Phased approach facilitates deepwater development

Smaller, standardized FPS can be sanctioned, constructed faster

Stafford Menard

Audubon Engineering Solutions

Over the past two years, it has become increasingly clear that in order for producers to remain profitable with oil at or less than $45/bbl, they will have to look beyond short-term cost cutting measures such as driving supplier and contractor prices down, reducing headcount, etc. This is particularly true in the offshore environment, where the high cost of construction and lengthy time to first oil have made traditional deepwater development operations uneconomical. In the coming years, new technology will undoubtedly play an important role in helping reduce the cost of offshore production. However, the time has come for the industry to face the facts and admit that current field development strategies, particularly in deeper waters, are simply not working. One method that may serve as a solution to this problem is phasing.

Deepwater development challenges

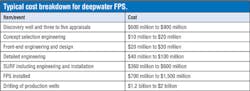

To put the current offshore industry challenges into better perspective, let’s first review a cost breakdown for a “typical” deepwater field development (standalone wet tree) floating production system (FPS) to identify the biggest contributors to cost. As an example, let’s use a prospect in 5,000 ft of water, lower Miocene wells (25,000-30,000 ft) with a subsalt reservoir. The first table shows what a cost breakdown for this example could look like.

Of course, in addition to these costs, there is the cost of ongoing operations and pipeline transportation, along with processing and delivery fees. These costs have not been included because they are generally paid through production and do not have a substantial impact on the project’s net present value (NPV).

It becomes evident when looking at the field development cost that the overall drilling program is the largest contributor to overall cost. This includes the drilling of discovery and appraisal wells, which occurs early in the project lifecycle and generally is a sunk cost (i.e., plugged and abandoned). This item alone makes maximizing NPV nearly impossible.

Next in line is the cost of the FPS followed closely by that of the subsea umbilicals, risers, and flowlines (SURF). Obviously, these items cannot be eliminated. However, should we not make every attempt to reduce their cost and shorten the timeline to first oil?

An overview of phasing

One possible solution for improving NPV and reducing time to first oil is to employ a phased approach. Unlike conventional deepwater development strategies, which involve proving up all the reserves required to size the FPS for full field development, phasing consists of proving up only enough reserves to justify an economic success with a pre-designed (i.e., standardized) smaller FPS (SFPS) that can be sanctioned and constructed in less than three years.

Along with the SFPS (defined here as 40,000 b/d of oil), a sufficient number of production wells would be drilled to load the process train. These wells would also be used to help determine the full field development requirements in lieu of additional appraisal wells. In addition to reducing overall drilling costs, this strategy allows for phasing of production wells, as well as SURF cost. It also enables the operator to use a smaller, less expensive FPS and secure the lease through production. Most importantly, it allows for more accurate determination of full field development requirements and improves the project’s NPV.

In most cases, within a year of initial production, a full field design basis can be established to determine whether the SFPS is sufficient for life of the field, or if additional production capacity will be required, as well as other options such as water flood, mudline pumping, gas lift, etc.

If the field is determined to require additional production and/or reservoir support, a second pre-designed FPS can be sanctioned and deployed to assist the initial SFPS. The second FPS can either be an exact duplicate of the initial SFPS, or a slightly larger design with similar production capabilities, but with additional topsides deck space, capacity, and hull buoyancy. This enhanced small FPS (ESFPS) would have open deck space and hull capacity (8,000 sq ft and 1,500 tons) to provide for selections from the full menu of possible reservoir support options. The initial export pipelines can be sized for the anticipated full field development and the subsea manifold can be designed to accommodate additional drill center tie-ins and in-field flowlines as required.

Another benefit of the phased production/two SFPS strategy when compared to a larger and more conventional facility is that after major depletion of the reservoir, one of the two SFPSs can be released and used to repeat this cycle for another development. Just as production was phased up, it can be phased down.

It is important to note when considering current reservoir discovery statistics regarding large fields vs. small fields, the probabilities favor smaller discoveries. Use of a SFPS can serve as an economic solution to develop these smaller fields, particularly if there is not an existing host platform available for a subsea tieback.

The two smaller FPSs (SFPS and ESFPS) could either be a specific company standard, designed to meet all, or most, of the company’s specifications and regional practices, or it could be a third-party standard - several of which exist today and are in production.

If electing to develop a new standard to meet company requirements, operators should make every effort not to over optimize the facility (after meeting all regulatory and safety requirements). Rather they should employ a basic design, which will later be aligned with each field’s requirements during the site-specific engineering phase. Areas such as gas compression, flow assurance, and export solutions will all vary from field to field. The use of “place holders” during the engineering of the standard can generally provide sufficient flexibility to accommodate specific field requirements, which are determined only after the initial wells are drilled (i.e., one size fits most).

Conventional vs. phased approach

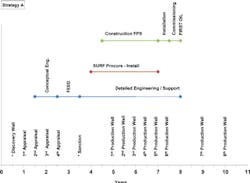

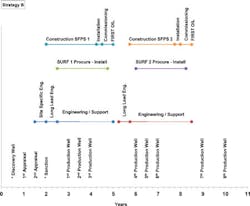

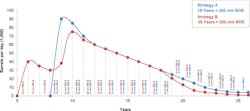

To more accurately quantify the benefits of using a phased strategy, let’s take a representative GoM reservoir (200 MMboe) which would normally be developed using a FPS large (100,000 b/d) and compare this development strategy using two smaller FPSs, both with a capacity of 40,000 b/d. To obtain as close to an “apple-to-apple” comparison as possible, we will assume certain commercial values and use the same estimated itemized cost shown in the table for both development plans. Timing of events will vary between cases, as well as spend profiles.

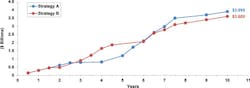

The total spend for Strategy A (conventional approach-large FPS) is $3.895 billion and for Strategy B (phased/two SFPS approach), $3.600 billion. This $295 million difference is due to the elimination of two appraisal wells ($300 million), a $45 million reduction in engineering, offset by a $50 million addition for the cost of two smaller FPSs vs. one large FPS.

It is important to highlight that the per barrel total installed cost (TIC) of two SFPs is higher than the per barrel TIC of the larger FPS. This is to be expected due to increased efficiencies in constructing the larger unit vs. the smaller units. While the costs outlined are merely an estimate and do not reflect all developments, they are representative of current industry expectations when performing project NPV comparisons.

The P-50 production profiles for Strategy A and Strategy B will be the basis for revenue generation assuming a flat $45/bbl for the life of the field with no royalties, taxes, and other common cost deducted from either.

Utilizing the respective spend curves and P-50 curves for each strategy yields a NPV11 of $29.08 million with a pre-tax IRR of 11.2% for Strategy A, and an NPV11 of $427.57 million with a pre-tax IRR of 14.5% for Strategy B.

This result is a bit surprising considering the monetary difference in the two strategies is only $295 million. However, the financial reduction along with the early recognition of revenue for the phased strategy was sufficient to overcome the increased cost per barrel of the two SFPSs, as well as the reduction in total nameplate production capacity.

The phased production strategy should not be confused with using an early production system (EPS), which is intended to be replaced with a full field development FPS. Generally, by the time the full field FPS is ready for installation, the EPS has depleted the reservoir to the extent that the large FPS is no longer commercially viable.

There are many variables which were marginalized in the above evaluation, and certainly need to be more clearly defined and evaluated for specific fields. However, it is important for operators to remember that when developing deepwater fields, there are no absolutes to any of these variables. As a result, the continuation of engineering and optimization of a customized FPS will not necessarily produce better results than the use of an existing, proven concept.

Additional benefits

Employing a phased/two SFPS approach also provides a number of benefits through standardization. Some of these include:

Continuous optimization. One-off, fit-for-purpose designs often present very unique operational and safety challenges, making it difficult for producers to take lessons learned from one facility and apply them to another. By using a standardized FPS, operators can continuously optimize project delivery, taking valuable knowledge and experience from one platform and using it to accelerate the development cycle, enhance safety, and improve efficiency on others.

Reduction in spare parts inventory. Standardized designs allow operators to significantly reduce spare parts inventory and simplify procurement operations. This is often in contrast to fit-for-purpose facilities, where unique equipment layouts and configurations make it difficult to effectively prepare for unexpected breakdowns, placing added pressure on facility personnel to operate and maintain systems.

Reduction in abandonment costs. The opportunity for reuse and redeployment of one of the two SFPSs from the original field to a second (and potentially third) field allows for life extension of the units and spreads the final abandonment cost over more than one field. Also, the smaller FPS size allows use of smaller floating equipment such as derrick barges, material barges, etc. when final abandonment is elected. The smaller hull opens a number of options for abandonment as well, such as reefing or scraping at a shore base.

Conclusion

Over the past three decades, an increasing number of operators throughout the offshore industry have elected to build larger, more fit-for-purpose floating production systems. In the last two years, however, it has become increasingly evident that in an environment with oil prices less than $50/bbl, developing these types of facilities in deeper waters is simply not economical. Phasing offers answers to many of the challenges currently being faced by offshore producers. In addition, with most beginning to accept oil price volatility as the new norm, it may be time for the industry to adapt its deepwater development strategies accordingly.

About the author

Stafford Menard is the vice president of Deepwater Development for Audubon Engineering Solutions. His career spans more than 40 years in the oil and gas industry, the majority of which has been in deepwater engineering and offshore projects. Before joining Audubon Engineering Solutions, he served as manager of Gulfstar Development for Williams Partners L.P., where he was responsible for the marketing and commercial efforts of Gulfstar, a spar-based FPS. He is widely recognized as a leader in the offshore arena for his ability to advance large-scale deepwater platforms safely and effectively.

Acknowledgment

The author wishes to thank Jeremy Zamzow, vice president of Finance at Audubon Engineering Solutions for providing assistance with NPV calculations.