of $165 million, over $132 million in 4Q 2015. Johansen said that while the black ink was “certainly a good starting point to become a bit more optimistic,” he felt the full recovery was still to come.

“When we look into 2017, I think one should be a bit cautious in expecting it to only go one way,” he commented. “We think it’s still going to be a relatively challenging market. It’s going to take some time for a significant recovery to take place.”

Within its revenue growth, one area Johansen highlighted was TGS’ recent increase in late sales, or sales of existing databases, as a first indication of recovery.

“Typically where we see a recovery is in the late sales, because that is considered discretionary spending. When companies have to reduce their costs, that’s the first thing they could cut immediately,” he said.

The company’s late sales totaled $145 million in 4Q 2016, up 60% year-over-year.

Also, IHS Markit’s Hunter reported some positive signs in the current marketplace, with various countries seeing an uptick in activity, including a Russian season that he sees being busy, and likely to stay that way over the next few years. Norway also still looks busy, and Mexico is still holding companies’ attention, even if the US side of the GoM looks to be somewhat quiet once again.

In addition, ocean bottom seismic (OBS) is another market he said is starting to pick up.

“Ocean bottom looks a bit more promising long term and the more it expands, the more it is used,” he said. “The age of 4D surveying is still relatively young.”

Like Hunter, Barclay’s Anderson also noted that brownfield and 4D seismic would be interesting areas to watch in terms of demand for services, as operators could start wanting to re-shoot some of their acreage to see what, if anything, has changed over the last couple of years.

FairfieldNodal’s Davison said that nodal marine seismic sometimes benefitted from being an opex, versus capex, spend. As companies cut exploration spend, they look to enhance recovery from their existing asset bases, he said, which is why he foresaw the production monitoring side and life-of-field seismic recovering first in his market. To this end, the company will soon debut a new product to meet a need that Davison classified as semi-permanent reservoir monitoring: ZLoF will be able to sit on the seafloor for five years, and can be turned on and off to offer “seismic-on-demand.”

For the overall nodal market, Davison acknowledged that the landscape would continue to be lumpy, but with pockets of activity around some brownfield and mature plays. He identified Brazil, GoM, West Africa, and the North Sea as regions that continued to be a good market for nodal seismic.

Other experts believe that signs of a turnaround were already evident, or would soon be evident, in at least some areas, such as Society of Exploration Geophysicists Associate Executive Director, Business Development and Chief Geophysicist William Barkhouse. He toldOffshore the he believed the impairment will pass this year if the early market improvements are sustained.

“Relative to 2016 and 2015, the geology and geophysical communities are beginning to see new projects as positive indications of recovery underway in 2017,” said Barkhouse. “The recent public announcements of large seismic data acquisitions are encouraging, and individual geophysicists that were sidelined for the last two to three years are currently receiving calls for hiring in interpretation and processing.”

Barkhouse said that he believes technologies leading to better data quality and interpretation will recover the quickest.

“Industry venture capital markets are presently looking for investment opportunities in high performance computing, geoscience earth modeling and production simulation, 4D seismic marine acquisition and geophysical bore hole measurements, all of which are state-of-the-art science and engineering,” he said.

Further, due in part to geophysics’ relationship to high-performance computing, Barkhouse believes that certain areas of the industry could rebound from the downturn to be stronger than ever.

“Geophysics is a direct beneficiary of the continued evolution of high performance computing, virtualization reality, earth modeling, and simulation with geoscience simulators,” he noted. “Interpretation related technology are seeing relatively tremendous support and funding.”

Shearwater’s Telfer has also seen increased activity in reprocessing sales. “We have seen this in previously downturns. Companies will focus on reprocessing current data with newer technology to see what they can get out of it and the costs are a lot cheaper,” he said. “It is definitely worth them doing that and it reduces their risk and enhances their recovery rate factors. In processing, technology is continuously improving. Like the rates for acquisition dropping in this downturn, the rates for processing have also dropped.”

PGS said it foresees an increase in acquisition activity this year, driven by 4D streamer monitoring surveys and 3D multi-client projects. It expects to take delivery of theRamform Hyperionnewbuild soon.

Role of technology

Indy Chakrabarti, senior vice president of Product Management and Strategy for Paradigm, says that the first signs of recovery are already evident, most visibly onshore. He believes the offshore market will be soon to follow.

“Geophysical applications that are increasingly in demand in the offshore environment include a greater focus on managing subsurface risk by assessing pore pressure changes in real-time, and simulating stress changes due to production,” he said.

Software has the advantage of being able to adapt more fluidly to a changing market. Both Paradigm and Landmark pointed to instances where each company had tried to adapt its respective product lines to quickly meet the needs of an industry in transformation.

“Customers are increasingly looking for integrated platforms, without having to compromise on high-end functionality. One of our main goals in 2017 is to use our advanced technology to ensure they don’t have to give up either one,” Chakrabarti continued.

“A strategy that is particularly popular with our customers is to use our geoscience services as a way to adopt our software platform more quickly. In general, customers have fewer staff working today, but they still have about the same total production targets. As a result, our services group has seen increasing demand to help our users, not just in a re-processing effort as might have been the case in the past, but rather, working side by side with them across the entire workflow.”

Landmarks’ Page continued by discussing how Landmark had tried to meet the needs of the rapidly changing industry, noting that the company now released its solutions three times a year, a change that “allows us to be far more agile than our competitors in terms of reacting to the requirements of the industries changing fortunes.” The company had also moved to the Cloud.

“With the announcement of DS365, our end-to-end suite of geoscience solutions can now be made available to our customers instantaneously,” he said, commenting that as “E&P companies scale their workforces up and down, they no longer need to worry about the logistics and provisioning costs” to access the software.

Page said that Landmark is examining how to best to leverage automation, real-time integration and the Cloud, and Big Data analytics.

While some organizations have dwindling R&D budgets and employee development programs, Davison said that FairfieldNodal approached its re-organization differently: It increased its technology spend significantly, filing for 24 patents last year. The company also used the downturn as an opportunity to implement a new business model and system that aims to run more efficient, simpler operations. It also exited some areas that it felt did not add value, such as data processing centers in three areas.

“We are an applied technology company,” he commented. “We recognize that if you look at the broader theme of oil and gas, the need for new technology has intensified. The supply chain has to help customers increase productivity, to help them get more out with less.”

To do that, one of the company’s goals is to decrease the overall cost of nodal seismic.

“Lowering the costs of marine nodal services will open up the fairway. Nodal is not for all means, but it has a good value proposition, particularly around maturing assets. I think nodal will be needed to improve the success rates for customers. Better image quality will yield better value,” he said.

“If you look at the technology contributions happening onshore, it has been massive, and there is a lot of technology in the offshore environment. Technology will continue to transform oil and gas through things like more sensing technology, more data analytics, and the movement to marry the physical to the analytical world.”

Tracking a comeback

Speaking toOffshore, Barclay’s Senior Analyst J. David Anderson, PE, CFA pointed to data from some of the indicators he tracks to illustrate what the industry’s path to recovery could look like.

“What we have seen overall, over the last year, is that for every four rigs that roll off contract, one continues to work,” he said. “We think that’s going to slightly improve to one out of three in the first half of 2017. Then, it’s one out of two in the second half of 2017.

“We think by 2018, rigs will start to be added to the rig count. So overall, we think that the floating rig count is going to bottom at about 120 rigs active by the end of this year. That should start to grow in 2018, which is where we see things picking up.”