Refocusing project assurance can improve cost certainty

Richard E. Westney

Westney Consulting Group, Inc.

The offshore industry has made a lot of progress in reducing the cost of the next wave of projects. But, simply having an estimate of lower cost is not enough; any tolerance that executives may have had for cost overruns is long gone.

If the next wave of offshore developments is to get funded, investors will want to know why they should have confidence in new, lower cost levels, when so many past projects have overrun, and the industry has lost so many experienced people.

Just as lower costs are being achieved by thinking differently, so too is fresh thinking required in how these lower cost expectations will be met. This requires a new, better approach to project assurance.

The goal of project assurance is to build and maintain the confidence of financial stakeholders that the outcome of a major project will meet expectations. While this goal is unchanged, a window of opportunity exists now to refocus project assurance to provide a higher certainty of lower cost.

Why projects fail

Although it is tempting to blame unexpected developments (i.e., “black swans”) for failed projects, the fact is that these are seldom the cause. We breed these black swans ourselves, by making the same mistakes year after year, and setting the stage for failure.

There are really only two root causes of project failure: poorly-informed decisions, and unmitigated risks. These happen for three reasons:

- A systemic bias to optimism and overconfidence

- Pressure to minimize the time and cost of front-end deliverables

- Inexperienced owner organizations.

Today’s pressure to lower cost, combined with project organizations that have been drained of experienced staff, make the potential for cost overruns even greater.

Clearly, the offshore industry cannot prosper if projects continue to overrun for preventable reasons. This is why changing the focus of project assurance can be so impactful; it can help eliminate the preventable cost increases which are the cause of most failed projects. The place to start is with redefining the objective.

The objective of project assurance is to increase the certainty of achieving a lower cost outcome by eliminating preventable cost increases due to poorly-informed decisions and unmitigated risks.

Critical inflection points

Project assurance has typically been a periodic intervention with a project team focused on conformance to corporate processes, procedures, and requirements. The objective has been to make sure that project teams produce the required decision gate deliverables, and that they follow the specified procedures.

While most owners and contractors agree some form of assurance is necessary, there is also general agreement that the past approach is insufficient. Today’s engineering, planning, and estimating systems make it easy to produce impressive-looking deliverables, but these may not be based on impressive thinking. Project assurance must change its focus, placing less emphasis on deliverables and conformance, and more on the critical decisions made during each project stage. The goal now becomes assuring that solid, experience-based, critical thinking is applied to these critical decisions.

The late Andrew Grove, former CEO of Intel and a Silicon Valley pioneer, introduced the concept of the inflection point as one of the key success factors in the fast-paced computer industry.

Grove pointed out that inflection points can be hard to recognize: If one of them is missed, one can find oneself on the decline curve even though one made no decision at all.

Of course, every major project has these as well; they are referred to as critical inflection points. Critical thinking is required at these points if the right decisions are to be made.

A critical inflection point is a point in time at which an opportunity exists to make a decision that will materially impact a project’s likelihood of success.

By providing an outside, expert view, and focusing on critical inflection points, project assurance can address the concern that inexperienced project leaders, working with limited resources, may handle critical decisions too simplistically (i.e., without a robust understanding of the complexities,) be influenced by overconfidence, or simply miss the opportunity altogether. A good example of this is the Yme project, as will be described later.

Engage in advance

The use of an independent, outside expert to engage a project at key points is a well-established best practice, and one that is even more important now that project organizations have been weakened by downsizing and retirements. Refocusing project assurance requires expanding the traditional role of the outside expert as an assurance leader - serving as a counterpart to the project leader - to engage well in advance of the critical inflection point. The role of today’s project assurance leader has four parts, as illustrated in the accompanying graphic.

Challenge. The assurance leader can use an outside perspective to stress-test assumptions, plans and potential decisions and, where necessary, offer alternatives. Challenge questions might typically include: “What would you do if ….?” or “Have you considered …?”

Advise. The assurance leader can advise based on industry intelligence, the absence of bias, data-based insights, and the lessons learned from personal experience. Typical advisory comments might be: “Are you aware of what is going on at the fabrication yards in Korea?” or “These are the unintended consequences if you go ahead with that decision.…” This outside perspective can also be invaluable in managing executive and stakeholder expectations. The “challenge” and “advise” roles are an essential part of all assurance engagements. Depending on the situation, the project assurance team can also provide assistance with alignment and other support activities.

Align.The assurance leader can facilitate an alignment process whereby joint venture partners and other financial stakeholders become engaged in the planning for the critical inflection point, have an opportunity to voice concerns or propose alternatives, and are aligned with the upcoming decision before it is made. This helps eliminate the costly recycling and delays that can occur when partners are misaligned.

Support. The assurance leader can minimize any disruption to the project work-plan by providing resources to perform or assist with the tasks that may be necessary to prepare for the critical inflection point. These support tasks may include special studies, analysis of alternatives, facilitation of best practices, contract and organization planning, and participation in management reviews.

To perform these roles, the assurance leader must have a truly unbiased, independent, outside perspective, and be well-informed about current projects, trends, and industry intelligence. He or she should also have experience, data and analytical techniques that are relevant to the project at hand.

Developing assurance plans

Assurance planning begins by identifying the critical inflection points. It is useful to think of these in two categories:

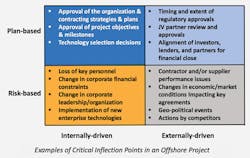

- Plan-based critical inflection points are those that can be identified through front-end and execution planning. These usually occur within each project stage. For example, key decisions such as finalizing the contracting strategy, selecting the technology, or approving the drilling plan are plan-based critical inflection points since the project leader determines when they occur.

- Working back from the planned date, an assurance plan can be developed to define the objectives and scope of the assurance engagement, and ensure the time and resources are available as may be needed for such activities as industry data acquisition, contractor due diligence, stakeholder alignment, best practice facilitation, and analysis of alternatives.

Risk-based critical inflection points are those that are determined by forces outside the project. It is usually some form of strategic risk that determines whether an opportunity to make a decision will arise and, if so, when. For example, there may be a risk that one or more projects by other operators will cause the preferred fabrication yards to be at capacity when needed.

Should this occur, it would impose a risk-based critical inflection point on the project. Risk-based critical inflection points can be identified via a strategic risk assessment process. Working back from the potential decision date, an assurance plan can be developed to monitor the risk, prepare scenario analyses, analyze alternatives, and define the assurance engagement.

The accompanying illustration provides examples of plan-based and risk-based critical inflection points on a typical offshore project. Note that these can be either internally- or externally-driven.

Assurance planning should begin early in front-end definition. In addition to improving certainty of cost outcomes, the assurance plan must also meet the goal of improving the efficiency of project teams. What is needed is not more assurance, but assurance that is more focused and less disruptive. This is achieved in several ways:

- Assurance interactions are focused on the project leader

- Any additional work to prepare for critical inflection points, such as analysis of alternatives, is not tasked to the project but, instead, handled by the assurance team

- Improving partner and stakeholder alignment spares the project team the non-productive work that results from misalignment

- Being proactive and making better decisions at critical inflection points reduces the effort teams often waste in coping with preventable issues.

This process begins with a kickoff meeting between the assurance and project leaders, and is followed by several steps.

Project assurance framework

The purpose of this step is to define the assumptions, constraints, and basis within which the assurance role will operate; this is summarized in the project assurance framework document. Framework considerations include:

- The business case, project objectives, financial parameters, risk appetite

- Key agreements, financing plan, stakeholder expectations

- Current plan of development, alternatives under consideration

- Host country considerations, logistics, infrastructure

- Constraints - e.g., corporate processes, local content requirements, cash-flow limitations, lender requirements, regulatory requirements.

Critical inflection points

The purpose of this step is to determine the plan-based critical inflection points to be addressed and develop an assurance plan for each of them. (Note: not all planned decision points are “critical.”) Activities include:

- Using the front-end plan, project execution plan, integrated project master schedule, and applicable agreements, determine the plan-based critical inflection points to be addressed.

- Determine the assurance tasks to be performed prior to the date of each plan-based critical inflection point:

- Acquisition and use of industry intelligence and data

- Analysis of alternatives

- Review/validation of existing plans, estimates, schedules, technical decisions

- Best practices to be applied, such as contract strategy or alignment workshops.

Develop assurance plan

The purpose of this step is to determine the risk-based critical inflection points to be addressed and develop an assurance plan for each of them. Activities include:

- Perform a strategic risk assessment to determine the potential sources of risk-based critical inflection points

- Using the most severe risks, identify potential critical inflection points. For example:

- The strategic risk is an upcoming election in the host country that may result in the opposition party assuming power. Their candidate has stated an intention to implement tighter regulations on the oil and gas industry.

- The potential impact if the opposition party wins is that new leaders will be appointed to the Ministries of Energy and Environment, and new emissions regulations put in place. If this happens, significant changes to the topsides design will be required during module fabrication, increasing weight and cost, and delaying offshore installation.

- The potential critical inflection point is a decision to make pro-active topsides design changes, prior to the release of approved construction drawings, in anticipation of new emission regulations.

- Determine the risk-based assurance tasks to be performed, to enable early identification and proactive attention to potential critical inflection points. Using the above example, these tasks may include risk monitoring, contingency planning, and decision analysis.

This work is documented in a project assurance plan.

Perform assurance engagements

Separate work-streams are required for plan-based and risk-based critical inflection points. The plan-based tasks are working toward a decision opportunity which is well-defined and already scheduled; the risk-based tasks are anticipating a decision opportunity that may or may not materialize, or that may take a different form. Assurance engagements should always be non-disruptive to the project work-flow.

Conclusion

Lower cost offshore projects will not proceed unless a higher certainty is provided that the lower cost will be achieved. Refocusing the project assurance function to address critical inflection points can improve execution efficiency, increase cost certainty, and enhance the attractiveness of investments in the next wave of offshore projects.

The author

Richard (Dick) Westney is the founder/director of Westney Consulting Group, and has 40 years of offshore project experience.

The impact of inexperience

The Norwegian Petroleum Directorate (NPD) report Evaluation of Projects Implemented on the Norwegian Shelf provides a useful perspective on the importance of project assurance in forestalling poorly-informed decisions and unmitigated risks. The projects studied included Yme which, although atypical in its results, provides a good illustration of the importance of critical thinking at critical inflection points.

Yme was a project that deserved to succeed. The location, 300 ft (91 m) water depth on the Norwegian shelf, was well-understood with a stable regulatory environment. And, a world-class contractor was selected to build a facility configuration similar to one that had been successfully used in the Danish sector.

In spite of these positive factors, the project did not end well. In discussing the root causes, NPD highlights the fact that the operator had limited experience with planning and executing projects in the operator role. This inexperience resulted in several missed opportunities to ensure a successful outcome including:

- Owner cash constraints dictated a fasttrack schedule that was unrealistic and poorly managed. As a result, front-end engineering and design was incomplete at sanction, which caused procurement and construction activities to begin before the needed design work was completed.

- An optimistic view of the total cost of the fixed price contract for the production facility resulted in an inadequate project cost contingency.

- An optimistic view of the potential variations to the drilling program resulted in an inadequate drilling cost contingency.

- An optimistic view of owner staffing for contractor oversight resulted in an understaffed project management team.

- The decision to base the contract strategy on a full-scope, lease contract resulted in a contract that severely limited operator ability to control cost, schedule and quality.

- The operator and prime contractor lacked experience with Norwegian regulations and standards. As a result, extensive non-conformities surfaced throughout the project, resulting in late changes and rework.

- The net result was a classic trainwreck.

- Sanctioned at $850 million, the final cost of the project was $2 billion.

- Planned to be complete in 28 months, the uncompleted facility was abandoned, and the facility scrapped, after 75 months.

- No oil was ever produced.